Question: 1. A security's value is equal to a. the book value of the firm. b. the book value of the firm divided by number of

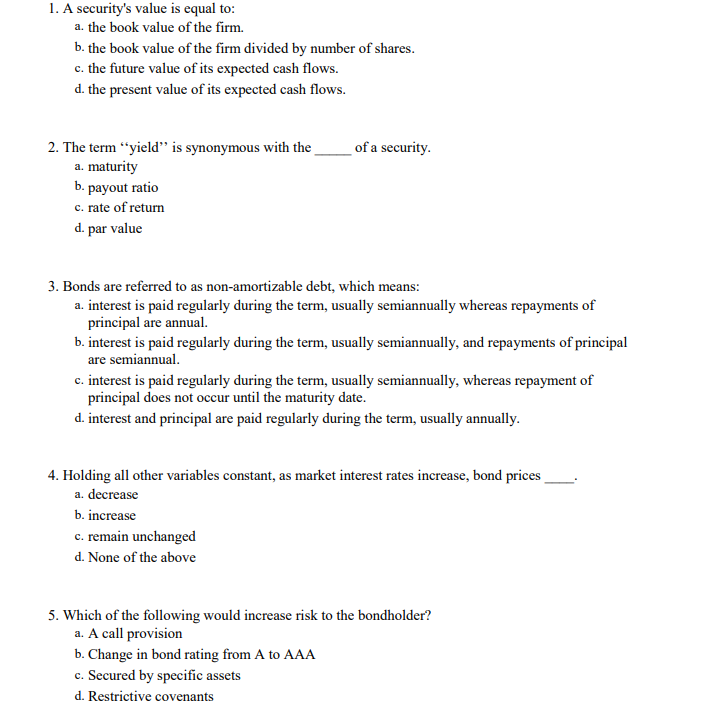

1. A security's value is equal to a. the book value of the firm. b. the book value of the firm divided by number of shares c. the future value of its expected cash flows. d. the present value of its expected cash flows. 2. The term "yield" is synonymous with of a security a. maturitv payout ratio c. rate of return d. par value 3. Bonds are referred to as non-amortizable debt, which means: a. interest is paid regularly during the term, usually semiannually whereas repayments of principal are annual. b. interest is paid regularly during the term, usually semiannually, and repayments of principal c. interest is paid regularly during the term, usually semiannually, whereas repayment of d. interest and principal are paid regularly during the term, usually annually are semiannual principal does not occur until the maturity date 4. Holding all other variables constant, as market interest rates increase, bond prices a. decrease b. increase c. remain unchanged d. None of the above 5. Which of the following would increase risk to the bondholder? a. A call provision b. Change in bond rating from A to AAA c. Secured by specific assets d. Restrictive covenants

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts