Question: 1. A: B: C. D. E. F. G. H. risk decreases By adding more more firms into a portfolio, the risk remains unchanged. while the

1.

A:

B:

C.

D.

E.

F.

G.

H.

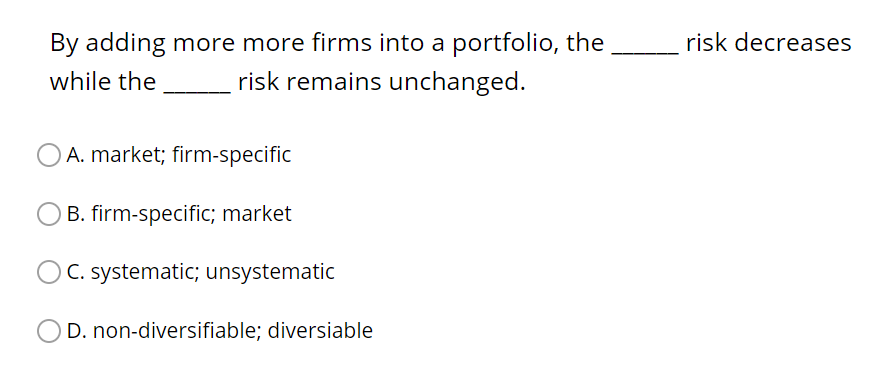

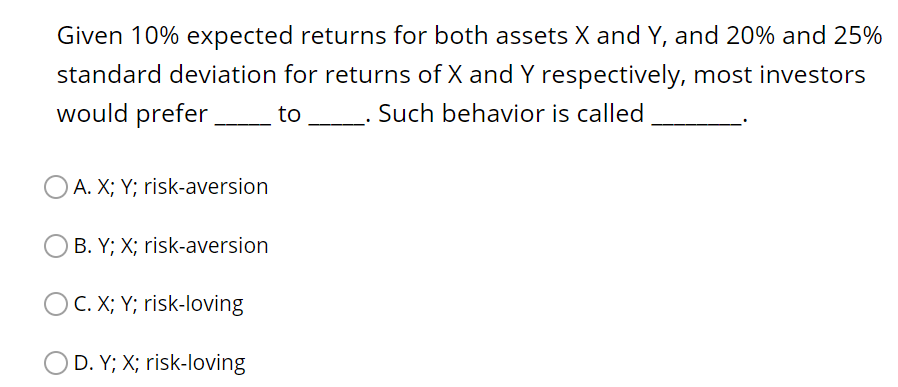

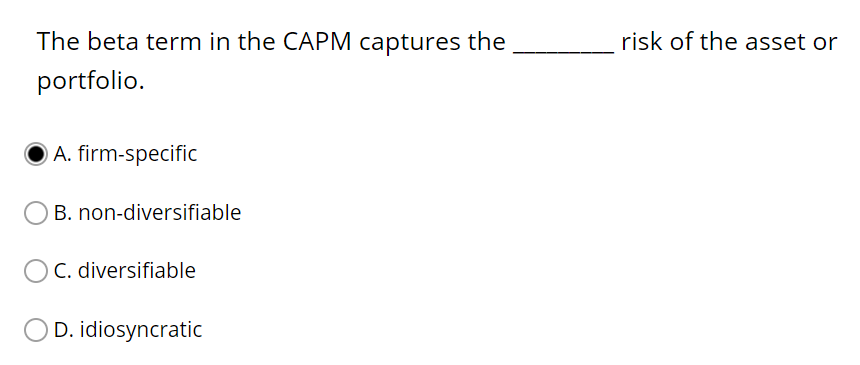

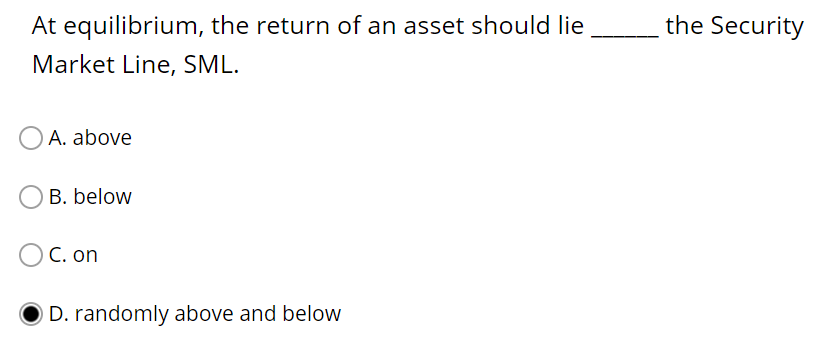

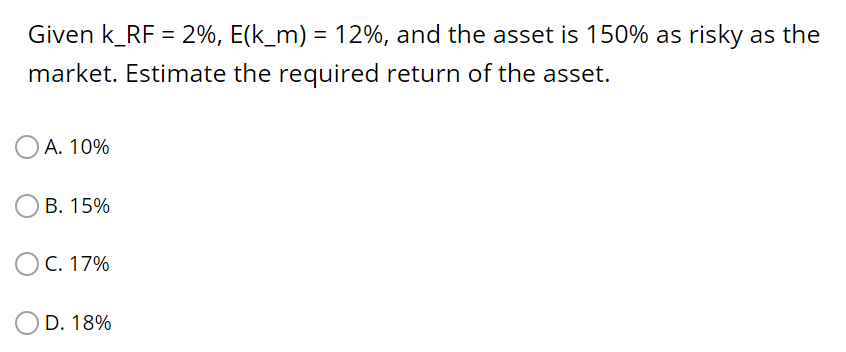

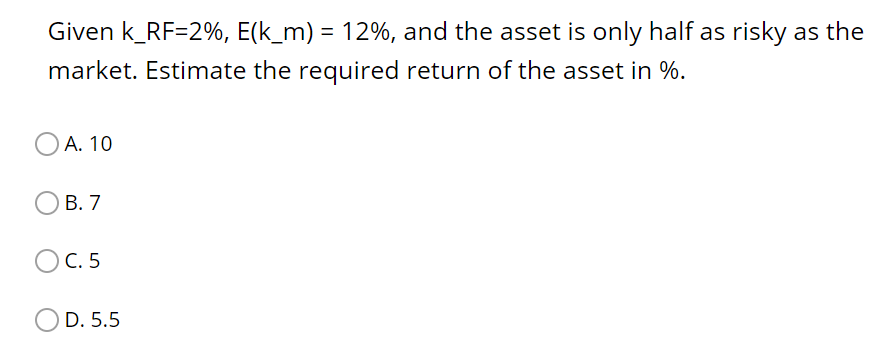

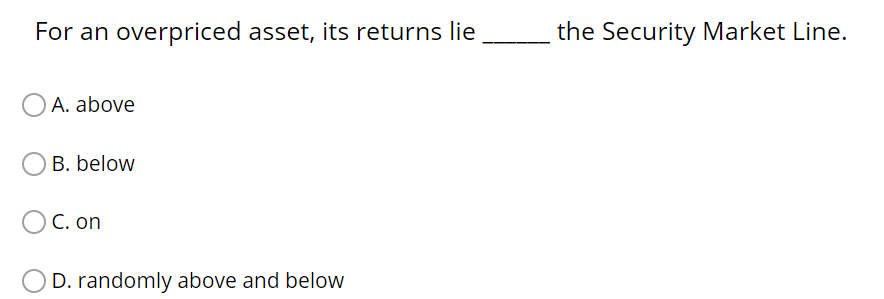

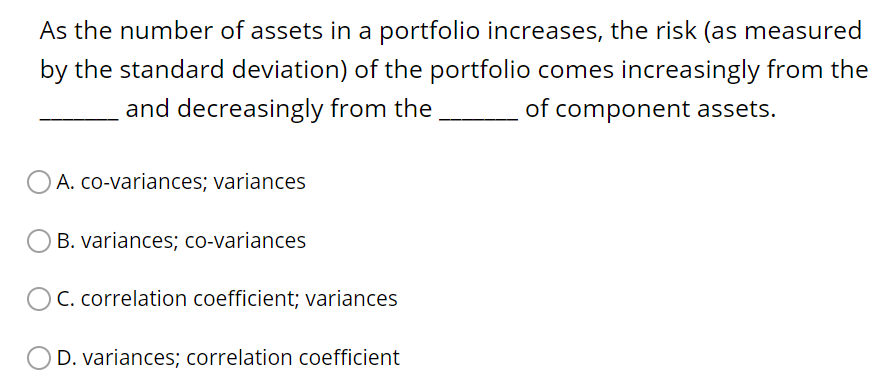

risk decreases By adding more more firms into a portfolio, the risk remains unchanged. while the A. market; firm-specific B. firm-specific; market C. systematic; unsystematic D. non-diversifiable; diversiable Given 10% expected returns for both assets X and Y, and 20% and 25% standard deviation for returns of X and Y respectively, most investors would prefer Such behavior is called to A. X; Y; risk-aversion B. Y; X; risk-aversion C. X; Y; risk-loving D. Y; X; risk-loving The beta term in the CAPM captures the risk of the asset or portfolio A. firm-specific B. non-diversifiable C. diversifiable D. idiosyncratic the Security At equilibrium, the return of an asset should lie Market Line, SML. A. above B. below C. on D. randomly above and below Given k_RF 2%, E(k_m) = 12%, and the asset is 150% as risky as the market. Estimate the required return of the asset. A. 10% B. 15% C. 17% D. 18% Given k_RF=2%, E(k_m) = 12%, and the asset is only half as risky as the market. Estimate the required return of the asset in % A. 10 . 7 C. 5 D. 5.5 the Security Market Line. For an overpriced asset, its returns lie A. above B. below C. on D. randomly above and below As the number of assets in a portfolio increases, the risk (as measured by the standard deviation) of the portfolio comes increasingly from the and decreasingly from the of component assets. A. co-variances; variances B. variances; co-variances C. correlation coefficient; variances D. variances; correlation coefficient

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts