Question: 1. A bond has a $1.000 face value, a market price of $1,045, and pays interest payments of $74.50 every year. What is the coupon

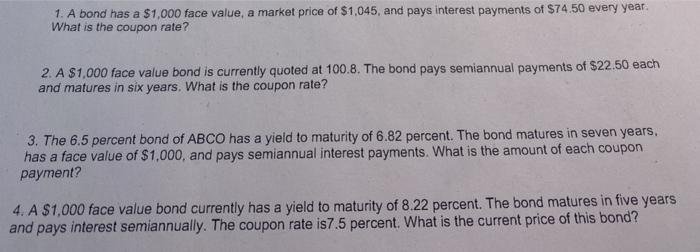

1. A bond has a $1.000 face value, a market price of $1,045, and pays interest payments of $74.50 every year. What is the coupon rate? 2. A $1,000 face value bond is currently quoted at 100.8. The bond pays semiannual payments of $22.50 each and matures in six years. What is the coupon rate? 3. The 6.5 percent bond of ABCO has a yield to maturity of 6.82 percent. The bond matures in seven years, has a face value of $1,000, and pays semiannual interest payments. What is the amount of each coupon payment? 4. A $1,000 face value bond currently has a yield to maturity of 8.22 percent. The bond matures in five years and pays interest semiannually. The coupon rate is7.5 percent. What is the current price of this bond

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts