Question: 1. A person has decided to set up a sinking fund to purchase a house after 10 years. It expected that the house will cost

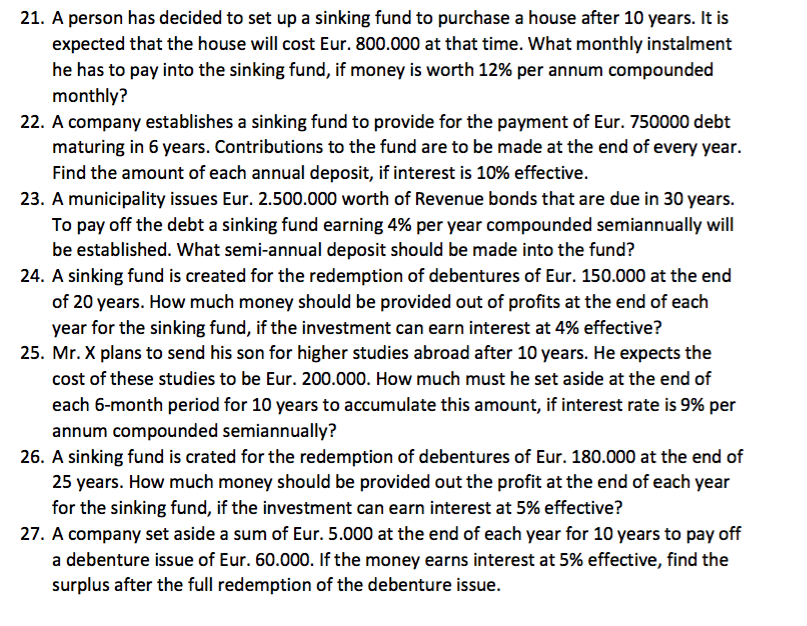

1. A person has decided to set up a sinking fund to purchase a house after 10 years. It expected that the house will cost Eur. 800.000 at that time. What monthly instalment he has to pay into the sinking fund, if money is worth 12% per annum compounded monthly? 22. A company establishes a sinking fund to provide for the payment of Eur. 750000 debt maturing in 6 years. Contributions to the fund are to be made at the end of every year. Find the amount of each annual deposit, if interest is 10% effective 23. A municipality issues Eur. 2.500.000 worth of Revenue bonds that are due in 30 years. To pay off the debt a sinking fund earning 4% per year compounded semiannually will be established. What semi-annual deposit should be made into the fund? 24. A sinking fund is created for the redemption of debentures of Eur. 150.000 at the end of 20 years. How much money should be provided out of profits at the end of each year for the sinking fund, if the investment can earn interest at 4% effective? 25. Mr. X plans to send his son for higher studies abroad after 10 years. He expects the cost of these studies to be Eur. 200.000. How much must he set aside at the end of each 6-month period for 10 years to accumulate this amount, if interest rate is 9% per annum compounded semiannually? 26. A sinking fund is crated for the redemption of debentures of Eur. 180.000 at the end of 25 years. How much money should be provided out the profit at the end of each year for the sinking fund, if the investment can earn interest at 5% effective? 27. A company set aside a sum of Eur. 5.000 at the end of each year for 10 years to pay off a debenture issue of Eur. 60.000. If the money earns interest at 5% effective, find the surplus after the full redemption of the debenture issue

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts