Question: 1. A pension plan is contributory when the employer makes payments to a funding agency. 2. Qualified pension plans permit deductibility of the employer's contributions

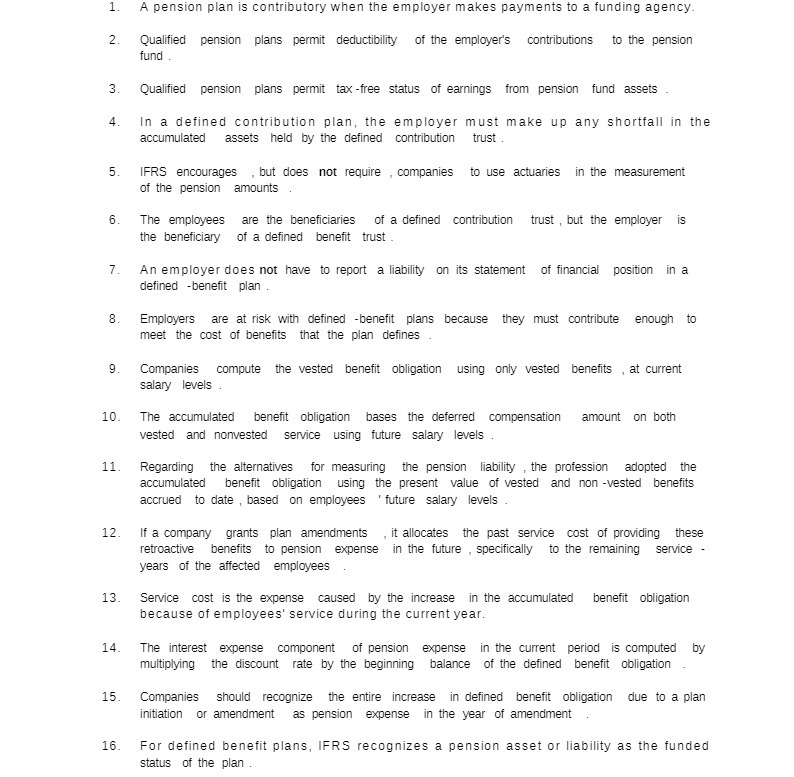

1. A pension plan is contributory when the employer makes payments to a funding agency. 2. Qualified pension plans permit deductibility of the employer's contributions to the pension fund 3. Qualified pension plans permit tax-free status of earnings from pension fund assets 4. In a defined contribution plan, the employer must make up any shortfall in the accumulated assets held by the defined contribution trust 5. IFRS encourages , but does not require , companies s to use actuaries in the measurement of the pension amounts 6. The employees are the beneficiaries of a defined contribution trust , but the employer is the beneficiary of a defined benefit trust 7. An employer does not have to report a liability on its statement of financial position in a defined -benefit plan . 8. Employers are at risk with defined -benefit plans because they must contribute enough to meet the cost of benefits that the plan defines 9. Companies compute the vested benefit obligation using only vested benefits , at current salary levels 10. The accumulated benefit obligation bases the deferred compensation amount on both vested and nonvested service using future salary levels 11 Regarding the alternatives for measuring the pension liability , the profession adopted the accumulated benefit obligation using the present value of vested and non -vested benefits accrued to date , based on employees ' future salary levels 12. If a company grants plan amendments , it allocates the past service cost of providing these retroactive benefits to pension expense in the future , specifically to the remaining service years of the affected employees 13 Service cost is the expense caused by the increase in the accumulated benefit obligation because of employees' service during the current year. 14 The interest expense component of pension expense in the current period is computed by multiplying the discount rate by the beginning balance of the defined benefit obligation 15. Companies should recognize the entire increase in defined benefit obligation due to a plan initiation or amendment as pension expense in the year of amendment 16. For defined benefit plans, IFRS recognizes a pension asset or liability as the funded status of the plan

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts