Question: 1 a Wolverine Corp. is considering the development of a subsidiary in Singapore that would manufacture and sell tennis rackets locally. All relevant information are

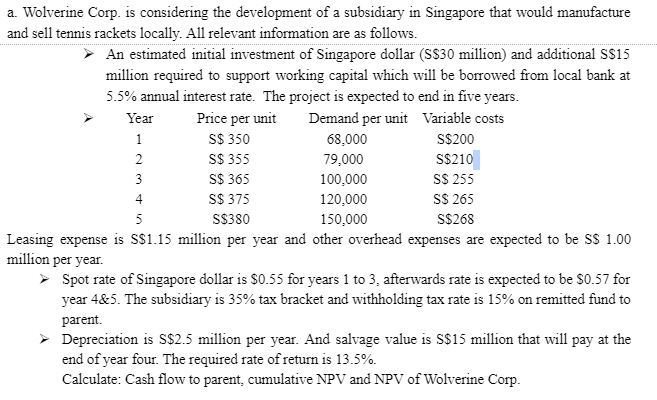

1 a Wolverine Corp. is considering the development of a subsidiary in Singapore that would manufacture and sell tennis rackets locally. All relevant information are as follows. An estimated initial investment of Singapore dollar (S$30 million) and additional SS15 million required to support working capital which will be borrowed from local bank at 5.5% annual interest rate. The project is expected to end in five years. Year Price per unit Demand per unit Variable costs S$ 350 68,000 S$200 2 S$ 355 79,000 S$210 3 S$ 365 100,000 S$ 255 4 S$ 375 120,000 SS 265 5 S$380 150.000 S$268 Leasing expense is $$1.15 million per year and other overhead expenses are expected to be S$ 1.00 million per year. Spot rate of Singapore dollar is $0.55 for years 1 to 3, afterwards rate is expected to be $0.57 for year 4&5. The subsidiary is 35% tax bracket and withholding tax rate is 15% on remitted fund to parent. Depreciation is S$2.5 million per year. And salvage value is S$15 million that will pay at the end of year four. The required rate of return is 13.5%. Calculate: Cash flow to parent, cumulative NPV and NPV of Wolverine Corp. 1 a Wolverine Corp. is considering the development of a subsidiary in Singapore that would manufacture and sell tennis rackets locally. All relevant information are as follows. An estimated initial investment of Singapore dollar (S$30 million) and additional SS15 million required to support working capital which will be borrowed from local bank at 5.5% annual interest rate. The project is expected to end in five years. Year Price per unit Demand per unit Variable costs S$ 350 68,000 S$200 2 S$ 355 79,000 S$210 3 S$ 365 100,000 S$ 255 4 S$ 375 120,000 SS 265 5 S$380 150.000 S$268 Leasing expense is $$1.15 million per year and other overhead expenses are expected to be S$ 1.00 million per year. Spot rate of Singapore dollar is $0.55 for years 1 to 3, afterwards rate is expected to be $0.57 for year 4&5. The subsidiary is 35% tax bracket and withholding tax rate is 15% on remitted fund to parent. Depreciation is S$2.5 million per year. And salvage value is S$15 million that will pay at the end of year four. The required rate of return is 13.5%. Calculate: Cash flow to parent, cumulative NPV and NPV of Wolverine Corp

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts