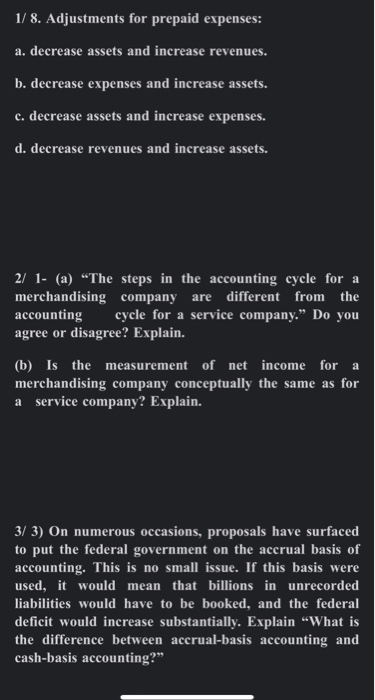

Question: 1/ 8. Adjustments for prepaid expenses: a. decrease assets and increase revenues. b. decrease expenses and increase assets. c. decrease assets and increase expenses. d.

1/ 8. Adjustments for prepaid expenses: a. decrease assets and increase revenues. b. decrease expenses and increase assets. c. decrease assets and increase expenses. d. decrease revenues and increase assets. 2/ 1- (a) The steps in the accounting cycle for a merchandising company are different from the accounting cycle for a service company. Do you agree or disagree? Explain. (b) Is the measurement of net income for a merchandising company conceptually the same as for a service company? Explain. 3/ 3) On numerous occasions, proposals have surfaced to put the federal government on the accrual basis of accounting. This is no small issue. If this basis were used, it would mean that billions in unrecorded liabilities would have to be booked, and the federal deficit would increase substantially. Explain "What is the difference between accrual-basis accounting and cash-basis accounting

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts