Question: 1. A. B. C. D. How would you interpret an inventory turnover ratio of 10.7? It takes 50 days on average to collect receivables. Inventory

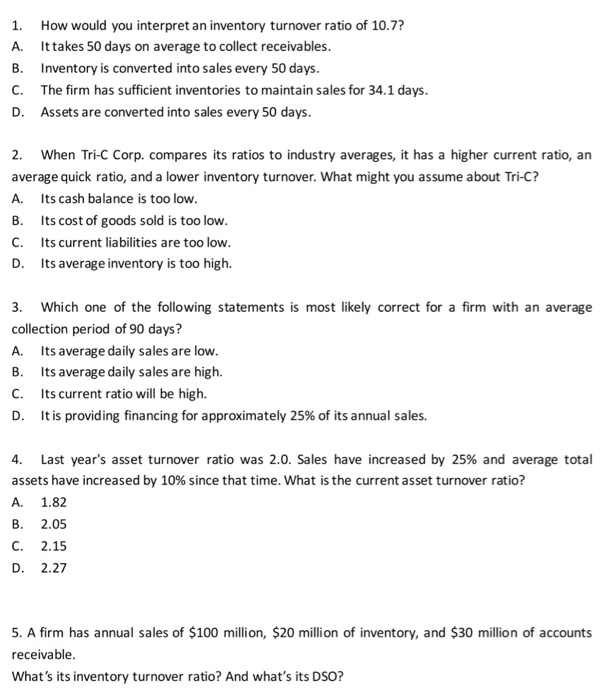

1. A. B. C. D. How would you interpret an inventory turnover ratio of 10.7? It takes 50 days on average to collect receivables. Inventory is converted into sales every 50 days. The firm has sufficient inventories to maintain sales for 34.1 days. Assets are converted into sales every 50 days. 2. When Tri-C Corp. compares its ratios to industry averages, it has a higher current ratio, an average quick ratio, and a lower inventory turnover. What might you assume about Tri-C? A. Its cash balance is too low. B. Its cost of goods sold is too low. C. Its current liabilities are too low D. Its average inventory is too high. 3. Which one of the following statements is most likely correct for a firm with an average collection period of 90 days? A. Its average daily sales are low. B. Its average daily sales are high. c. Its current ratio will be high. D. It is providing financing for approximately 25% of its annual sales. 4. Last year's asset turnover ratio was 2.0. Sales have increased by 25% and average total assets have increased by 10% since that time. What is the current asset turnover ratio? A. 1.82 B. 2.05 C. 2.15 D. 2.27 5. A firm has annual sales of $100 million, $20 million of inventory, and $30 million of accounts receivable. What's its inventory turnover ratio? And what's its DSO

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts