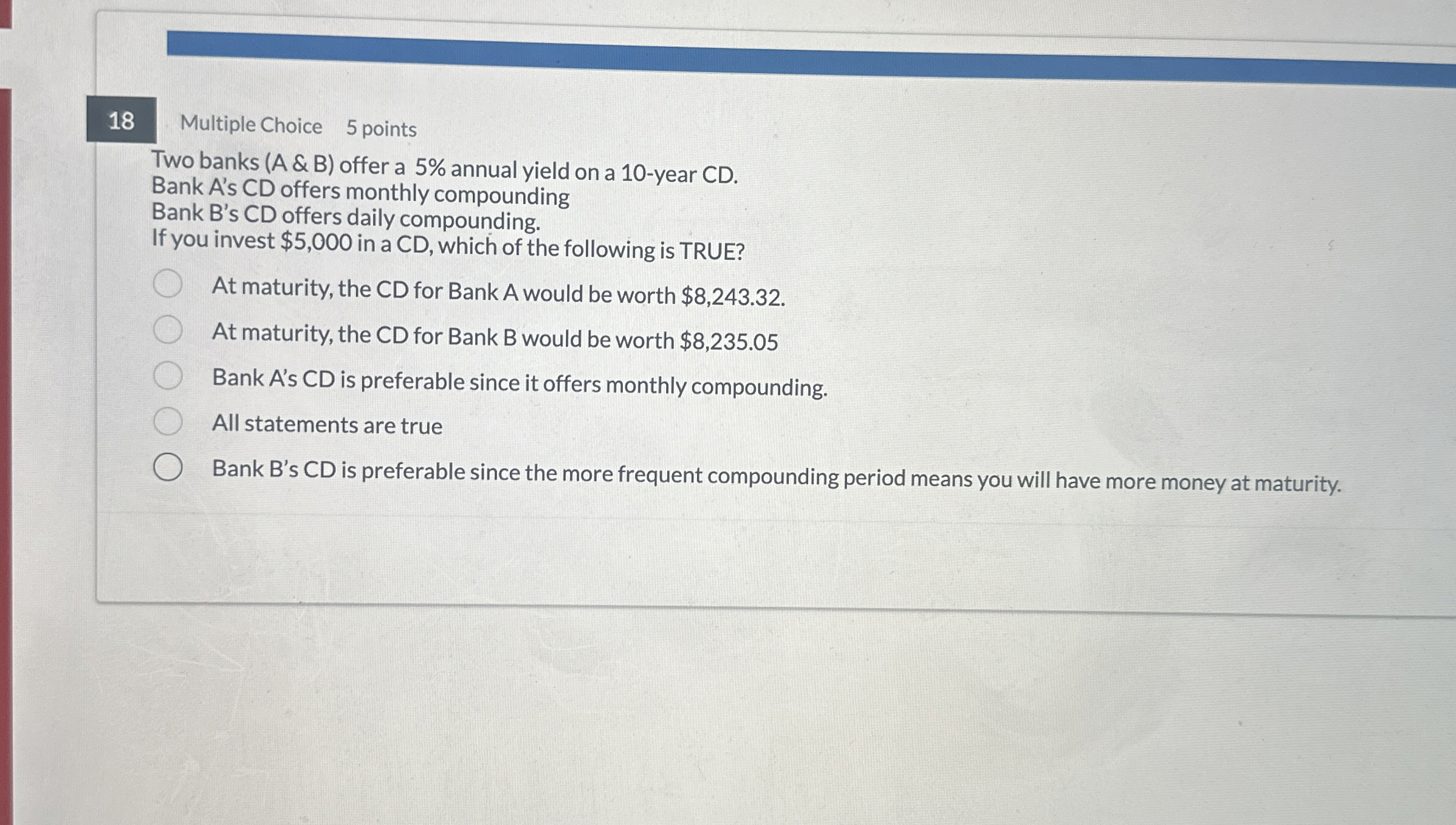

Question: 1 8 Multiple Choice 5 points Two banks ( A & B ) offer a 5 % annual yield on a 1 0 - year

Multiple Choice

points

Two banks A & B offer a annual yield on a year CD

Bank As CD offers monthly compounding

Bank Bs CD offers daily compounding.

If you invest $ in a CD which of the following is TRUE?

At maturity, the CD for Bank A would be worth $

At maturity, the CD for Bank B would be worth $

Bank As CD is preferable since it offers monthly compounding.

All statements are true

Bank Bs CD is preferable since the more frequent compounding period means you will have more money at maturity.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock