Question: 1. (a) Explain the capital asset pricing model (CAPM), its relationship to the security market line, and the major forces causing the security market

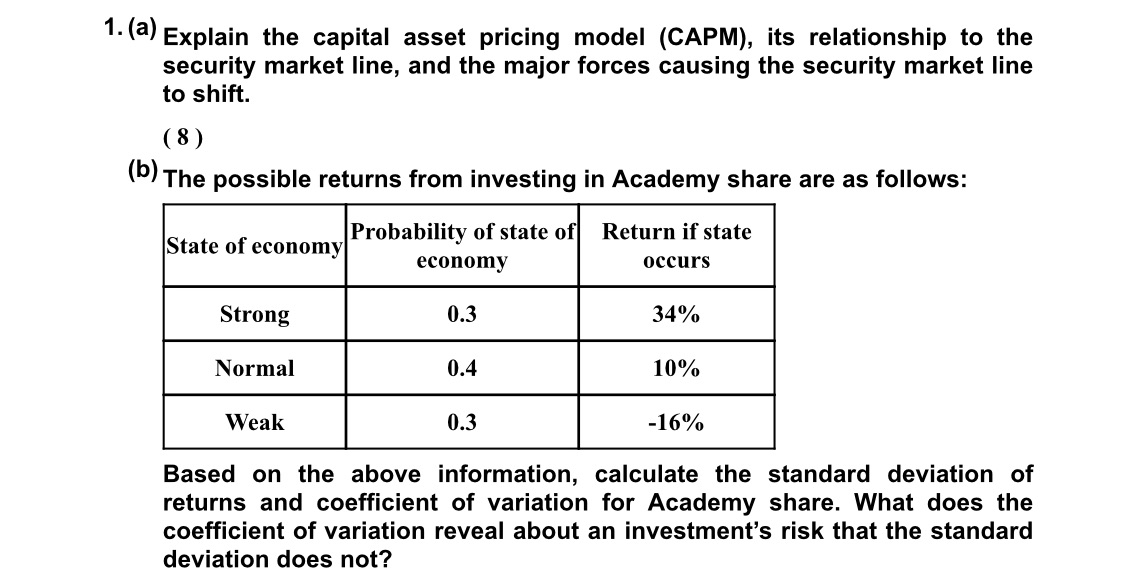

1. (a) Explain the capital asset pricing model (CAPM), its relationship to the security market line, and the major forces causing the security market line to shift. (8) (b) The possible returns from investing in Academy share are as follows: State of economy Probability of state of Return if state economy occurs Strong 0.3 34% Normal 0.4 10% Weak 0.3 -16% Based on the above information, calculate the standard deviation of returns and coefficient of variation for Academy share. What does the coefficient of variation reveal about an investment's risk that the standard deviation does not?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts