Question: 1) a. How much debt does the issuer have? Has the debt level changed over the past three years? Can the increase/decrease in debt level

1) a. How much debt does the issuer have? Has the debt level changed over the past three years? Can the increase/decrease in debt level affect their credit rating? Provide a graph that shows the debt level over the past three years. b. What is the bond's ratings? What does the rating indicate about default risk? 2) a. What is the coupon payment frequency and how much interest (in dollar amount) does the bond pay each period? b. Why is the bond a good investment based on group risk profile? Include following points: Issuers debt ratio relative to their industry, Price risk, Reinvestment risk.

1) a. How much debt does the issuer have? Has the debt level changed over the past three years? Can the increase/decrease in debt level affect their credit rating? Provide a graph that shows the debt level over the past three years. b. What is the bond's ratings? What does the rating indicate about default risk? 2) a. What is the coupon payment frequency and how much interest (in dollar amount) does the bond pay each period? b. Why is the bond a good investment based on group risk profile? Include following points: Issuers debt ratio relative to their industry, Price risk, Reinvestment risk.

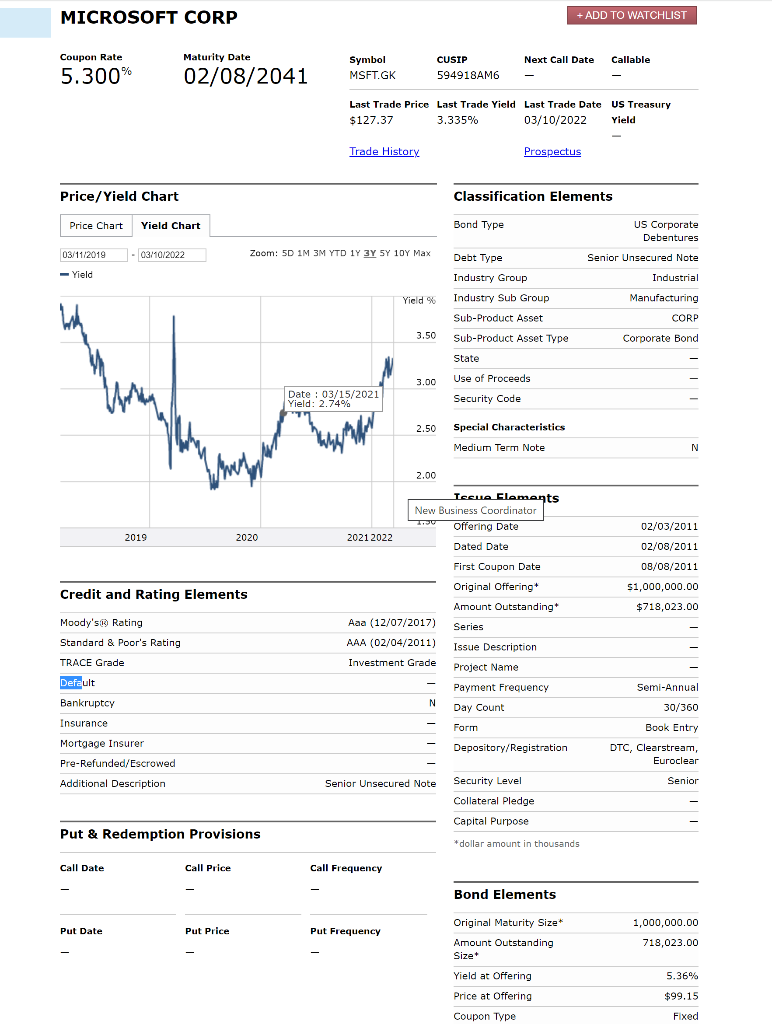

MICROSOFT CORP + ADD TO WATCHLIST Coupon Rate Maturity Date Next Call Date Callable 5.300% 02/08/2041 Symbol MSFT.GK CUSIP 594918AM6 Last Trade Price Last Trade Yield Last Trade Date US Treasury $127.37 3.335% 03/10/2022 Yield Trade History Prospectus Price/Yield Chart Classification Elements Price Chart Yield Chart Bond Type 03/10/2022 Zoom: 5D 1M 3M YTD 1Y 3Y SY 1DY Max Debt Type 03/11/2019 -Yield US Corporate Debentures Senior Unsecured Note Industrial Manufacturing CORP Industry Group Yield Industry Sub Group Sub-Product Asset 3.50 Sub-Product Asset Type Corporate Bond State 3.00 Use of Proceeds Date : 03/15/2021 Yield: 2.74% Security Code wall 2.50 Special Characteristics Medium Term Note N 2.00 Teens Elements New Business Coordinator 2.30 Offering Date 02/03/2011 2019 2020 2021 2022 Dated Date 02/08/2011 First Coupon Date 08/08/2011 Original Offering $1,000,000.00 Credit and Rating Elements Amount Outstanding $718,023.00 Aaa (12/07/2017) Series Moody's Rating Standard & Poor's Rating AAA (02/04/2011) Investment Grade Issue Description TRACE Grade Project Name Default Bankruptcy Payment Frequency Semi-Annual N Day Count 30/360 Insurance Form Book Entry Depository/Registration Mortgage Insurer Pre-Refunded/Escrowed Additional Description DTC, Clearstream, Euroclear Senior Unsecured Note Security Level Senior Collateral Pledge Capital Purpose Put & Redemption Provisions *dollar amount in thousands Call Date Call Price Call Frequency Bond Elements Original Maturity Size* Put Date Put Price Put Frequency 1,000,000.00 718,023.00 Amount Outstanding Size 5.36% Yield at Offering Price at Offering Coupon Type $99.15 Fixed MICROSOFT CORP + ADD TO WATCHLIST Coupon Rate Maturity Date Next Call Date Callable 5.300% 02/08/2041 Symbol MSFT.GK CUSIP 594918AM6 Last Trade Price Last Trade Yield Last Trade Date US Treasury $127.37 3.335% 03/10/2022 Yield Trade History Prospectus Price/Yield Chart Classification Elements Price Chart Yield Chart Bond Type 03/10/2022 Zoom: 5D 1M 3M YTD 1Y 3Y SY 1DY Max Debt Type 03/11/2019 -Yield US Corporate Debentures Senior Unsecured Note Industrial Manufacturing CORP Industry Group Yield Industry Sub Group Sub-Product Asset 3.50 Sub-Product Asset Type Corporate Bond State 3.00 Use of Proceeds Date : 03/15/2021 Yield: 2.74% Security Code wall 2.50 Special Characteristics Medium Term Note N 2.00 Teens Elements New Business Coordinator 2.30 Offering Date 02/03/2011 2019 2020 2021 2022 Dated Date 02/08/2011 First Coupon Date 08/08/2011 Original Offering $1,000,000.00 Credit and Rating Elements Amount Outstanding $718,023.00 Aaa (12/07/2017) Series Moody's Rating Standard & Poor's Rating AAA (02/04/2011) Investment Grade Issue Description TRACE Grade Project Name Default Bankruptcy Payment Frequency Semi-Annual N Day Count 30/360 Insurance Form Book Entry Depository/Registration Mortgage Insurer Pre-Refunded/Escrowed Additional Description DTC, Clearstream, Euroclear Senior Unsecured Note Security Level Senior Collateral Pledge Capital Purpose Put & Redemption Provisions *dollar amount in thousands Call Date Call Price Call Frequency Bond Elements Original Maturity Size* Put Date Put Price Put Frequency 1,000,000.00 718,023.00 Amount Outstanding Size 5.36% Yield at Offering Price at Offering Coupon Type $99.15 Fixed

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts