Question: 1 7 . Brandt Corp. ( a U . S . - based company ) sold parts to a South Korean customer on December 1

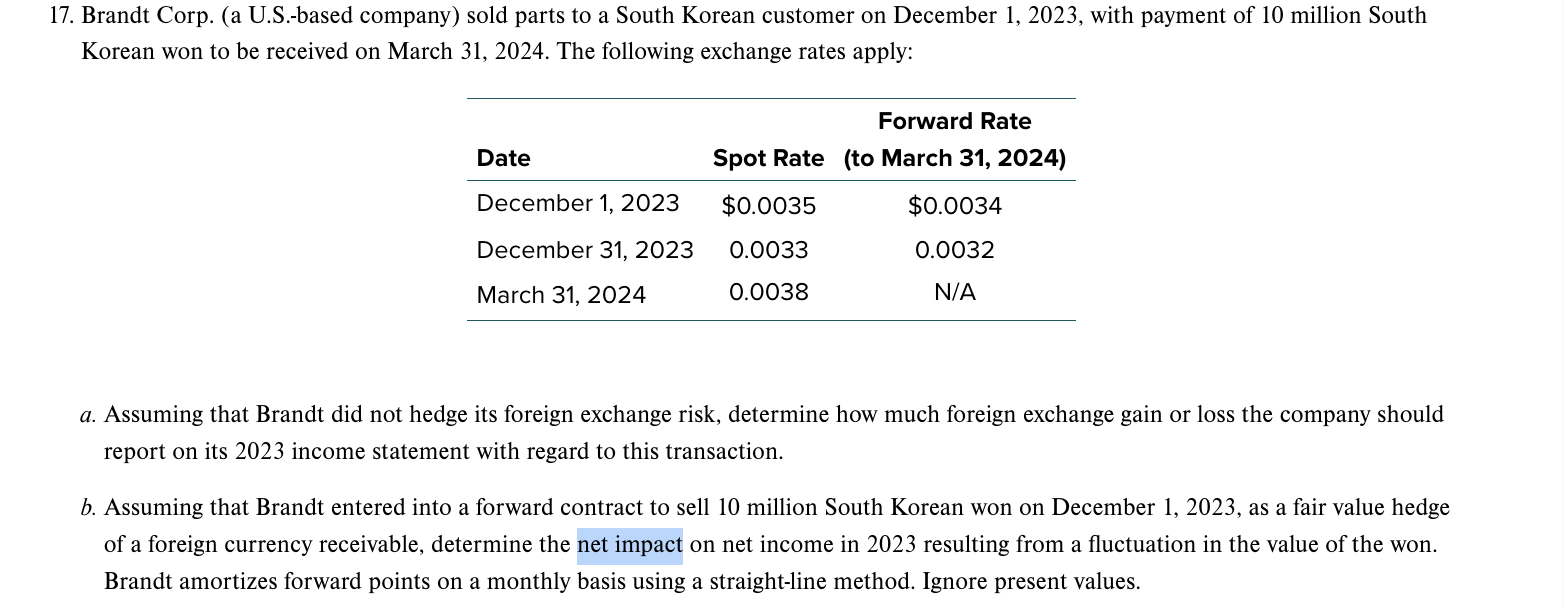

Brandt Corp. a USbased company sold parts to a South Korean customer on December with payment of million South Korean won to be received on March The following exchange rates apply:

a Assuming that Brandt did not hedge its foreign exchange risk, determine how much foreign exchange gain or loss the company should report on its income statement with regard to this transaction.

b Assuming that Brandt entered into a forward contract to sell million South Korean won on December as a fair value hedge of a foreign currency receivable, determine the net impact on net income in resulting from a fluctuation in the value of the won. Brandt amortizes forward points on a monthly basis using a straightline method. Ignore present values.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock