Question: 1. A company's demand for a given component for the next 10 years is expected to be 1800/year. One of the following two options has

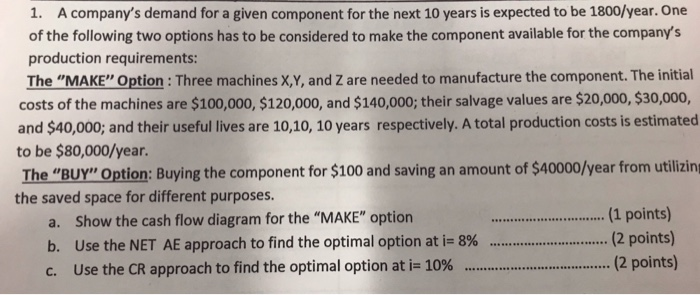

1. A company's demand for a given component for the next 10 years is expected to be 1800/year. One of the following two options has to be considered to make the component available for the company's production requirements: The "MAKE" Option : Three machines X,Y, and Z are needed to manufacture the component. The initial costs of the machines are $100,000, $120,000, and $140,000; their salvage values are $20,000, $30,000, and $40,000; and their useful lives are 10,10, 10 years respectively. A total production costs is estimated to be $80,000/year. The "BUY" Option: Buying the component for $100 and saving an amount of $40000/year from utilizing the saved space for different purposes. a. b. c. Show the cash flow diagram for the "MAKE" option Use the NET AE approach to find the optimal option at i-8% Use the CR approach to find the optimal option at i 10% ..1 points) (2 points) 2points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts