Question: 1. A portfolio's expected return is 12%, its standard deviation is 20%, and the risk free rate is 4%, which of the following would make

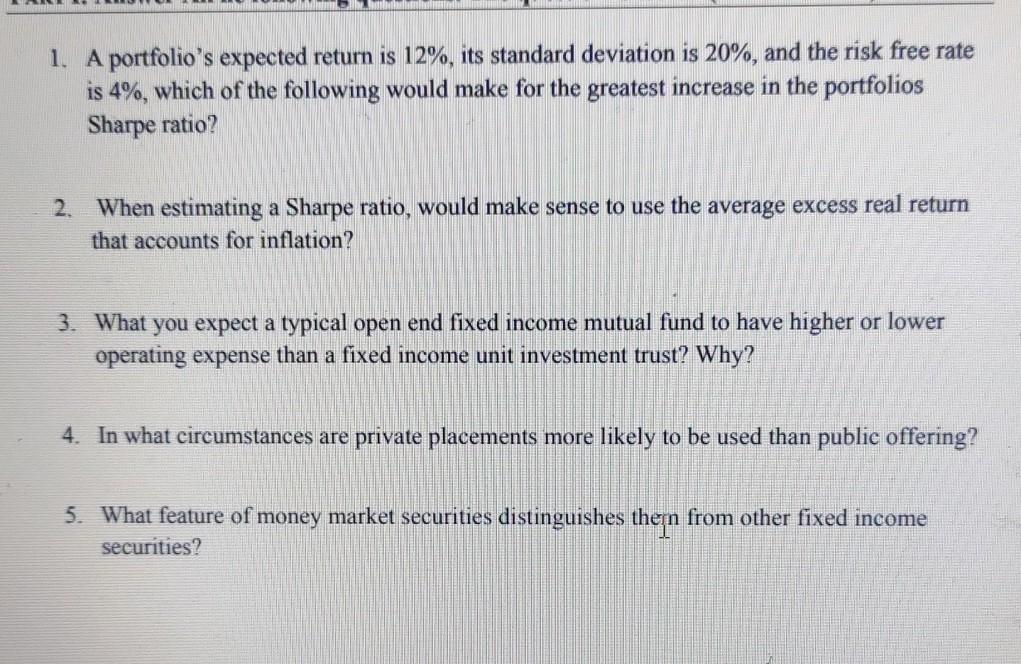

1. A portfolio's expected return is 12%, its standard deviation is 20%, and the risk free rate is 4%, which of the following would make for the greatest increase in the portfolios Sharpe ratio? 2. When estimating a Sharpe ratio, would make sense to use the average excess real return that accounts for inflation? 3. What you expect a typical open end fixed income mutual fund to have higher or lower operating expense than a fixed income unit investment trust? Why? 4. In what circumstances are private placements more likely to be used than public offering? 5. What feature of money market securities distinguishes them from other fixed income securities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts