Question: 1. A special machine can save $11,200 per year in cash operating expenses for the next 10 years. The cost is $44,000. No salvage value

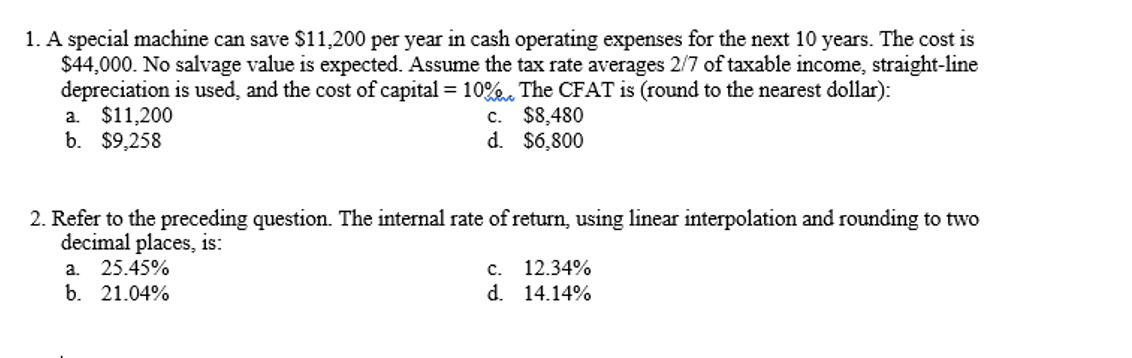

1. A special machine can save $11,200 per year in cash operating expenses for the next 10 years. The cost is $44,000. No salvage value is expected. Assume the tax rate averages 2/7 of taxable income, straight-line depreciation is used, and the cost of capital = 10%. The CFAT is (round to the nearest dollar): a. $11,200 c. $8,480 b. $9,258 d. $6,800 2. Refer to the preceding question. The internal rate of return, using linear interpolation and rounding to two decimal places, is: 25.45% c. 12.34% b. 21.04% d. 14.14% a

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock