Question: 1. (a) Explain the difference between direct and indirect quotes, by giving appropriate examples. [10 marks] (b) Suppose the direct quote for USD ($) in

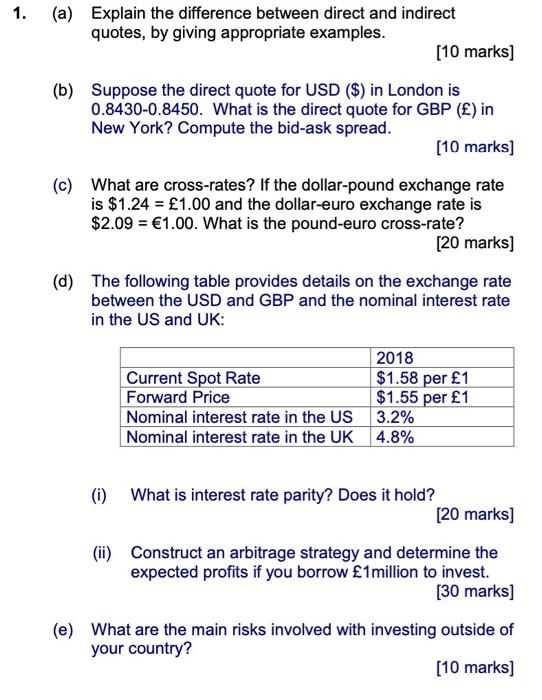

1. (a) Explain the difference between direct and indirect quotes, by giving appropriate examples. [10 marks] (b) Suppose the direct quote for USD ($) in London is 0.8430-0.8450. What is the direct quote for GBP () in New York? Compute the bid-ask spread. [10 marks] (c) What are cross-rates? If the dollar-pound exchange rate is $1.24 = 1.00 and the dollar-euro exchange rate is $2.09 = 1.00. What is the pound-euro cross-rate? [20 marks) (d) The following table provides details on the exchange rate between the USD and GBP and the nominal interest rate in the US and UK: 2018 Current Spot Rate $1.58 per 1 Forward Price $1.55 per 1 Nominal interest rate in the US 3.2% Nominal interest rate in the UK 4.8% (i) What is interest rate parity? Does it hold? [20 marks] (ii) Construct an arbitrage strategy and determine the expected profits if you borrow 1million to invest. (30 marks] (e) What are the main risks involved with investing outside of your country? [10 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts