Question: 1. A positive Net Present Value tells us that: a. We will make nothing on the project. b. The discount rate that we used in

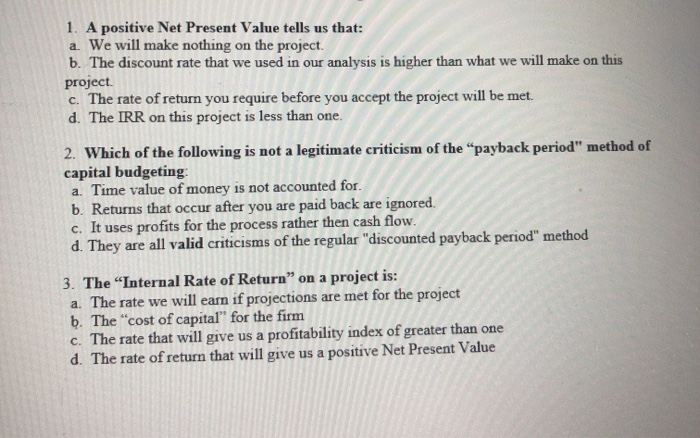

1. A positive Net Present Value tells us that: a. We will make nothing on the project. b. The discount rate that we used in our analysis is higher than what we will make on this project. c. The rate of return you require before you accept the project will be met. d. The IRR on this project is less than one. 2. Which of the following is not a legitimate criticism of the "payback period" method of capital budgeting a. Time value of money is not accounted for. b. Returns that occur after you are paid back are ignored. c. It uses profits for the process rather then cash flow. d. They are all valid criticisms of the regular "discounted payback period" method 3. The "Internal Rate of Return on a project is: a. The rate we will earn if projections are met for the project b. The "cost of capital" for the firm c. The rate that will give us a profitability index of greater than one d. The rate of return that will give us a positive Net Present Value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts