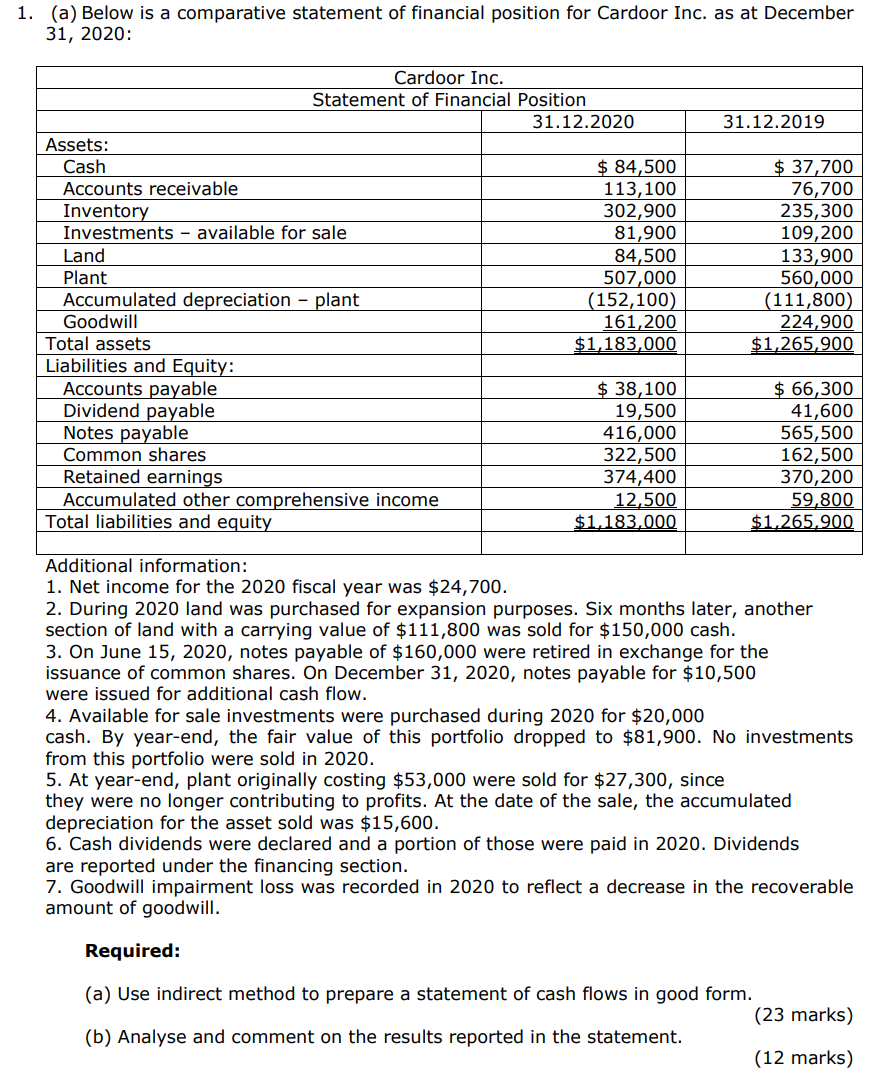

Question: 1. (a) Below is a comparative statement of financial position for Cardoor Inc. as at December 31, 2020: 31.12.2019 Cardoor Inc. Statement of Financial Position

1. (a) Below is a comparative statement of financial position for Cardoor Inc. as at December 31, 2020: 31.12.2019 Cardoor Inc. Statement of Financial Position 31.12.2020 Assets: Cash $ 84,500 Accounts receivable 113,100 Inventory 302,900 Investments - available for sale 81,900 Land 84,500 Plant 507,000 Accumulated depreciation - plant (152,100) Goodwill 161,200 Total assets $1,183,000 Liabilities and Equity: Accounts payable $ 38,100 Dividend payable 19,500 Notes payable 416,000 Common shares 322,500 Retained earnings 374,400 Accumulated other comprehensive income 12,500 Total liabilities and equity $1,183,000 $ 37,700 76,700 235,300 109,200 133,900 560,000 (111,800) 224,900 $1,265,900 $ 66,300 41,600 565,500 162,500 370,200 59,800 $1.265,900 Additional information: 1. Net income for the 2020 fiscal year was $24,700. 2. During 2020 land was purchased for expansion purposes. Six months later, another section of land with a carrying value of $111,800 was sold for $150,000 cash. 3. On June 15, 2020, notes payable of $160,000 were retired in exchange for the issuance of common shares. On December 31, 2020, notes payable for $10,500 were issued for additional cash flow. 4. Available for sale investments were purchased during 2020 for $20,000 cash. By year-end, the fair value of this portfolio dropped to $81,900. No investments from this portfolio were sold in 2020. 5. At year-end, plant originally costing $53,000 were sold for $27,300, since they were no longer contributing to profits. At the date of the sale, the accumulated depreciation for the asset sold was $15,600. 6. Cash dividends were declared and a portion of those were paid in 2020. Dividends are reported under the financing section. 7. Goodwill impairment loss was recorded in 2020 to reflect a decrease in the recoverable amount of goodwill. Required: (a) Use indirect method to prepare a statement of cash flows in good form. (23 marks) (b) Analyse and comment on the results reported in the statement. (12 marks) 1. (a) Below is a comparative statement of financial position for Cardoor Inc. as at December 31, 2020: 31.12.2019 Cardoor Inc. Statement of Financial Position 31.12.2020 Assets: Cash $ 84,500 Accounts receivable 113,100 Inventory 302,900 Investments - available for sale 81,900 Land 84,500 Plant 507,000 Accumulated depreciation - plant (152,100) Goodwill 161,200 Total assets $1,183,000 Liabilities and Equity: Accounts payable $ 38,100 Dividend payable 19,500 Notes payable 416,000 Common shares 322,500 Retained earnings 374,400 Accumulated other comprehensive income 12,500 Total liabilities and equity $1,183,000 $ 37,700 76,700 235,300 109,200 133,900 560,000 (111,800) 224,900 $1,265,900 $ 66,300 41,600 565,500 162,500 370,200 59,800 $1.265,900 Additional information: 1. Net income for the 2020 fiscal year was $24,700. 2. During 2020 land was purchased for expansion purposes. Six months later, another section of land with a carrying value of $111,800 was sold for $150,000 cash. 3. On June 15, 2020, notes payable of $160,000 were retired in exchange for the issuance of common shares. On December 31, 2020, notes payable for $10,500 were issued for additional cash flow. 4. Available for sale investments were purchased during 2020 for $20,000 cash. By year-end, the fair value of this portfolio dropped to $81,900. No investments from this portfolio were sold in 2020. 5. At year-end, plant originally costing $53,000 were sold for $27,300, since they were no longer contributing to profits. At the date of the sale, the accumulated depreciation for the asset sold was $15,600. 6. Cash dividends were declared and a portion of those were paid in 2020. Dividends are reported under the financing section. 7. Goodwill impairment loss was recorded in 2020 to reflect a decrease in the recoverable amount of goodwill. Required: (a) Use indirect method to prepare a statement of cash flows in good form. (23 marks) (b) Analyse and comment on the results reported in the statement. (12 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts