Question: 1. A public utility has a relatively low credit (BBB) rating. It would like to match its long-term assets with long-term, fixed-rate debt, but it

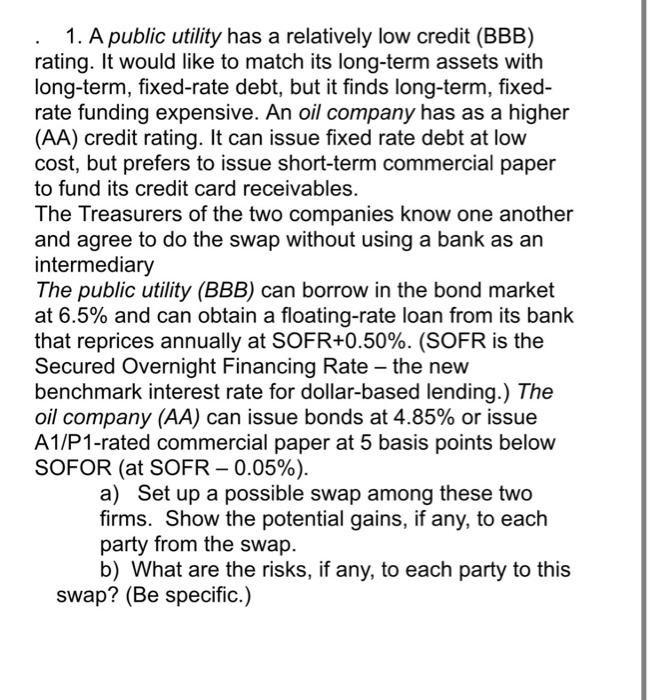

1. A public utility has a relatively low credit (BBB) rating. It would like to match its long-term assets with long-term, fixed-rate debt, but it finds long-term, fixed- rate funding expensive. An oil company has as a higher (AA) credit rating. It can issue fixed rate debt at low cost, but prefers to issue short-term commercial paper to fund its credit card receivables. The Treasurers of the two companies know one another and agree to do the swap without using a bank as an intermediary The public utility (BBB) can borrow in the bond market at 6.5% and can obtain a floating-rate loan from its bank that reprices annually at SOFR+0.50%. (SOFR is the Secured Overnight Financing Rate - the new benchmark interest rate for dollar-based lending.) The oil company (AA) can issue bonds at 4.85% or issue A1/P1-rated commercial paper at 5 basis points below SOFOR (at SOFR -0.05%). a) Set up a possible swap among these two firms. Show the potential gains, if any, to each party from the swap. b) What are the risks, if any, to each party to this swap? (Be specific.) 1. A public utility has a relatively low credit (BBB) rating. It would like to match its long-term assets with long-term, fixed-rate debt, but it finds long-term, fixed- rate funding expensive. An oil company has as a higher (AA) credit rating. It can issue fixed rate debt at low cost, but prefers to issue short-term commercial paper to fund its credit card receivables. The Treasurers of the two companies know one another and agree to do the swap without using a bank as an intermediary The public utility (BBB) can borrow in the bond market at 6.5% and can obtain a floating-rate loan from its bank that reprices annually at SOFR+0.50%. (SOFR is the Secured Overnight Financing Rate - the new benchmark interest rate for dollar-based lending.) The oil company (AA) can issue bonds at 4.85% or issue A1/P1-rated commercial paper at 5 basis points below SOFOR (at SOFR -0.05%). a) Set up a possible swap among these two firms. Show the potential gains, if any, to each party from the swap. b) What are the risks, if any, to each party to this swap? (Be specific.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts