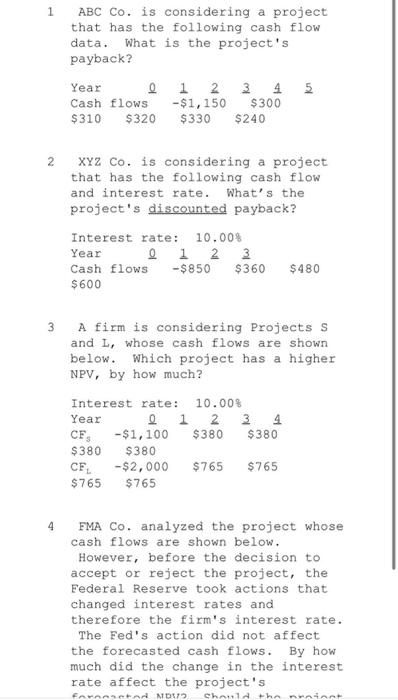

Question: 1 ABC Co. is considering a project that has the following cash flow data. What is the project's payback? Year 0 1 2 3 4

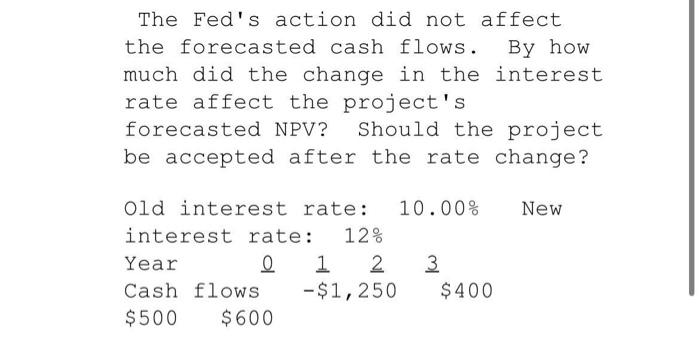

1 ABC Co. is considering a project that has the following cash flow data. What is the project's payback? Year 0 1 2 3 4 5 Cash flows -$1,150 $300 $310 $320 $330 $240 2 XYZ Co. is considering a project that has the following cash flow and interest rate. What's the project's discounted payback? Interest rate: 10.00% Year 0 1 2 3 Cash flows -$850 $360 $480 $ 600 3 A firm is considering Projects s and L, whose cash flows are shown below. Which project has a higher NPV, by how much? Interest rate: 10.008 Year 0 1 2 3 4 CFS -$1,100 $380 $380 $380 $380 CF -$2,000 $765 $ 765 $765 $765 4 FMA Co. analyzed the project whose cash flows are shown below. However, before the decision to accept or reject the project, the Federal Reserve took actions that changed interest rates and therefore the firm's interest rate. The Fed's action did not affect the forecasted cash flows. By how much did the change in the interest rate affect the project's FAALAM Chauhat The Fed's action did not affect the forecasted cash flows. By how much did the change in the interest rate affect the project's forecasted NPV? Should the project be accepted after the rate change? New old interest rate: 10.00% interest rate: 12% Year 1 2 3 Cash flows -$1,250 $400 $500 $ 600

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts