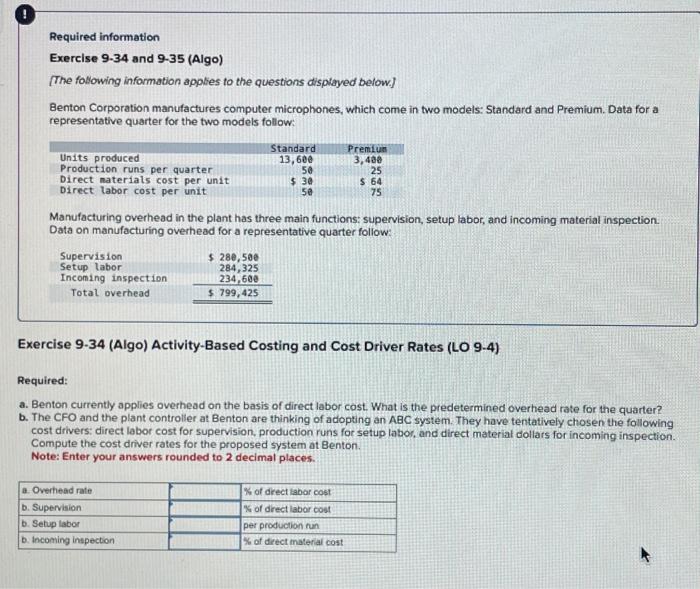

Question: 1. 9-34 & 9-35 3. 9-53 Required information Exercise 9-34 and 9-35 (Algo) [The following information applies to the questions displayed below] Benton Corporation manufactures

![9-35 (Algo) [The following information applies to the questions displayed below] Benton](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e68743ce548_93966e6874350d64.jpg)

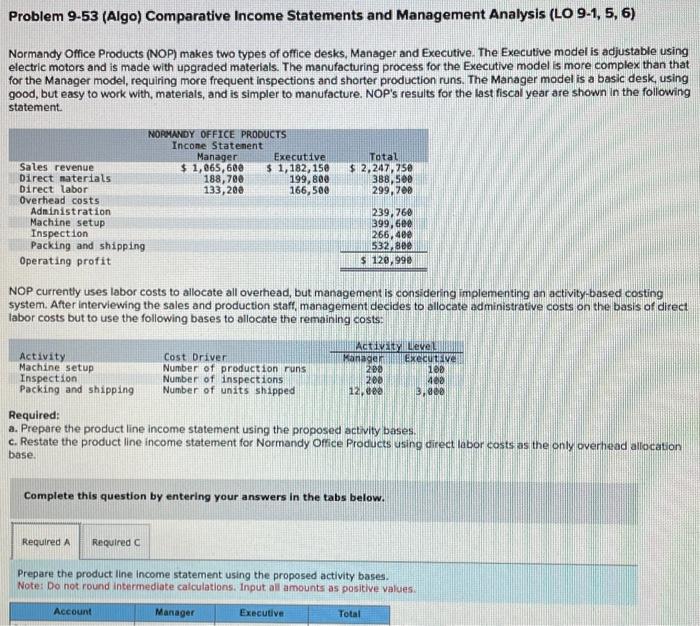

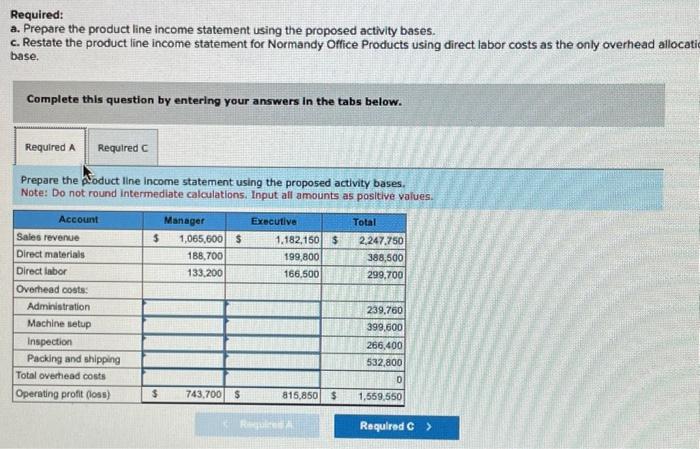

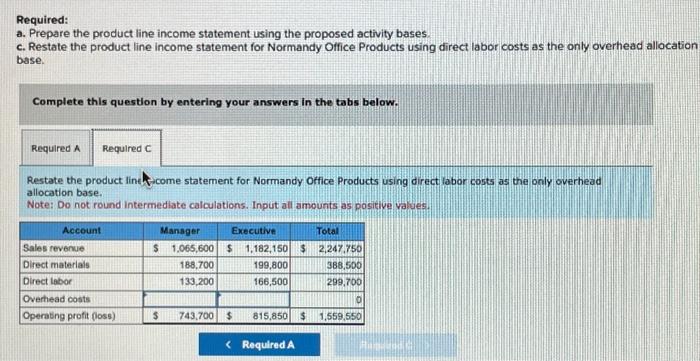

Required information Exercise 9-34 and 9-35 (Algo) [The following information applies to the questions displayed below] Benton Corporation manufactures computer microphones, which come in two models: Standard and Premium. Data for a representative quarter for the two models follow: Manufacturing overhead in the plant has three main functions: supervision, setup labor, and incoming material inspection. Data on manufacturing overhead for a representative quarter follow: Exercise 9-34 (Algo) Activity-Based Costing and Cost Driver Rates (LO 9-4) Required: a. Benton currently applies overhead on the basis of direct labor cost. What is the predetermined overhead rate for the quarter? b. The CFO and the plant controller at Benton are thinking of adopting an ABC system. They have tentatively chosen the following cost drivers: direct labor cost for supervision, production runs for setup labor, and direct materiat dollars for incoming inspection. Compute the cost driver rates for the proposed system at Benton. Note: Enter your answers rounded to 2 decimal places. Required: a. Prepare the product line income statement using the proposed activity bases. c. Restate the product line income statement for Normandy Office Products using direct labor costs as the only overhead allocation base. Complete this question by entering your answers in the tabs below. Restate the product line ficome statement for Normandy office Products using direct labor costs as the only overhead allocation base. Note: Do not round intermediate calculations. Input all amounts as positive values. Required information Exerclse 934 and 9-35 (Algo) [The following information applies to the questions displayed below.] Benton Corporation manufactures computer microphones, which come in two models: Standard and Premium, Data for a representative quarter for the two models follow: Manufacturing overhead in the plant has three main functions: supervision, setup labor, and incoming material inspection. Data on manufacturing overhead for a representative quarter follow: Exercise 9-35 (algo) Activity-Based Costing (LO 9-4) Required: a. Compute the unit costs for the two products, Standard and Premium, using the current costing system at Benton (using direct labor costs as the allocation basis for overhead). b. Compute the unit costs for the two products, Standard and Premium, using the proposed ABC system at Benton. Note: For all requirements, do not round intermediate calculations. Round your answers to 2 decimal places. Required: a. Prepare the product line income statement using the proposed activity bases. c. Restate the product line income statement for Normandy Office Products using direct labor costs as the only overhead allocati base. Complete this question by entering your answers in the tabs below. Prepare the poduct line income statement using the proposed activity bases. Note: Do not round intermediate calculations. Input all amounts as positive values. Problem 9-53 (Algo) Comparative Income Statements and Management Analysis (LO 9-1, 5, 6) Normandy Office Products (NOP) makes two types of office desks, Manager and Executive. The Executive model is adjustable using electric motors and is made with upgraded materials. The manufacturing process for the Executive model is more complex than that for the Manager model, requiring more frequent inspections and shorter production runs. The Manager model is a basic desk, using good, but easy to work with, materials, and is simpler to manufacture. NOP's results for the last fiscal year are shown in the following statement. NOP currently uses labor costs to allocate all overhead, but management is considering implementing an activity-based costing system. After interviewing the sales and production staff, management decides to allocate administrative costs on the basis of direct labor costs but to use the following bases to allocate the remaining costs: Required: a. Prepare the product line income statement using the proposed activity bases. c. Restate the product line income statement for Normandy Office Products using direct labor costs as the only overhead allocation base. Complete this question by entering your answers in the tabs below. Prepare the product line income statement using the proposed activity bases. Note: Do not round intermediate calculations. Input all amounts as positive values

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts