Question: 1. a. Compute the future value of $1,000 compounded annually for 20 years at 7 percent. (Do not round intermediate calculations and round your answer

1.

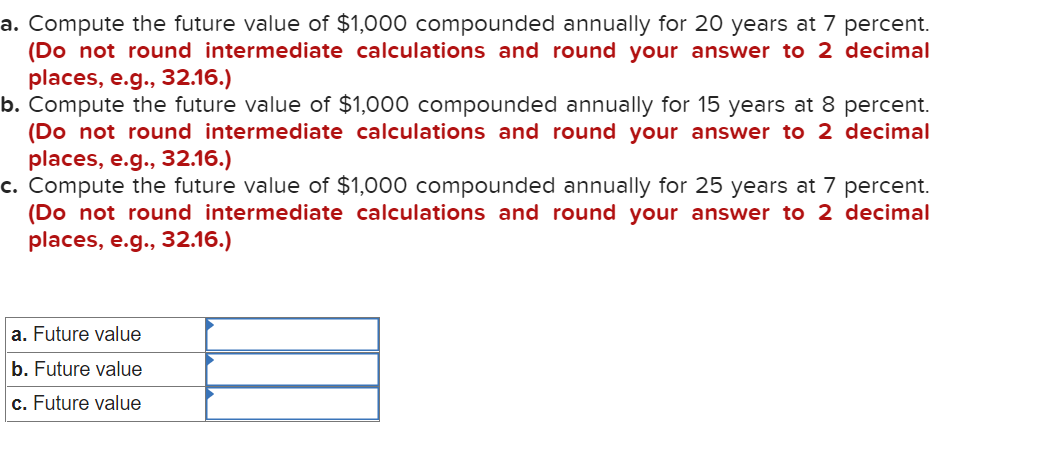

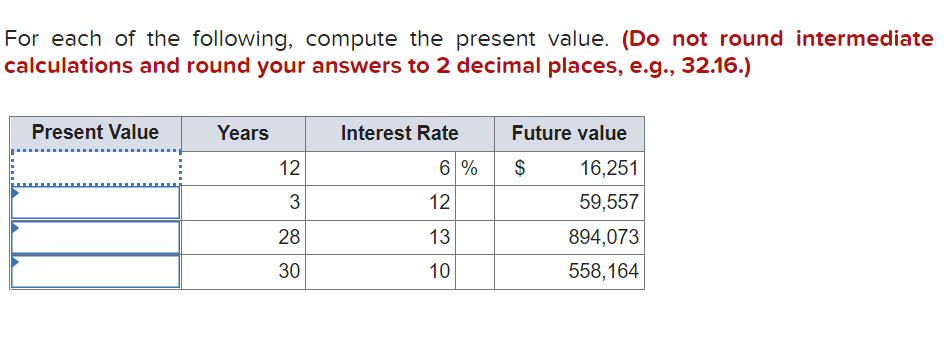

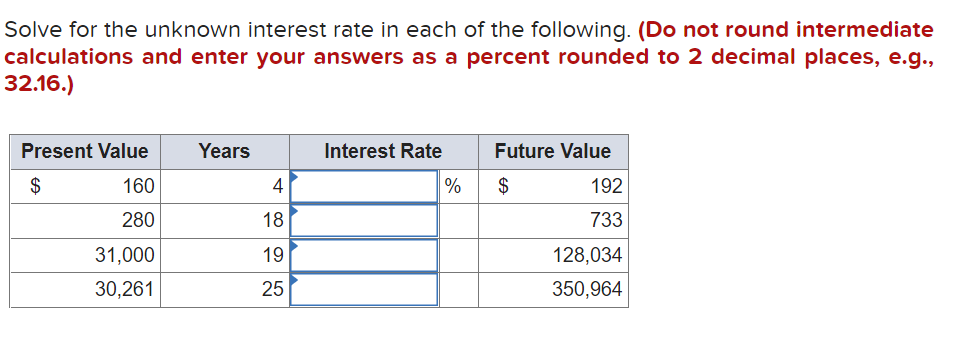

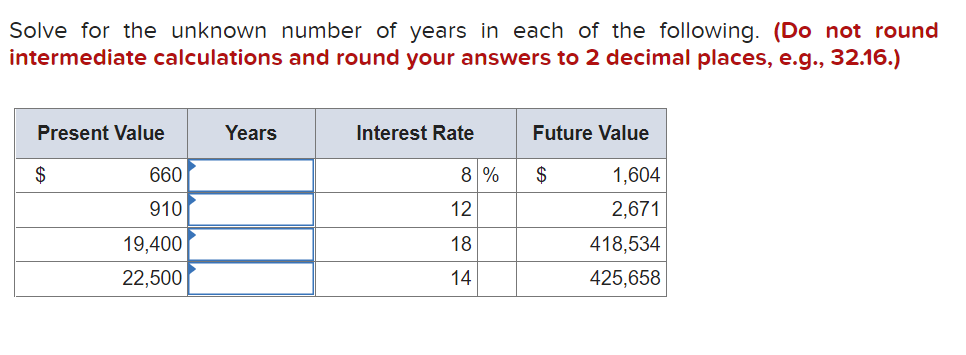

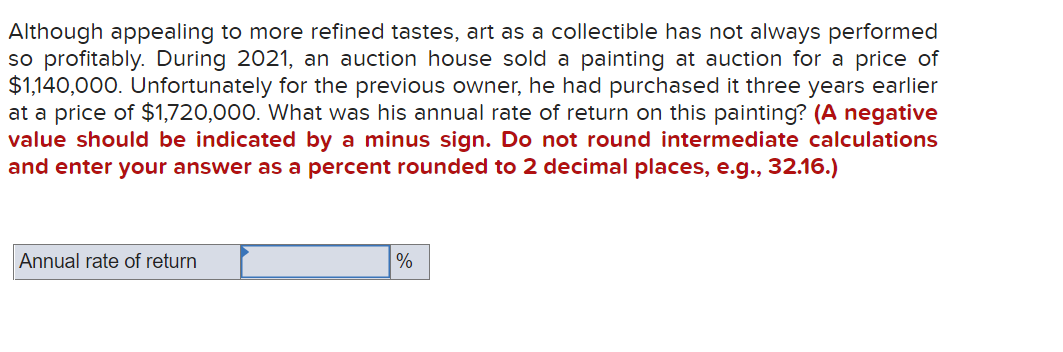

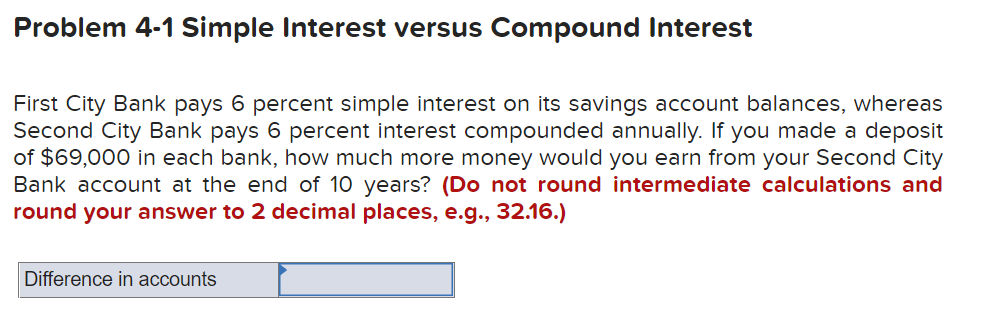

a. Compute the future value of $1,000 compounded annually for 20 years at 7 percent. (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. Compute the future value of $1,000 compounded annually for 15 years at 8 percent. (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) c. Compute the future value of $1,000 compounded annually for 25 years at 7 percent. (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) a. Future value b. Future value c. Future value For each of the following, compute the present value. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Present Value Years Interest Rate Future value ' ' 12 6 % $ 16,251 28 13 894,073 30 10 558,164 Solve for the unknown interest rate in each of the following. (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) Present Value Years Interest Rate Future Value $ 160 4 % $ 192 280 18 733 31,000 19 128,034 30,261 25 350,964Solve for the unknown number of years in each of the following. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Present Value Years Interest Rate Future Value $ 660 8 % $ 1,604 910 12 2,671 19,400 18 418,534 22,500 14 425,658 Although appealing to more refined tastes, art as a collectible has not always performed so profitably. During 2021, an auction house sold a painting at auction for a price of $1,140,000. Unfortunately for the previous owner, he had purchased it three years earlier at a price of $1,720,000. What was his annual rate of return on this painting? (A negative value should be indicated by a minus sign. Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Annual rate of return % Problem 4-1 Simple Interest versus Compound Interest First City Bank pays 6 percent simple interest on its savings account balances, Whereas Second City Bank pays 6 percent interest compounded annually. If you made a deposit of $69,000 in each bank, how much more money would you earn from your Second City Bank account at the end of 10 years? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) ' Difference in accounts :l

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts