Question: 1 8 : 2 8 5 0 4 ACC 2 4 1 CON PRESENTATIO... a result of net realisable value being less than cost. The

:

ACC CON PRESENTATIO...

a result of net realisable value being less than cost. The accountant wants to know how this $ should be treated in the financial statements.

Required

Answer all of the accountant's questions and provide reasons forers as well as calculations if applicabl.

B IAS Inventories was first issued in October and most recently revised in December Its most important principle is that inventories be measured at the lower of their cost and their net realisable value. Hardware Limited manufactures plastic water tanks for the farming industry. On May its closing inventory consisted of kg of plastic resin raw material, and also finished units plastic water tanks

Plastic:

The purchase price of plastic resin was $ per kg throughout the year to May Delivery costs an additional $ per kg Hardware has a policy of always keeping plenty of plastic resin in inventory, as its supply can be unreliable. However, close to the yearend, the price of plastic resin collapsed due to market oversupply. The purchase price of Hardware's raw material is now $ per kg plus the $ per kg delivery charge. The existing inventory of plastic resin can be sold in the market for $ per kg net of all costs.

Tanks:

Each tank requires kg of plastic to manufacture, plus each unit incurs $ in conversion costs labour and overhead Hardware sells the tanks for $ It is expected that this price will drop to $ as a result of the fall in the market price of plastic. All completed units sold by Hardware incur a $ selling and distribution cost.

Required

a Describe how the "cost" of inventory is determined under IAS

b Discuss the principles for determining the "Net Realisable Value" of inventory under IAS

c Calculate the value of closing inventory in the books of Hardware Limited at May applying the principles of IAS

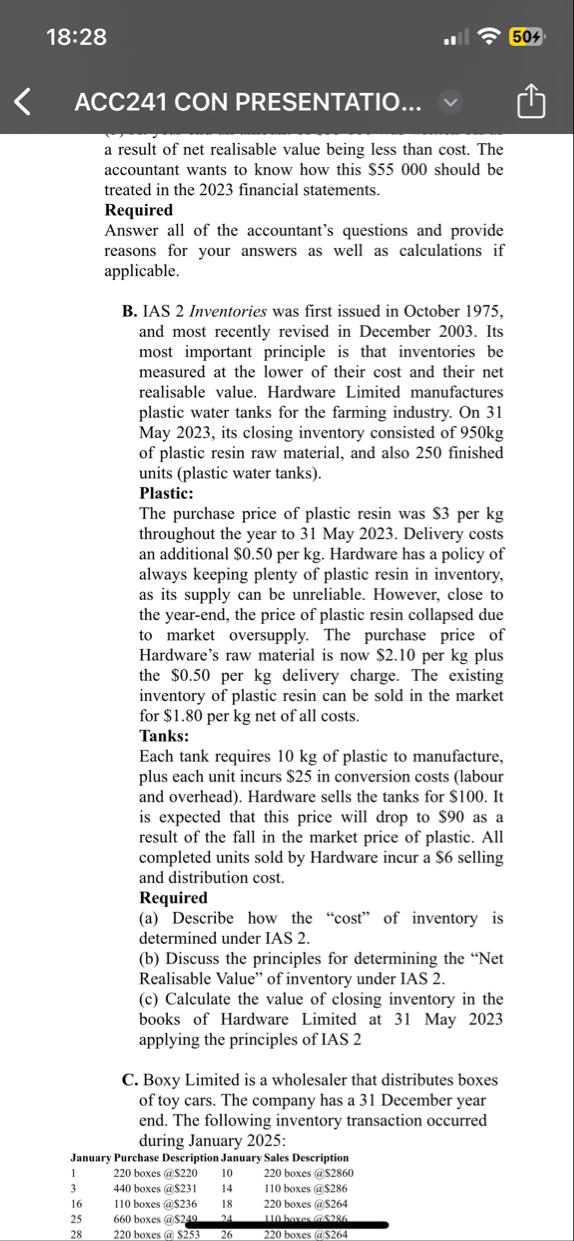

C Boxy Limited is a wholesaler that distributes boxes of toy cars. The company has a December year end. The following inventory transaction occurred during January :

January Purchase Description January Sales Description

boxes @ $ boxes @ $

boxes@$ boxes@$

boxes @ $ boxes @ $

boxes @ Showes a S

boxes @$ boxes

Question IAS on December is provided:

Rand

DrCr

Share capital ordinary

Preference share capital noncumulative

Nondistributable reserve

Retained earnings

Land and buildings separable assets

Motor vehicles

Aeroplane

Furniture and equipment

Inventory

Trade receivables

Trade and other payables

Loan

Revenue

Other expenses

Depreciation motor vehicles

Depreciation aeroplane

Depreciation furniture and equipment

Interest paid

Normal SA tax

Additional information

The American dollar is regarded as a stable currency throughout the world. The exchange rates for the past year have been as follows:

January $

December $ R

Inventory represents two months' purchases and all items in the statement of profit or loss and other comprehensive income accrued evenly during the year.

Assume that the inflation rate for is and that the consumer price index on

January was

Required

a Prepare the statement of financial position of Tourism Ltd as at December in accordance with the requirements of IAS

b Prepare the statement of profit or loss and other comprehensive income and statement Oo

:

LTE

ACC CON PRESENTATIO...

Question IAS on December is provided:

Rand

DrCr

Share capital ordinary

Preference share capital noncumulative

Nondistributable reserve

Retained earnings

Land and buildings separable assets

Motor vehicles

Aeroplane

Furniture and equipment

Inventory

Trade receivables

Trade and other payables

Loan

Revenue

Other expenses

Depreciation motor vehicles

Depreciation aeroplane

Depreciation furniture and equipment

Interest paid

Normal SA tax

Additional information

The American dollar is regarded as a stable currency throughout the world. The exchange rates for the past year have been as follows:

January

$ R

December

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock