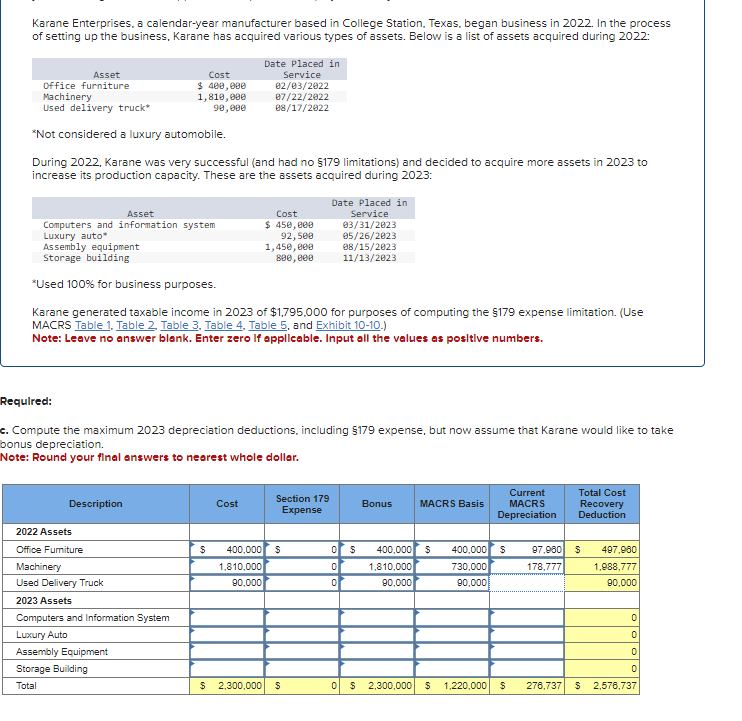

Question: $ 1 7 9 limitations 1 0 0 % for business purposes. Karane generated taxable income in 2 0 2 3 of $ 1 ,

$ limitations for business purposes.

Karane generated taxable income in of $ for purposes of computing the $ expense limitationUse MACRS Table Table Table Table Table and Exhibit

Note: Leave no answer blank. Enter zero If applicable. Input all the values as posltive numbers.

Required:

c Compute the maximum depreciation deductions, including $ expense, but now assume that Karane would like to take bonus depreciation.

Note: Round your final answers to nearest whole dollar.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock