Question: 1 a . A particular security ' s equilibrium rate of return is 8 percent. For all securities , the inflation risk premium is 1

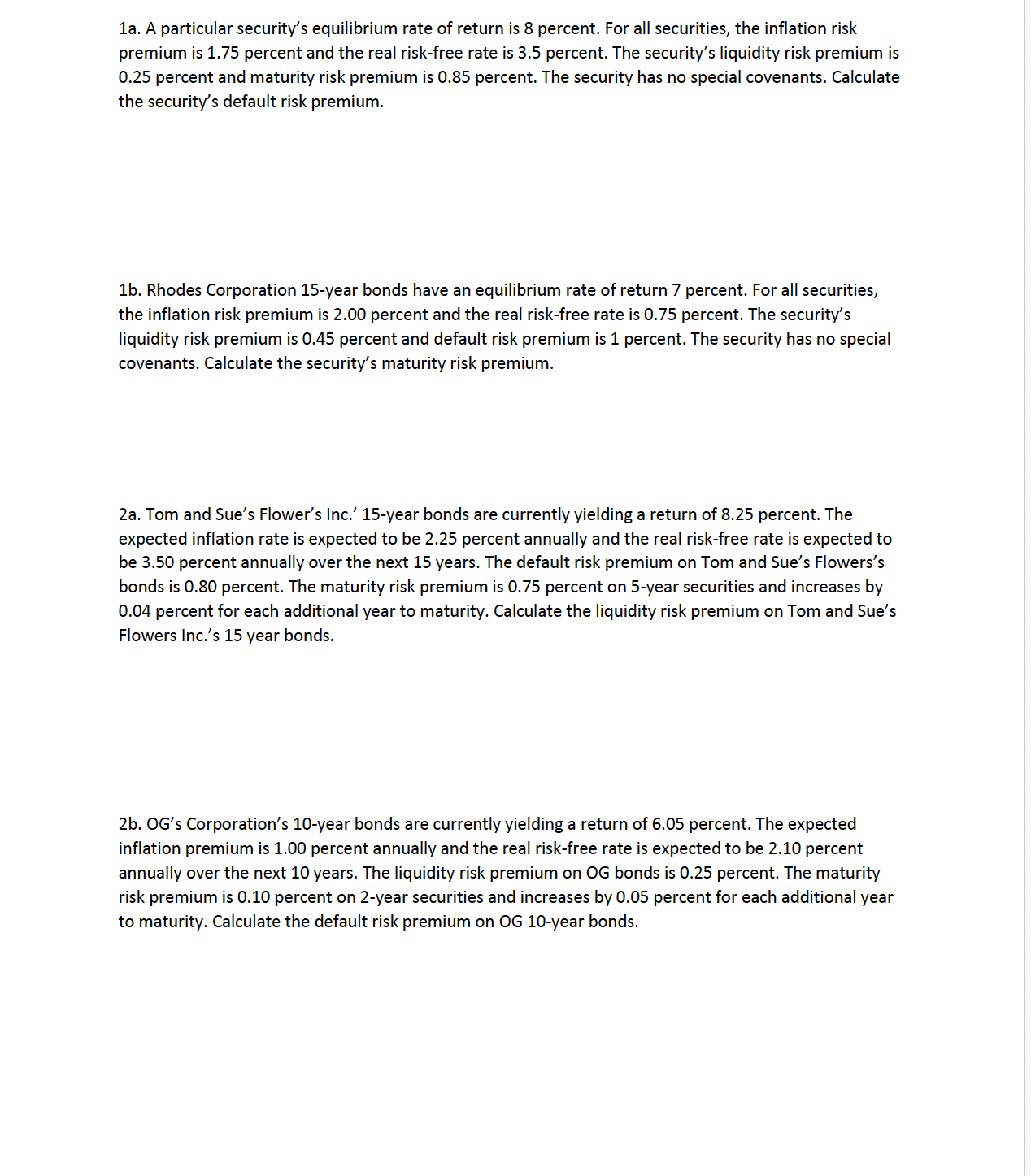

a A particular securitys equilibrium rate of return is percent. For all securities the inflation risk premium is percent and the real riskfree rate is percent. The securitys liquidity risk premium is percent and maturity risk premium is percent. The security has no special covenants. Calculate the securitys default risk premium. b Rhodes Corporation year bonds have an equilibrium rate of return percent. For all securities the inflation risk premium is percent and the real riskfree rate is percent. The securitys liquidity risk premium is percent and default risk premium is percent. The security has no special covenants. Calculate the securitys maturity risk premium. a Tom and Sue's Flower's Inc.year bonds are currently yielding a return of percent. The expected inflation rate is expected to be percent annually and the real riskfree rate is expected to be percent annually over the next years. The default risk premium on Tom and Sue's Flowers's bonds is percent. The maturity risk premium is percent on year securities and increases by percent for each additional year to maturity. Calculate the liquidity risk premium on Tom and Sue's Flowers Inc.s year bonds. b OG's Corporation's year bonds are currently yielding a return of percent. The expected inflation premium is percent annually and the real riskfree rate is expected to be percent annually over the next years. The liquidity risk premium on OG bonds is percent. The maturity risk premium is percent on year securities and increases by percent for each additional year to maturity. Calculate the default risk premium on OG year bonds.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock