Question: 1 . A small town has approached you to develop a small amphitheater district with mixed - use retail, office, and housing in a contained

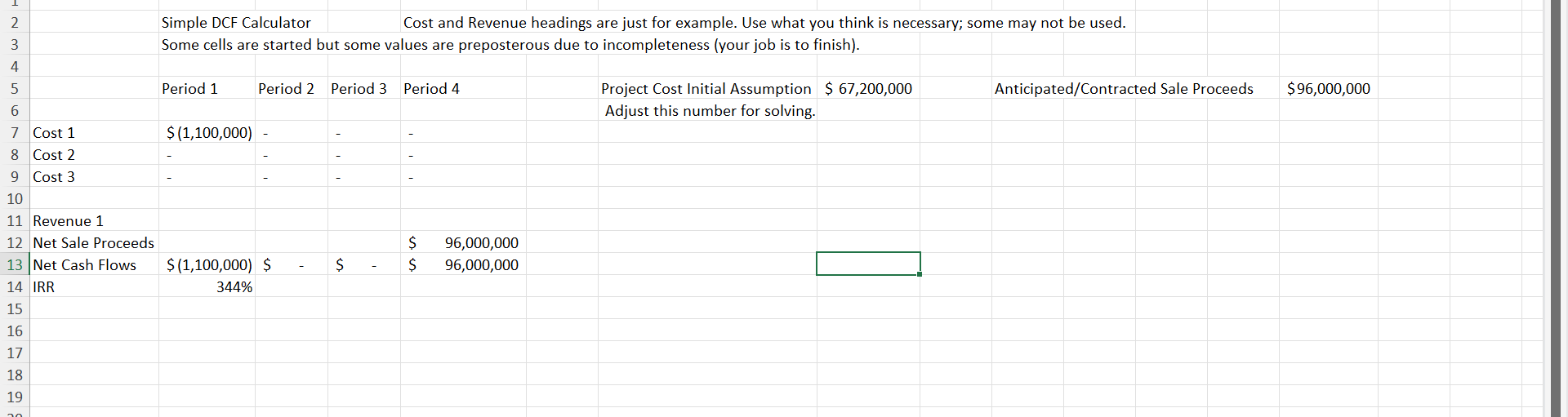

A small town has approached you to develop a small amphitheater district with mixeduse retail, office, and housing in a contained fourblock area, about acres. The town will acquire it at full cost upon completion, estimated resale value of $ million the payment you will receive from the city at the end of four years from contract execution, including land and engineering, planning, and construction. You take on no development projects for less than a annualized return. Before you sign the contract, you obtain soft bids ballpark estimates from your most trusted contractors to see if the total cost will exceed your investment ceiling. What is the most you can spend your cost ceiling on completing this project and still realize a annualized return IRR Show your work. Assume you are a full equity developer, meaning cashonly, no debt. Further assume your costs are staggered as follows: i Year $ million for land transferred from city and engineering ii Year of construction estimate iii. Year of construction estimate iv Year of construction estimate Start with an assumption of of final sale for your project costs including land and engineering, or $ The city is paying for any brokerage and additional transaction fees. Years through cash flows occur at end of period, including costs and sale proceeds. $

$

$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock