Question: 1. (a) Using your own words, discuss the weak form Efficient Market Hypothesis. Identify the main tests used to examine the weak form EMH, and

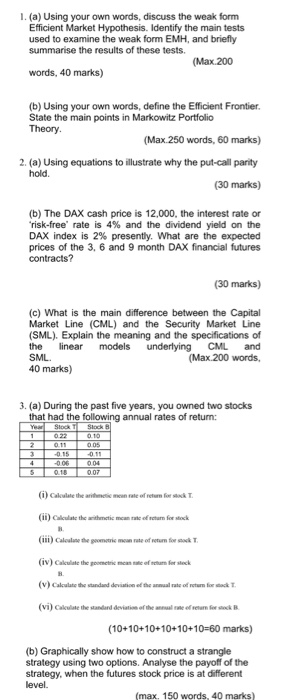

1. (a) Using your own words, discuss the weak form Efficient Market Hypothesis. Identify the main tests used to examine the weak form EMH, and briefly summarise the results of these tests. (Max 200 words, 40 marks) (b) Using your own words, define the Efficient Frontier. State the main points in Markowitz Portfolio Theory. (Max 250 words, 60 marks) 2. (a) Using equations to illustrate why the put-call parity hold. (30 marks) (b) The DAX cash price is 12,000, the interest rate or "risk-free' rate is 4% and the dividend yield on the DAX index is 2% presently. What are the expected prices of the 3, 6 and 9 month DAX financial futures contracts ? (30 marks) (c) What is the main difference between the Capital Market Line (CML) and the Security Market Line (SML). Explain the meaning and the specifications of the linear models underlying CML and SML (Max 200 words, 40 marks) 3. (a) During the past five years. you owned two stocks that had the following annual rates of return: (i) Calculate the ar m en e of return for (ii) Cicate the tim e of forstock (iii) Calculate the geometric mean rute of return for a t (iv) Calele the of f er steck (v) Calculate the standardeve the wall of our f ack (vi) Calculate the standard deviation of the name of retum forsk B (10+10+10+10+10+10=60 marks) (b) Graphically show how to construct a strangle strategy using two options. Analyse the payoff of the strategy, when the futures stock price is at different level (max. 150 words, 40 marks) 1. (a) Using your own words, discuss the weak form Efficient Market Hypothesis. Identify the main tests used to examine the weak form EMH, and briefly summarise the results of these tests. (Max 200 words, 40 marks) (b) Using your own words, define the Efficient Frontier. State the main points in Markowitz Portfolio Theory. (Max 250 words, 60 marks) 2. (a) Using equations to illustrate why the put-call parity hold. (30 marks) (b) The DAX cash price is 12,000, the interest rate or "risk-free' rate is 4% and the dividend yield on the DAX index is 2% presently. What are the expected prices of the 3, 6 and 9 month DAX financial futures contracts ? (30 marks) (c) What is the main difference between the Capital Market Line (CML) and the Security Market Line (SML). Explain the meaning and the specifications of the linear models underlying CML and SML (Max 200 words, 40 marks) 3. (a) During the past five years. you owned two stocks that had the following annual rates of return: (i) Calculate the ar m en e of return for (ii) Cicate the tim e of forstock (iii) Calculate the geometric mean rute of return for a t (iv) Calele the of f er steck (v) Calculate the standardeve the wall of our f ack (vi) Calculate the standard deviation of the name of retum forsk B (10+10+10+10+10+10=60 marks) (b) Graphically show how to construct a strangle strategy using two options. Analyse the payoff of the strategy, when the futures stock price is at different level (max. 150 words, 40 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts