Question: 1. a) b) c) d) Why is it impossible to model an American-style option using the 1-period binomial option pricing model? It doesn't take into

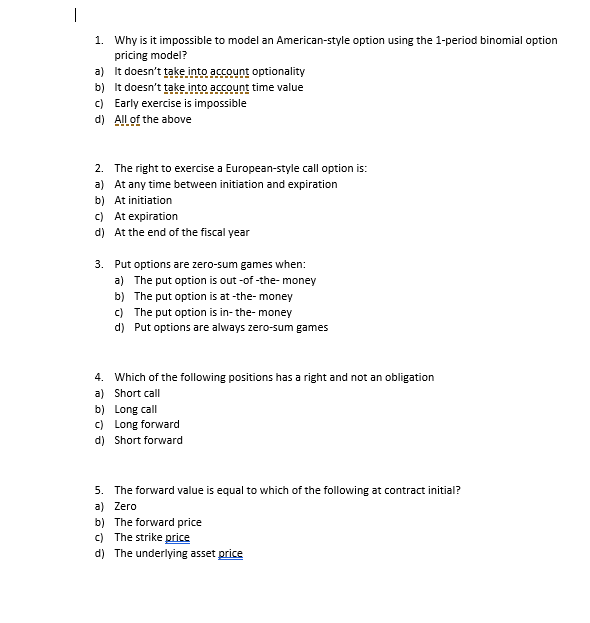

1. a) b) c) d) Why is it impossible to model an American-style option using the 1-period binomial option pricing model? It doesn't take into account optionality It doesn't take into account time value Early exercise is impossible All of the above 2. a) b) c) d) The right to exercise a European-style call option is: At any time between initiation and expiration At initiation At expiration At the end of the fiscal year Put options are zero-sum games when: a) 3. b) c) d) The put option is out -of -the-money The put option is at -the- money The put option is in- the- money Put options are always zero-sum games 4. a) b) c) d) Which of the following positions has a right and not an obligation Short call Long call Long forward Short forward 5. The forward value is equal to which of the following at contract initial? a) Zero b) The forward price c) The strike price d) The underlying asset price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts