Question: 1) a) How much positive contribution margin in total is the childrens shoe line providing that is helping the firm profit financially?___ b) How much

1)

a) How much positive contribution margin in total is the childrens shoe line providing that is helping the firm profit financially?___

b) How much the firms total net income drop if the childrens shoe line is dropped? __

c) How much positive margin in total is the Cups line providing- that is helping the firm profit financially?

d) How much will the firms total net income drop if the Cups line is dropped?

2) A condensed income statement by product line for Celestial Beverage Inc. indicated the following for Star Cola for the past year:

Sales $390,000

Cost of goods sold 184,000

Gross profit 206,000

Operating expenses 255,000

Loss from operations (49,000)

It is estimated that 20% of the cost of goods sold represents fixed factory overhead costs and that 30% of the operating expenses are fixed. Because Star Cola is only one of many products, the fixed costs will not be materially affected if the product is discontinued.

a) How much positive contribution margin in total is the Star Cola line providing-that is helping the firm profit financially?

b) How much will the firms total net income drop if the Star Cola is dropped?

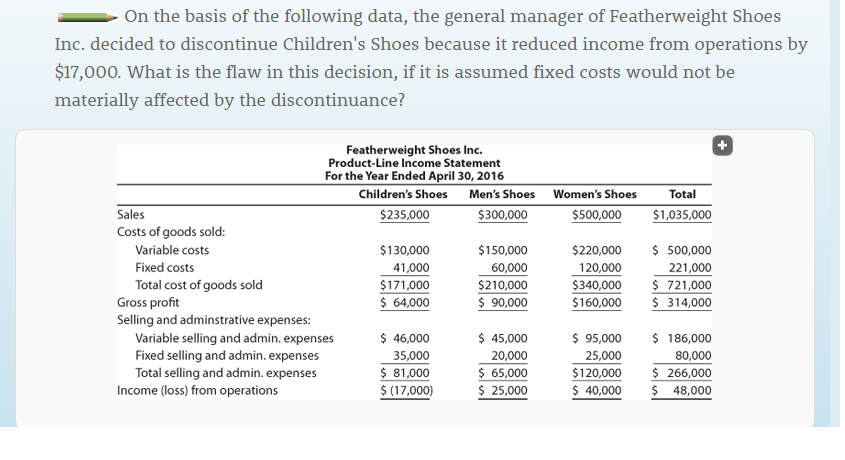

On the basis of the following data, the general manager of Featherweight Shoes Inc. decided to discontinue Children's Shoes because it reduced income from operations by $17,000. What is the flaw in this decision, if it is assumed fixed costs would not be materially affected by the discontinuance? Featherweight Shoes Inc. Product-Line Income Statement For the Year Ended April 30, 2016 Children's Shoes Men's Shoes Women's Shoes Total Sales $235,000 $300,000 $500,000 $1,035,000 Costs of goods sold $130,000 Variable costs $150,000 $220,000 500,000 Fixed costs 120,000 41,000 60,000 221,000 Total cost of goods sold $171,000 $210,000 $340,000 721,000 Gross profit 64,000 90,000 $160,000 314,000 Selling and adminstrative expenses: Variable selling and admin. expenses 45,000 46,000 95,000 186,000 Fixed selling and admin. expenses 35,000 20,000 25,000 80,000 Total selling and admin. expenses 81,000 65,000 $120,000 266,000 Income (loss) from operations (17,000) 25,000 40,000 48,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts