Question: 1 7 The expected return - beta relationship: Multiple Choice 0 0 . 4 8 . 2 5 assumes that investors hold well - diversitied

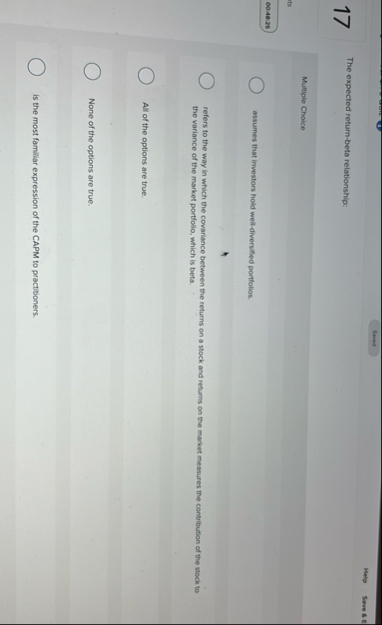

The expected returnbeta relationship:

Multiple Choice

assumes that investors hold welldiversitied portfolios.

refers to the way in which the covariance between the returns on a stock and returns on the market measures the contribution of the stock to the variance of the market portfolio, which is beta.

All of the options are true.

None of the options are true.

is the most familiar expression of the CAPM to practitioners.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock