Question: 1. Above equation indicates that shareholders require higher expected return than the expected return of business because in addition to business risk, shareholders also need

1. Above equation indicates that shareholders require higher expected return than the expected return of business because in addition to business risk, shareholders also need to bear risk associated with the usage of debt.

A question requiring a 'True/False' answer

2. While the expected return of ROE is higher than ROA, the realized return of ROE can be lower than realized ROA.

A question requiring a 'True/False' answer.

3.

Round to the whole number.

ROA is %

ROE is %

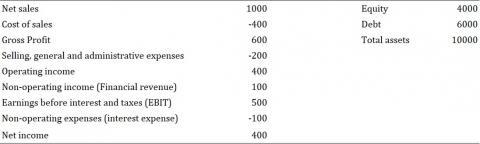

Debt ROE= ROA + * (ROA - interest spread) Equity 1000 -400 600 Equity Debt Total assets 4000 6000 10000 Net sales Cost of sales Gross Profit Selling, general and administrative expenses Operating income Non-operating income (Financial revenue) Earnings before interest and taxes (EBIT) Non-operating expenses (interest expense) Net income -200 400 100 500 -100 400

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts