1. a) Explain how a suspense account can be used as part of the book-keeping

error correction process. (4 marks)

b) The following are extracted balances from Harbhajan's business accounts along

with other information relating to the business's year end on 30 April 2017.

For some reason, the figure for Capital at the beginning of the year has not

been supplied, although you have been given the year end net profit figure:

Capital as at 1 May 2016 unknown

Machinery at cost 100,000

Sales Revenue 59,000

Motor Vehicles at cost 50,000

Purchases 25,000

Trade Receivables 13,500

Trade Payables 12,500

Accumulated [provision for] depreciation: Machinery 10,000

HM Revenue and Customs: VAT (owing) 7,750

Net Profit as at 30 April 2017 7,105

Accumulated [provision for] depreciation: Motor Vehicles 5,000

Water and Utilities 4,500

Inventory as at 1 May 2016 3,500

Wages and Salaries 3,500

Rent 3,000

Bank (in funds) 1,800

Purchases Returns 1,355

Business Rates 1,250

Bad Debts written off 1,150

Sales Returns 1,250

Discounts Allowed 950

Cash in Hand 760

Drawings 750

Discounts Received 550

The Rent figure includes 600 relating to May, June and July 2017.

The Machinery still has to be depreciated at year end by 10% straight line.

There was unpaid Wages and Salaries at year end 30 April 2017 of 800.

Stocktake at year end 30 April 2017 valued Inventory at 5,000.

Motor Vehicles need year end depreciation (diminishing [reducing] balance

at 10%).

June 2017 7B/PQP/8 Continued

TASK for part b)

Use the information given about Harbhajan's business as appropriate to

prepare Statement of Financial Position for its year end, including the

missing figure for Capital. (12 marks)

c) Explain the problems from a working capital perspective for a business which

has i) too many orders and ii) too few orders. (4 marks)

Total 20 marks

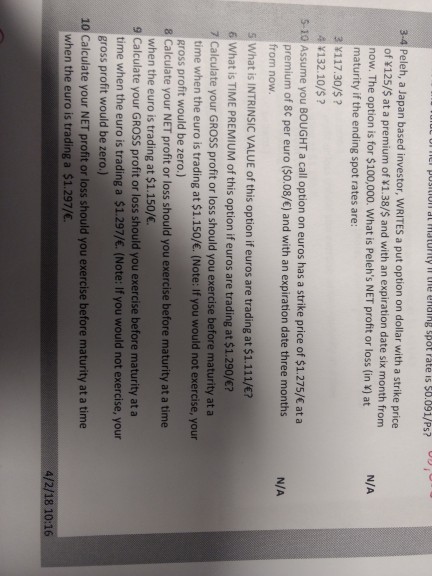

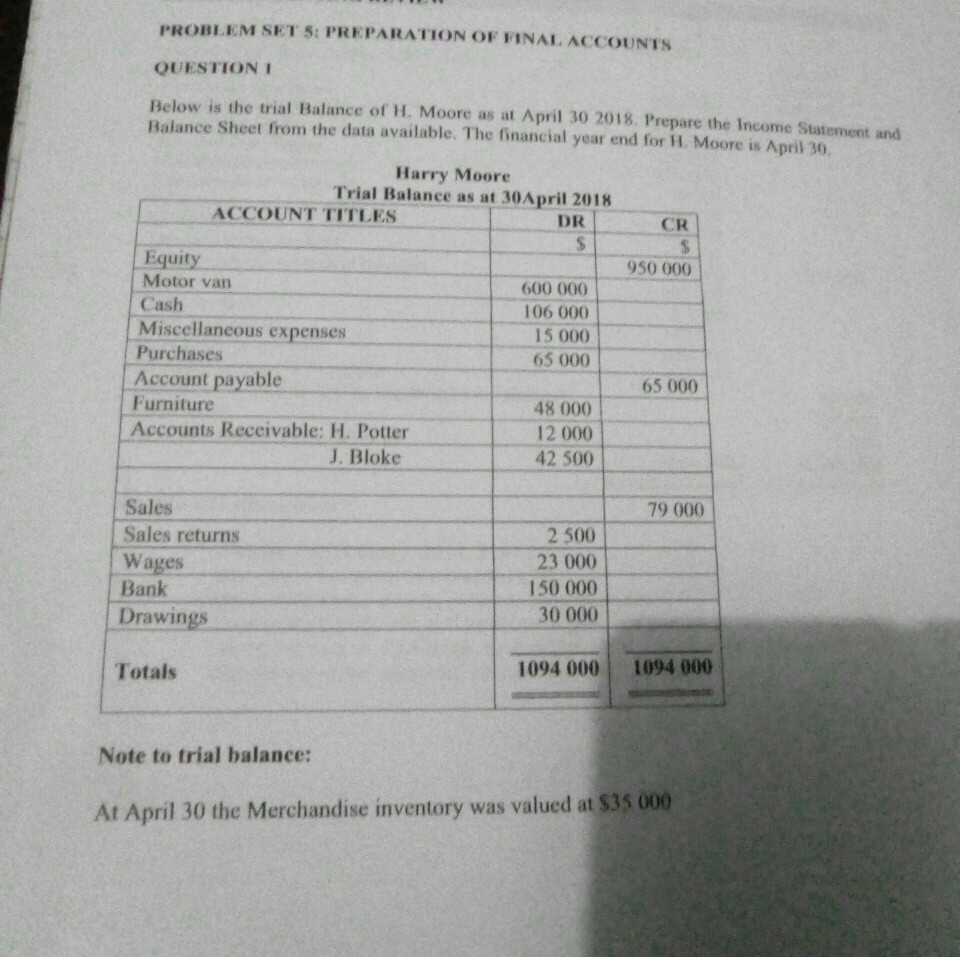

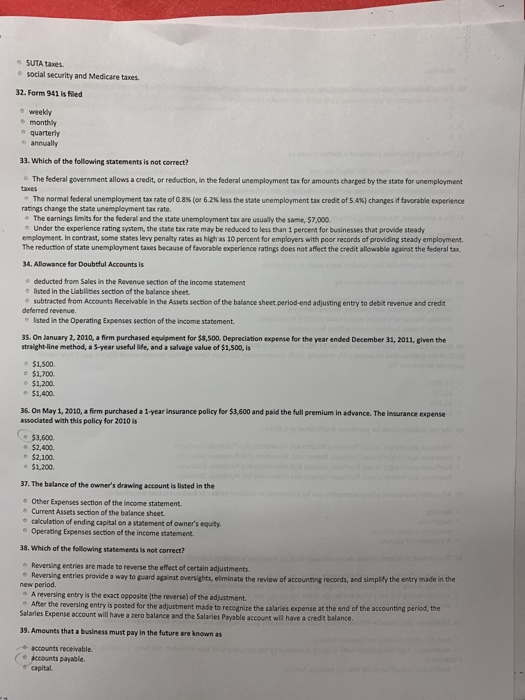

3-4 Peleh, a Japan based investor, WRITES a put option on dollar with a strike price of Y125/$ at a premium of *1.38/$ and with an expiration date six month from now. The option is for $100,000. What is Peleh's NET profit or loss (in Y) at N/A maturity if the ending spot rates are: 3 x117.30/$? V132.10/5 ? 5-10 Assume you BOUGHT a call option on euros has a strike price of $1.275/C at a premium of 8c per euro ($0.08/() and with an expiration date three months N/A from now. 5 What is INTRINSIC VALUE of this option if euros are trading at $1.111/E? 6 What is TIME PREMIUM of this option if euros are trading at $1.290/E? 7 Calculate your GROSS profit or loss should you exercise before maturity at a time when the euro is trading at $1.150/E. (Note: If you would not exercise, your gross profit would be zero.] 8 Calculate your NET profit or loss should you exercise before maturity at a time when the euro is trading at $1.150/C. 9 Calculate your GROSS profit or loss should you exercise before maturity at a time when the euro is trading a $1.297/E. (Note: If you would not exercise, your gross profit would be zero.) 10 Calculate your NET profit or loss should you exercise before maturity at a time when the euro is trading a $1.297/C. 4/2/18 10:16PROBLEM SET 5: PREPARATION OF FINAL ACCOUNTS QUESTION I Below is the trial Balance of H. Moore as at April 30 2018. Prepare the Income Statement and Balance Sheet from the data available. The financial year end for H. Moore is April 30 Harry Moore Trial Balance as at 30April 2018 ACCOUNT TITLES DR CR Equity 950 000 Motor van 600 000 Cash 106 000 Miscellaneous expenses 15 000 Purchases 65 000 Account payable 65 000 Furniture 48 000 Accounts Receivable: H. Potter 12 000 J. Bloke 42 500 Sales 79 000 Sales returns 2 500 Wages 23 000 Bank 150 000 Drawings 30 000 Totals 1094 000 1094 000 Note to trial balance: At April 30 the Merchandise inventory was valued at $35 000SUTA taxes social security and Medicare taxes. 32. Form 941 is filled weekly monthly n quarterly annually 33. Which of the following statements Is not correct? The federal government allows a credit, of reduction, In the federal unemployment tax for amounts charged by the state for unemployment The normal federal unemployment tax rate of 0.8% [or 6.2% Mass the state unemployment tax credit of 5.416) changes if favorable experience ratings change the state unemployment bix rate. The earnings limits for the federal and the state unemployment tax are usually the same, 57/090. Under the experience rating system, the state tax rate may be reduced to less than 1 percent for businesses that provide steady employment. In contrast, some states levy penalty rates as high as 10 percent for employers with poor records of providing steady employment. The reduction of state unemployment taxes because of favorable experience ratings does not affect the credit allowable against the federal tax. 34, Allowance for Doubtful Accounts Is deducted from Sales in the Revenue section of the income statement e listed In the Lablitles section of the balance sheet. subtracted from Accounts Receivable In the Aspits section of the balance sheet period-end adjusting entry to debit revenue and credit deferred revenue. Noted in the Operating Expenses section of the Income statement. 35. On January 2, 2010, a firm purchased equipment for $8,500. Depreciation experie for the year ended December 31, 2011, given the straight-line method, a 5-year useful life, and a salvage value of $1,500, Is #$1,500. 51.700 8 51,200. 0 51,400. 35. On May 1, 2010, a firm purchased a 1-year insurance policy for $3,600 and paid the full premium in advance. The insurance expense associated with this policy for 2010 $3,600. $2,400. $2.100. 51,200. 37. The balance of the owner's drawing account is listed in the Other Expenses section of the income statement Current Assets section of the balance sheet. calculation of ending capital on a Matement of owner's equity. Operating Expenses section of the income statement. 38. Which of the following statements is not correct? . Reversing entries are made to reverse the effect of certain adjustments. Reversing entries provide a way to guard against overnights, eliminate the review of accounting records, and simplify the entry made in the new period. A reversing entry is the exact opposite (the reverse) of the adjustment. After the reversing entry is posted for the adjustment made to recognize the salaries expense at the end of the accounting perlod, the Salaries Expense account will have a zero balance and the Salarici Payable accourt will have a credit balance. 39. Amounts that a business must pay In the future are known as # accounts receivable accounts payable. capital