Question: 1. A deficiency judgment is a a. Judgment with no means for payment b. Judgment which reduces the debt through periodic payments c. Judgment due

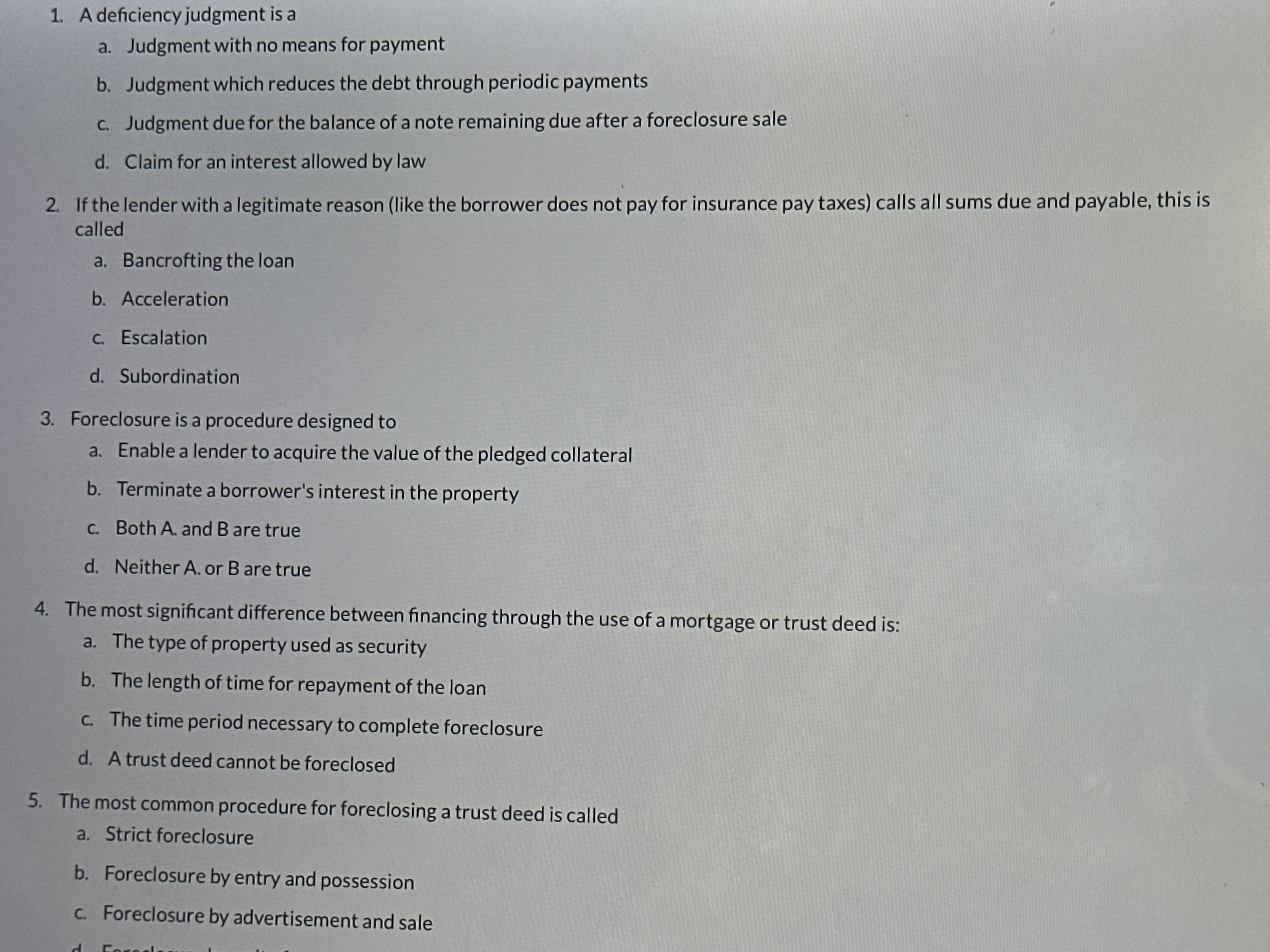

1. A deficiency judgment is a a. Judgment with no means for payment b. Judgment which reduces the debt through periodic payments c. Judgment due for the balance of a note remaining due after a foreclosure sale d. Claim for an interest allowed by law 2. If the lender with a legitimate reason (like the borrower does not pay for insurance pay taxes) calls all sums due and payable, this is called a. Bancrofting the loan b. Acceleration c. Escalation d. Subordination 3. Foreclosure is a procedure designed to a. Enable a lender to acquire the value of the pledged collateral b. Terminate a borrower's interest in the property c. Both A. and B are true d. Neither A. or B are true 4. The most significant difference between financing through the use of a mortgage or trust deed is: a. The type of property used as security b. The length of time for repayment of the loan c. The time period necessary to complete foreclosure d. A trust deed cannot be foreclosed 5. The most common procedure for foreclosing a trust deed is called a. Strict foreclosure b. Foreclosure by entry and possession c. Foreclosure by advertisement and sale

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts