Question: 1 a . What is the ending value ( future value ) of a one - year project that requires an initial investment of $

a What is the ending value future value of a oneyear project that requires an initial investment of $ and generates an interest rate of

b What is the current value present value of a oneyear investment that provides an interest rate of and has an expected future value of $

What is the ending value future value of a threeyear project that requires an initial investment of $ and generates an interest rate of

d What is the ending value future value of a sevenyear project that requires an initial investment of $ and generates an interest rate of

e What is the ending value future value of a twelveyear project that requires an initial investment of $ and generates an interest rate of

f What is the current value present value of a threeyear investment that provides an interest rate of and has an expected future value of $

What is the current value present value of a sevenyear investment that provides an interest rate of and has expected future value of $

h What is the current value present value of a sevenyear investment that provides an interest rate of and has an expected future value of $

i What is the current value present value of a sevenyear investment that provides an interest rate of and has an expected future value of $

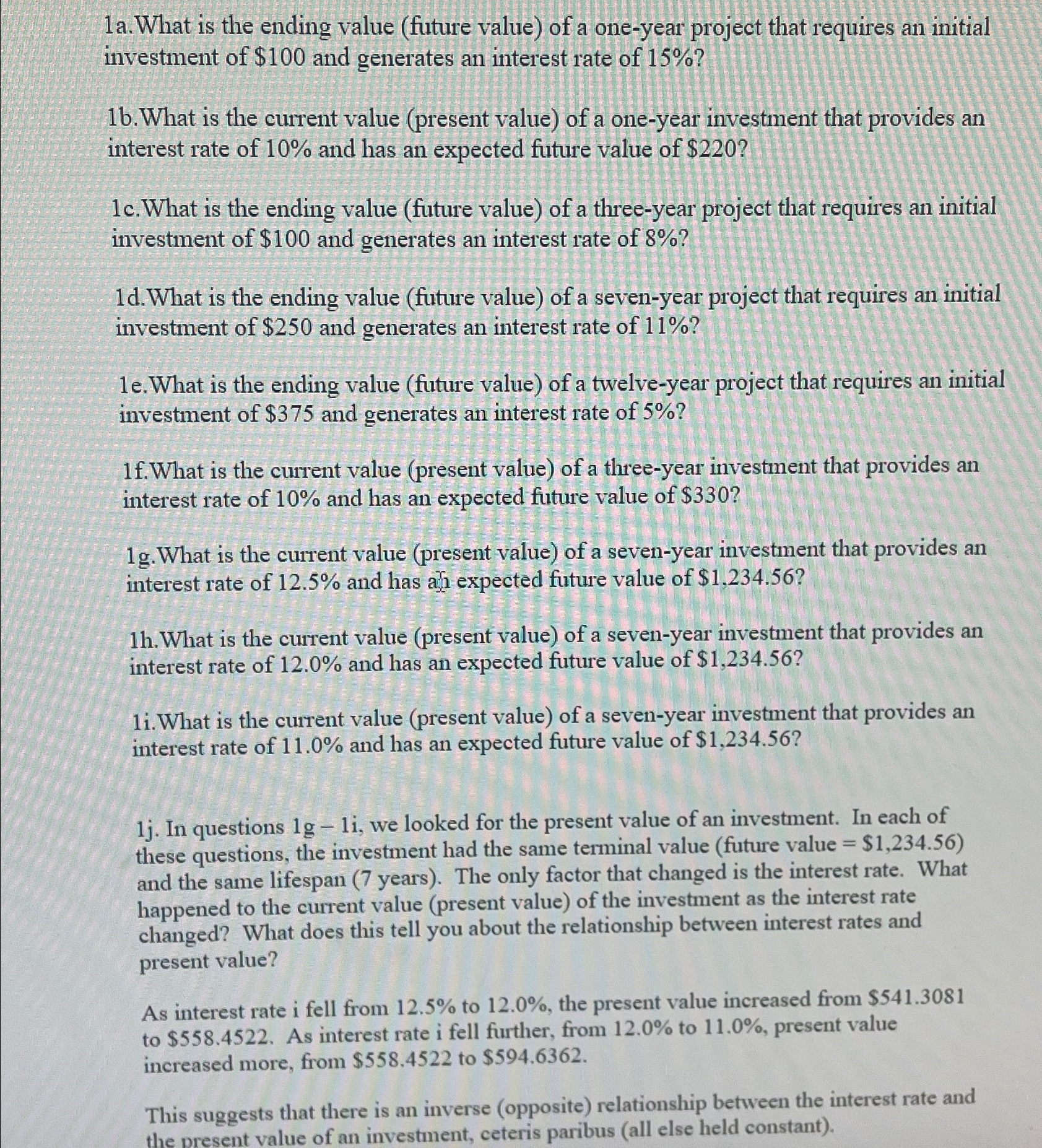

j In questions we looked for the present value of an investment. In each of these questions, the investment had the same terminal value future value $ and the same lifespan years The only factor that changed is the interest rate. What happened to the current value present value of the investment as the interest rate changed? What does this tell you about the relationship between interest rates and present value?

As interest rate i fell from to the present value increased from $ to $ As interest rate i fell further, from to present value increased more, from $ to $

This suggests that there is an inverse opposite relationship between the interest rate and the present value of an investment, ceteris paribus all else held constant

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock