Question: 1. A forward swap is an agreement made between two parties today. One party agrees to exchange floating payments for fixed payments. The other party

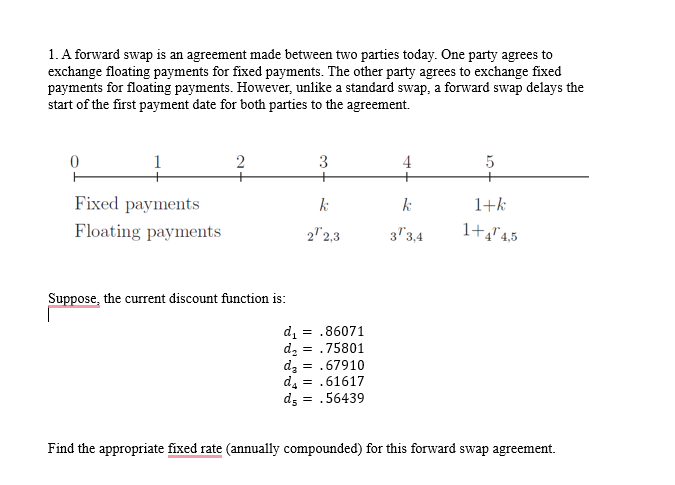

1. A forward swap is an agreement made between two parties today. One party agrees to exchange floating payments for fixed payments. The other party agrees to exchange fixed payments for floating payments. However, unlike a standard swap, a forward swap delays the start of the first payment date for both parties to the agreement. Suppose, the current discount function is: d1=.86071d2=.75801d3=.67910d4=.61617d5=.56439 Find the appropriate fixed rate (annually compounded) for this forward swap agreement

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock