Question: 1. A riskfree asset (a) has a return correlation coefficient with securities of 1. (b) has a negative return covariance with each security (c) has

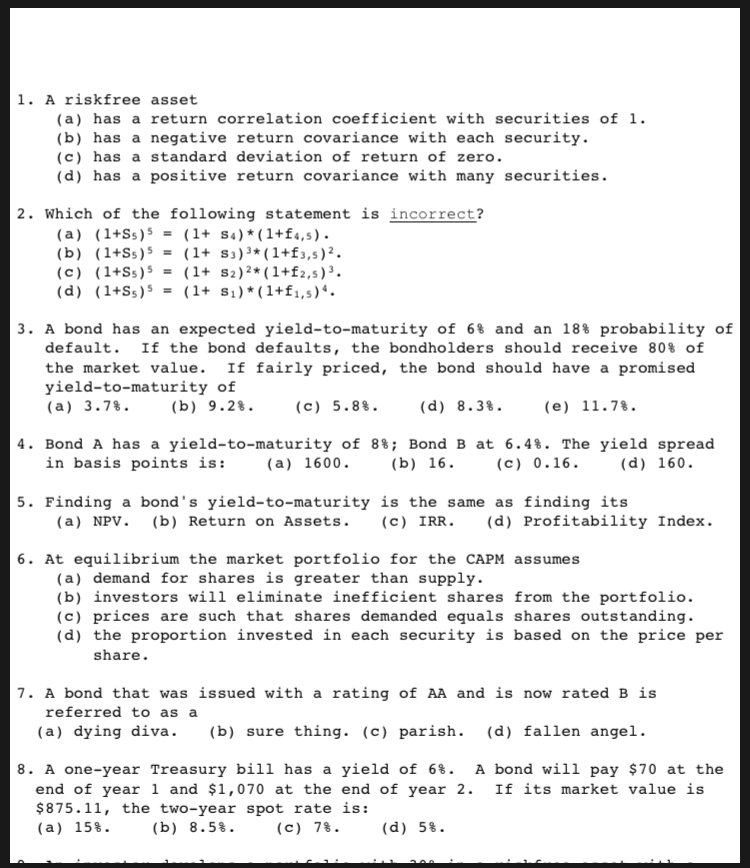

1. A riskfree asset (a) has a return correlation coefficient with securities of 1. (b) has a negative return covariance with each security (c) has a standard deviation of return of zero. (d) has a positive return covariance with many securities. 2. Which of the following statement is incorrect? 3. A bond has an expected yield-to-maturity of 6% and an 18% probability of default. If the bond defaults, the bondholders should receive 80% of the market value If fairly priced, the bond should have a promised yield-to-maturity of (a) 3.7%. (b) 9.2%. (c) 5.8%. (d) 8.3%. (e) 11.7%. 4. Bond A has a yield-to-maturity of 88; Bond B at 6.4%. The yield spread in basis points is: (a) 1600. (b) 16. (c) 0.16. (d) 160. 5. Finding a bond's yield-to-maturity is the same as finding its (a) NPV. (b) Return on Assets.(c) IRR.(d) Profitability Index. 6. At equilibrium the market portfolio for the CAPM assumes (a) demand for shares is greater than supply (b) investors will eliminate inefficient shares from the portfolio. (c) prices are such that shares demanded equals shares outstanding. (d) the proportion invested in each security is based on the price per share. 7. A bond that was issued with a rating of AA and is now rated B is referred to as a (a) dying diva. ) sure thing. (c) parish. (d) fallen angel. 8. A one-year Treasury bill has a yield of 6%. A bond will pay $70 at the end of year 1 and $1,070 at the end of year 2. If its market value is $875.11, the two-year spot rate is: (a) 15. (b) 8.58. (c) 78. (d) 58

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts