Question: 1 . A U . K . resident buys Facebook shares, paying the equivalent of $ 5 0 0 0 Debit: Long term portfolio /

A UK resident buys Facebook shares, paying the equivalent of $

Debit: Long term portfolio FDI???

Amount: $

Reasoning: Increase in US ownership of a foreign asset

Credit: Long term portfolio

Amount: $

Reasoning: Decrease in UK ownership of a US asset outflow of capital from the UK

Academy Sports Outdoors imports $ million worth of sports equipment from Vietnam to the USA.

Debit: Goods

Amount: $M

Reasoning: import of goods from Vietnam

Credit: Short Term Portfolio

Amount: $ million

Reasoning: increase in foreign ownership of USD

A Canadian entrepreneur seeking to sell souvenirs at the Superbowl in New Orleans, pays American Airlines $ for a Toronto New Orleansroundtrip ticket.

Debit: Short Term Portfolio

Amount: $

Reasoning: Decrease in foreign ownership of a US asset

Credit: Service

Amount $

Reasoning: Export of a service

The US government gives Ethiopia $ million worth of food for humanitarian aid.

Debit: giftsunilateral transfers

Amount: $ million

Reasoning: gift given to foreign entity

Credit: Short term portfolio GOODS?

Amount: $ million

Reasoning: Decrease in US assets outflow of goods without receiving payment Ford Motor Company US pays $ billion to purchase all the common stock of the Jaguar Motor Company UK

Debit: Foreign Direct Investment

Amount: $ billion

Reasoning: Increase in US ownership of a foreign asset

Credit: Foreign Direct Investment

Amount: $ billion

Reasoning: Decrease in UK ownership of a US asset outflow of capital to acquire a foreign company

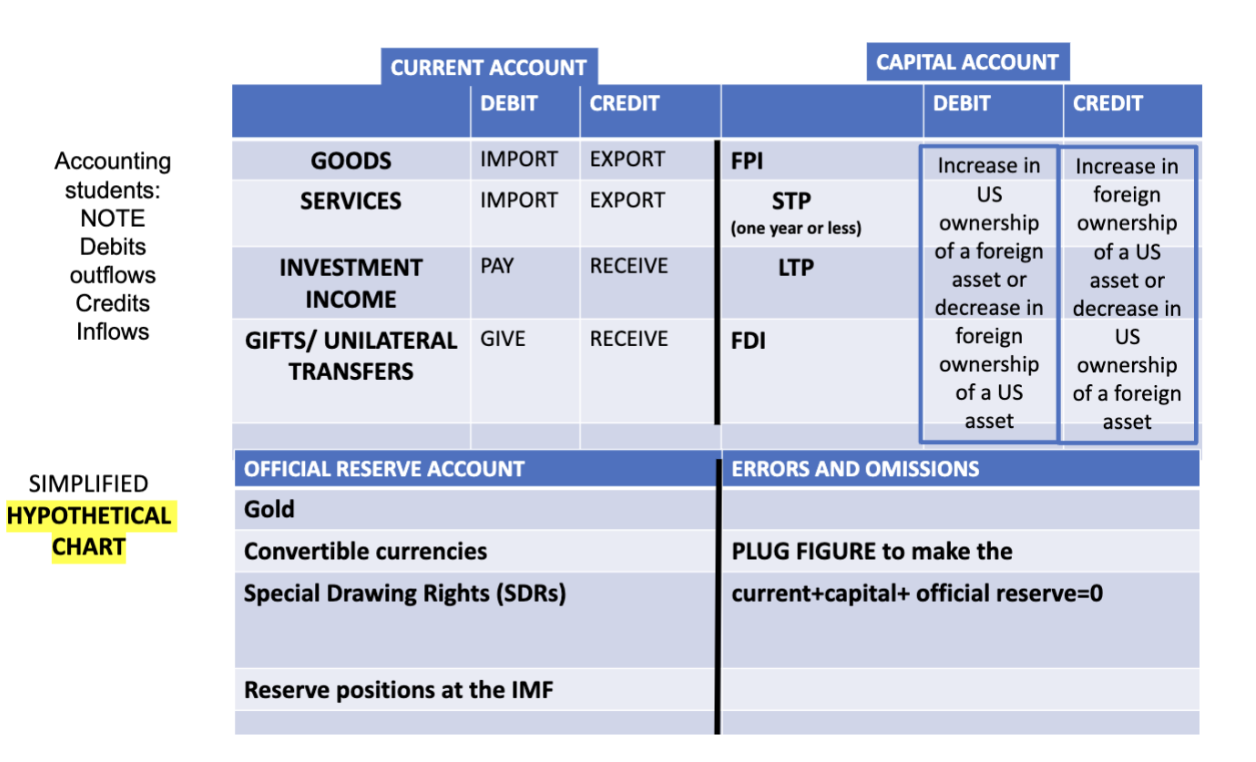

begintabularccccccc

hline multirowt & multicolumncCURRENT ACCOUNT & multicolumncCAPITAL ACCOUNT

hline & & DEBit & CREDIT & & DEBIT & CREDIT

hline multirowtbegintabularl

Accounting students:

NOTE

Debits outflows Credits Inflows

endtabular & GOODS & IMPORT & EXPORT & FPI & Increase in & Increase in

hline & SERVICES & IMPORT & EXPORT & begintabularl

STP

one year or less

endtabular & us ownership & foreign ownership

hline & INVESTMENT INCOME & PAY & RECEIVE & LTP & of a foreign asset or decrease in & of a US asset or decrease in

hline & GIFTS UNILATERAL TRANSFERS & GIVE & RECEIVE & FDI & foreign ownership of a US asset & US ownership of a foreign asset

hline multirowt

beginarrayl

text SIMPLIFIED

text HYPOTHETICAL

text CHART

endarray

& multicolumnlOFFICIAL RESERVE ACCOUNT & multicolumnlERRORS AND OMISSIONS

hline & multicolumnlGold & multicolumnl

hline & multicolumnlConvertible currencies & multicolumnlPLUG FIGURE to make the

hline & multicolumnlSpecial Drawing Rights SDRs & multicolumnlcurrentcapital official reserve

hline & multicolumnlReserve positions at the IMF & & &

hline

endtabular

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock