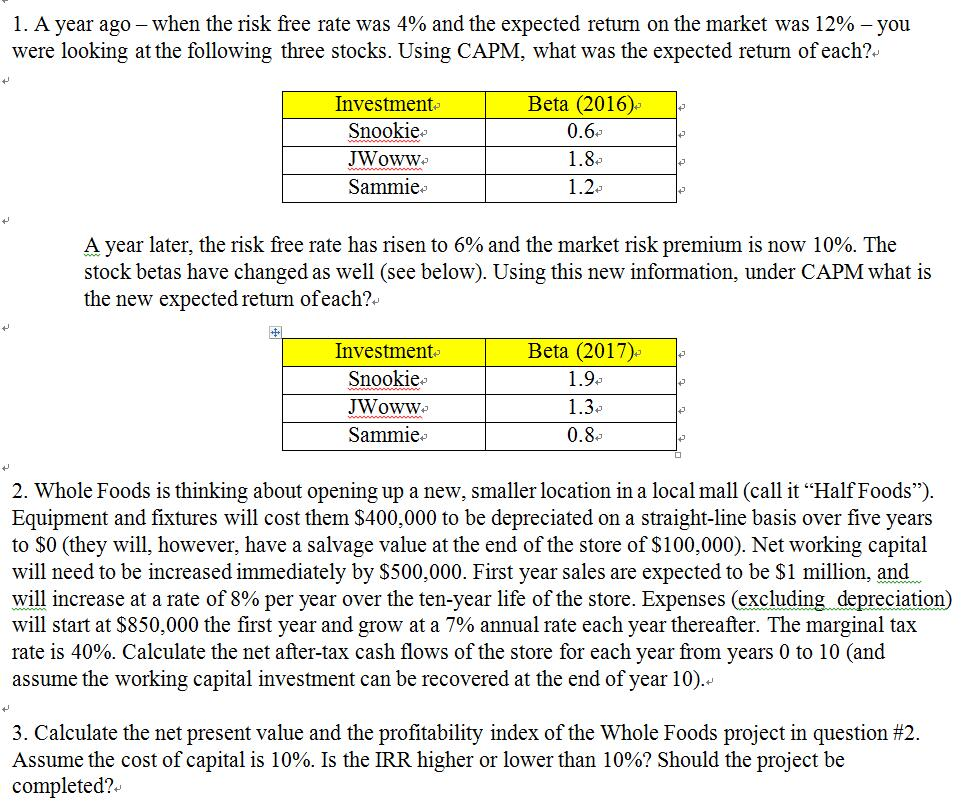

Question: 1. A year ago _ when the risk free rate was 4% and the expected return on the market was 12%-you were looking at the

1. A year ago _ when the risk free rate was 4% and the expected return on the market was 12%-you were looking at the following three stocks. Using CAPM, what was the expected return of each?- Beta (2016). 0.6 1.8 12- Investment Snookie. Sammie A year later, the risk free rate has risen to 6% and the market risk premium is now 10%. The stock betas have changed as well (see below). Using this new information, under CAPM what is the new expected return ofeach? Beta (2017) 1.9- 1.3 0.8 Investment Snookie. Sammie 2. Whole Foods is thinking about opening up a new, smaller location in a local mall (call it "HalfFoods") Equipment and fixtures will cost them S400,000 to be depreciated on a straight-line basis over five years to S0 (they will, however, have a salvage value at the end of the store of $100,000). Net working capital will need to be increased immediately by S500,000. First year sales are expected to be $1 million, and will increase at a rate of 8% per year over the ten-year life of the store. Expenses (excluding depreciation) will start at $850,000 the first year and grow at a 7% annual rate each year thereafter. The marginal tax rate is 40%. Calculate the net after-tax cash flows of the store for each year from years 0 to 10 (and assume the working capital investment can be recovered at the end of year 10). 3. Calculate the net present value and the profitability index of the Whole Foods project in question #2. Assume the cost of capital is 10%. Is the IRR higher or lower than 10%? Should the project be completed?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts