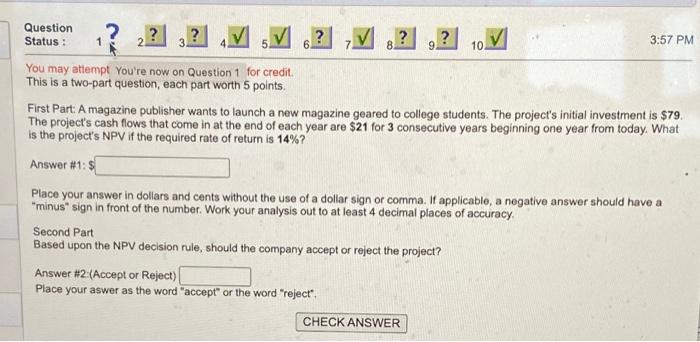

Question: 1? 9 10 Question V ? ? V 3:57 PM Status: You may attempt You're now on Question 1 for credit. This is a two-part

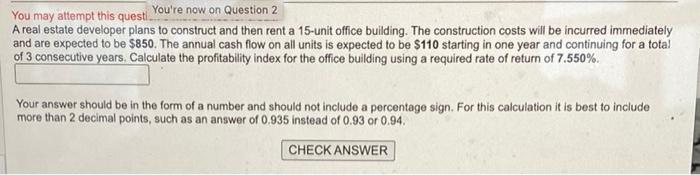

1? 9 10 Question V ? ? V 3:57 PM Status: You may attempt You're now on Question 1 for credit. This is a two-part question, each part worth 5 points. First Part A magazine publisher wants to launch a new magazine geared to college students. The project's initial investment is $79 The project's cash flows that come in at the end of each year are $21 for 3 consecutive years beginning one year from today. What is the project's NPV if the required rate of return is 14%?' Answer #1: $ Place your answer in dollars and cents without the use of a dollar sign or comma. If applicable, a negative answer should have a "minus sign in front of the number. Work your analysis out to at least 4 decimal places of accuracy Second Part Based upon the NPV decision rule, should the company accept or reject the project? Answer #2:(Accept or Reject) Place your aswer as the word "accept" or the word "reject", CHECK ANSWER You may attempt this questi. You're now on Question 2 A real estate developer plans to construct and then rent a 15-unit office building. The construction costs will be incurred immediately and are expected to be $850. The annual cash flow on all units is expected to be $110 starting in one year and continuing for a total of 3 consecutive years. Calculate the profitability index for the office building using a required rate of return of 7.550% Your answer should be in the form of a number and should not include a percentage sign. For this calculation it is best to include more than 2 decimal points, such as an answer of 0.935 instead of 0.93 or 0.94 CHECK

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts