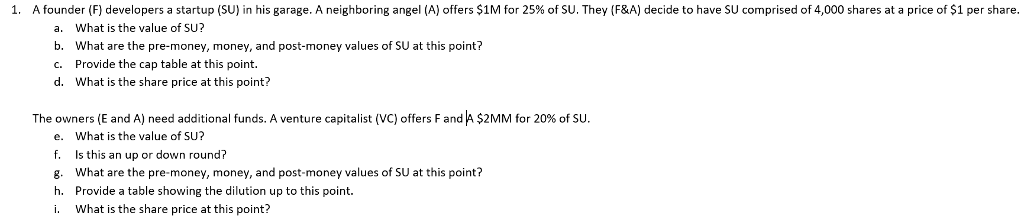

Question: 1, A founder (F) developers a startup (SU) in his garage. A neighboring angel (A) offers $1M for 25% of SU. They (F&A) decide to

1, A founder (F) developers a startup (SU) in his garage. A neighboring angel (A) offers $1M for 25% of SU. They (F&A) decide to have SU comprised of 4,000 shares at a price of $1 per share a. b. c. d. What is the value of SU? What are the pre-money, money, and post-money values of SU at this point? Provide the cap table at this point. What is the share price at this point? The owners (E and A) need additional funds. A venture capitalist (VC) offers F and A $2MM for 20% of SU e. What is the value of SU? f Is this an up or down round? g. What are the pre-money, money, and post-money values of SU at this point? h. Provide a table showing the dilution up to this point. i. What is the share price at this point? 1, A founder (F) developers a startup (SU) in his garage. A neighboring angel (A) offers $1M for 25% of SU. They (F&A) decide to have SU comprised of 4,000 shares at a price of $1 per share a. b. c. d. What is the value of SU? What are the pre-money, money, and post-money values of SU at this point? Provide the cap table at this point. What is the share price at this point? The owners (E and A) need additional funds. A venture capitalist (VC) offers F and A $2MM for 20% of SU e. What is the value of SU? f Is this an up or down round? g. What are the pre-money, money, and post-money values of SU at this point? h. Provide a table showing the dilution up to this point. i. What is the share price at this point

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts