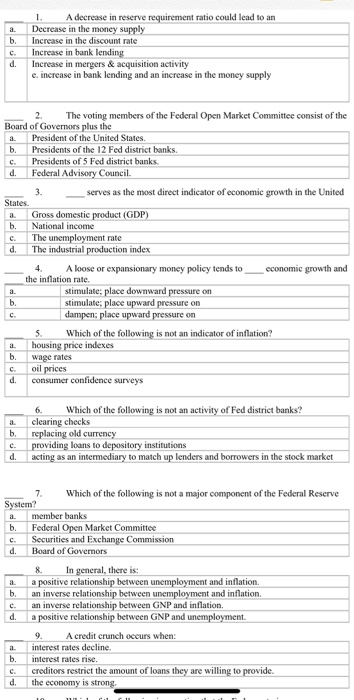

Question: 1 a. b. c d. A decrease in reserve requirement ratio could lead to an Decrease in the money supply Increase in the discount rate

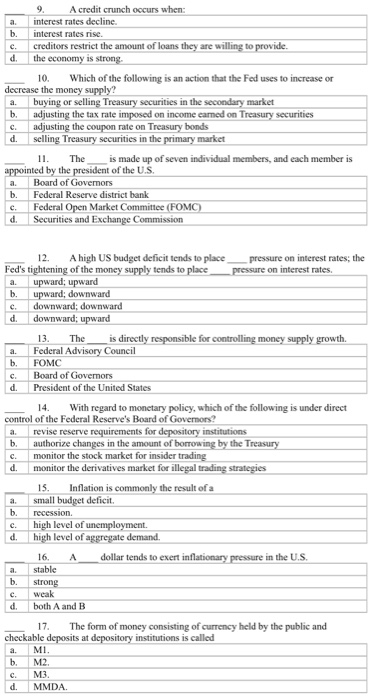

1 a. b. c d. A decrease in reserve requirement ratio could lead to an Decrease in the money supply Increase in the discount rate Increase in bank lending Increase in mergers & acquisition activity e increase in bank lending and an increase in the money supply 2. The voting members of the Federal Open Market Committee consist of the Board of Governors plus the a. President of the United States. b. Presidents of the 12 Fed district banks. Presidents of 5 Fed district banks. d. Federal Advisory Council 3 serves as the most direct indicator of economic growth in the United States Gross domestic product (GDP) b. National income c. The unemployment rate d. The industrial production index 4 A loose or expansionary money policy tends to economic growth and the inflation rate stimulate; place downward pressure on b. stimulate; place upward pressure on dampen: place upward pressure on 5. Which of the following is not an indicator of inflation? a. housing price indexes b. wage rates oil prices d. consumer confidence surveys b. c. d. 6. Which of the following is not an activity of Fed district banks! clearing checks replacing old currency providing loans to depository institutions acting as an intermediary to match up lenders and borrowers in the stock market 7. Which of the following is not a major component of the Federal Reserve System? a. member banks b. Federal Open Market Committee c. Securities and Exchange Commission d. Board of Goverors a. b. c. d. 8 In general, there is a positive relationship between unemployment and inflation. an inverse relationship between unemployment and inflation an inverse relationship between GNP and inflation a positive relationship between GNP and unemployment 9. A credit crunch occurs when: interest rates decline. interest rates rise. creditors restrict the amount of loans they are willing to provide. the economy is strong. b. d. a b. a. A credit crunch occurs when: interest rates decline. interest rates rise creditors restrict the amount of loans they are willing to provide. d. the economy is strong 10. Which of the following is an action that the Fed uses to increase or decrease the money supply? buying or selling Treasury securities in the secondary market b. adjusting the tax rate imposed on income eamed on Treasury securities c. adjusting the coupon rate on Treasury bonds d. selling Treasury securities in the primary market 11. The is made up of seven individual members, and each member is appointed by the president of the U.S. Board of Governors b. Federal Reserve district bank e. Federal Open Market Committee (FOMC) Securities and Exchange Commission a. d a. The a. c 12 A high US budget deficit tends to place pressure on interest rates, the Fed's tightening of the money supply tends to place pressure on interest rates, upward; upward b. upward; downward downward: downward d. downward; upward 13. is directly responsible for controlling money supply growth. Federal Advisory Council b. FOMC Board of Governors d. President of the United States 14. With regard to monetary policy, which of the following is under direct control of the Federal Reserve's Board of Governors? a. revise reserve requirements for depository institutions b. authorize changes in the amount of borrowing by the Treasury c. monitor the stock market for insider trading d. monitor the derivatives market for illegal trading strategies 15. Inflation is commonly the result of a small budget deficit b. recession high level of unemployment. high level of aggregate demand. 16. dollar tends to exert inflationary pressure in the U.S. stable strong weak d. both A and B c. d. a b. 17. The form of money consisting of currency held by the public and checkable deposits at depository institutions is called a. MI b. M2. c. d. MMDA. M3. b. 18. Default risk is likely to be highest for short-term Treasury securities AAA corporate securities. c. long-term Treasury securities. d. BBB corporate securities. 19. Which of the following is probably not a goal the Fed is trying to achieve consistently? low inflation high interest rates steady GDP growth d. low unemployment b. c d. 20. If the federal government is willing to pay whatever is necessary to borrow loanable funds, but the private sector is not, this reflects the crowding-out effect. b. dynamic open market operations, defensive open market operations. monetizing the debt. 21. When the Fed purchases securities, the total funds of commercial banks by the market value of securities purchased by the Fed. This activity initiated by the FOMC's policy directive is referred to as an) of money supply growth. increase; loosening b. decrease; tightening decrease loosening d. increase; tightening e. none of the above 22. If a security can casily be converted to cash without a loss in value, it is liquid b. has a high after-tax yield has high default risk d. is illiquid. C a c. 23) If the FED wishes to stimulate the economy, it could a) buy US Government Securities b) raise the fed funds rate and discount rate c) lower reserve requirements d) a and c e) a,b and c 24) The discount rate is the rate that a) banks charge for loans to corporate customers b) the Federal Reserve charges on loans to commercial banks c) banks charge each other on overnight loans d)banks charge brokerage firms to finance their inventory 25) The current Chair of the Federal Reserve is a) Donald Trump b) Bernard Beranke c) Warren Buffett d) Jerome Powell

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts