Question: 1. (a) Red rock capital management are developing a fund with the following stocks: Stock BATS Compass Grp Nat. Grid BP Astra Zeneca Market capitalization

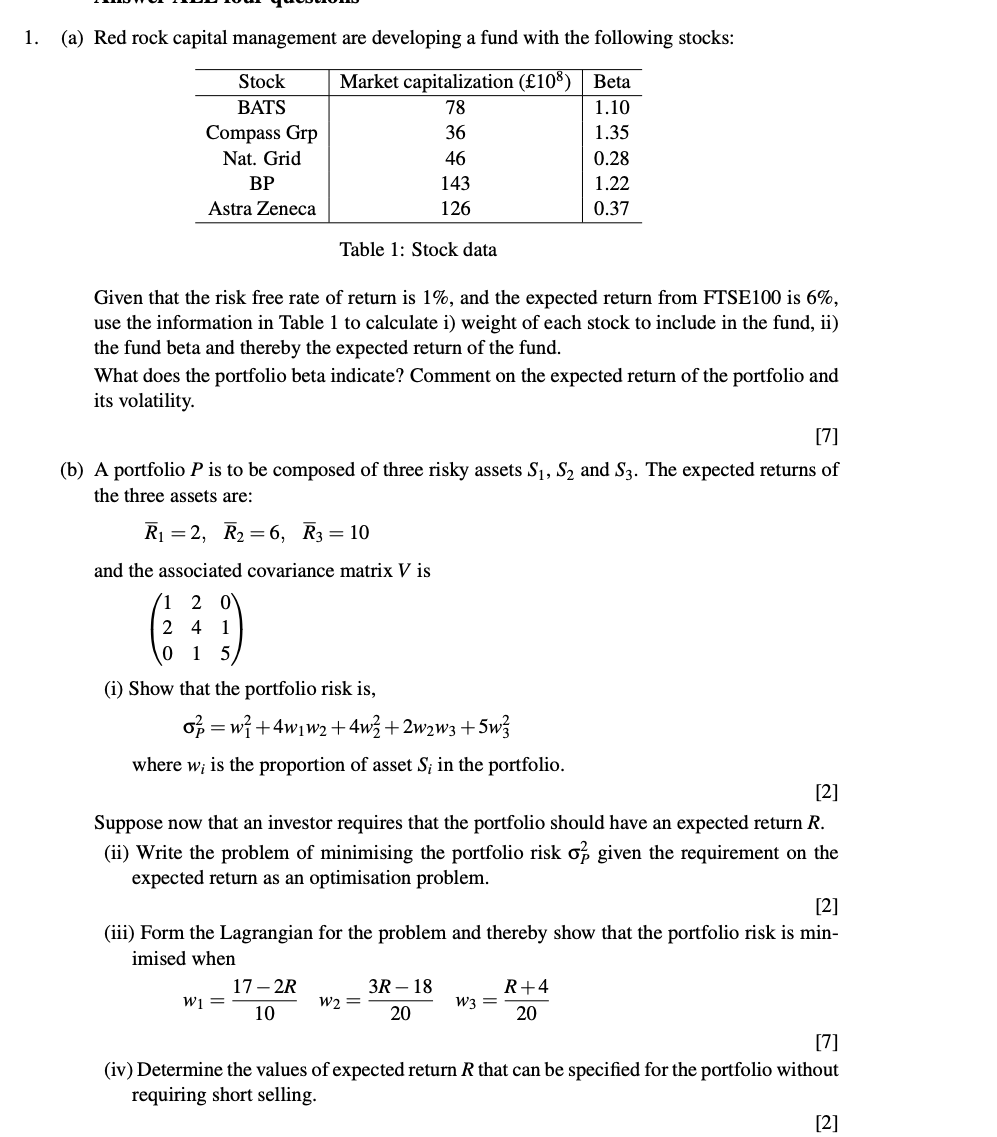

1. (a) Red rock capital management are developing a fund with the following stocks: Stock BATS Compass Grp Nat. Grid BP Astra Zeneca Market capitalization (108) 78 36 46 143 126 Beta 1.10 1.35 0.28 1.22 0.37 Table 1: Stock data Given that the risk free rate of return is 1%, and the expected return from FTSE100 is 6%, use the information in Table 1 to calculate i) weight of each stock to include in the fund, ii) the fund beta and thereby the expected return of the fund. What does the portfolio beta indicate? Comment on the expected return of the portfolio and its volatility. [7] (b) A portfolio P is to be composed of three risky assets S1, S2 and S3. The expected returns of the three assets are: R1 = 2, R2 =6, R3 = 10 and the associated covariance matrix V is (1 2 0 2 4 1 0 1 5 (i) Show that the portfolio risk is, o}=w +4w1w2 +4w + 2w2w3 +5w where w; is the proportion of asset S; in the portfolio. [2] Suppose now that an investor requires that the portfolio should have an expected return R. (ii) Write the problem of minimising the portfolio risk o given the requirement on the expected return as an optimisation problem. [2] (iii) Form the Lagrangian for the problem and thereby show that the portfolio risk is min- imised when 17-2R 3R - 18 R+4 W1 = W2 = W3 = 10 20 20 [7] (iv) Determine the values of expected return R that can be specified for the portfolio without requiring short selling. [2]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts