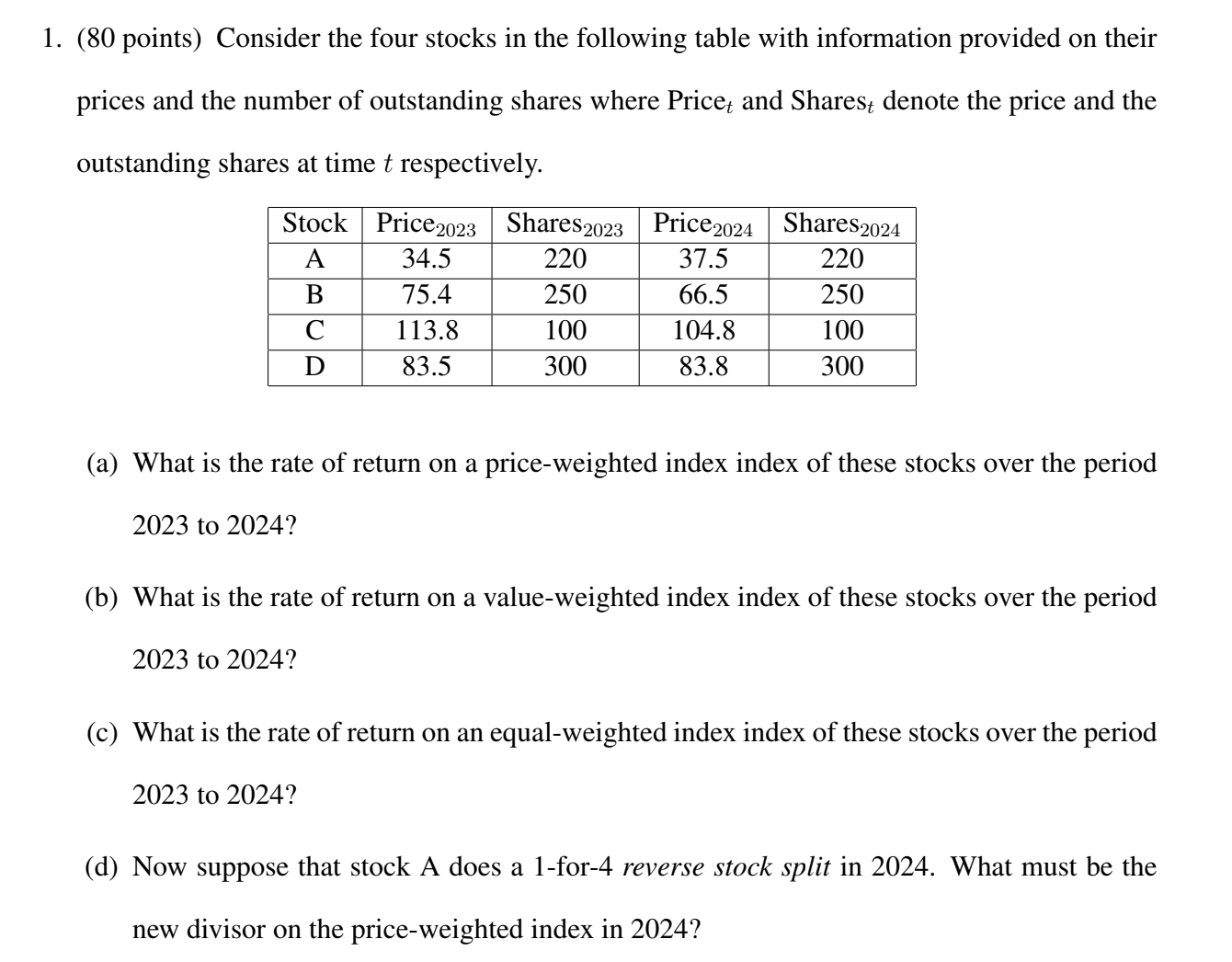

Question: 1 . ( 8 0 points ) Consider the four stocks in the following table with information provided on their prices and the number of

points Consider the four stocks in the following table with information provided on their prices and the number of outstanding shares where Price t and Shares t denote the price and the outstanding shares at time t respectively. a What is the rate of return on a priceweighted index index of these stocks over the period to b What is the rate of return on a valueweighted index index of these stocks over the period to c What is the rate of return on an equalweighted index index of these stocks over the period to d Now suppose that stock A does a for reverse stock split in What must be the new divisor on the priceweighted index in

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock