Question: 1 AC 371 2 Chapter 10 Homework Assignment 3 Note: You must show all work for each question in this Excel spreadsheet to receive credit

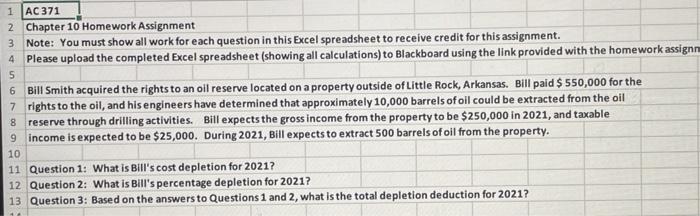

1 AC 371 2 Chapter 10 Homework Assignment 3 Note: You must show all work for each question in this Excel spreadsheet to receive credit for this assignment. 4 Please upload the completed Excel spreadsheet (showing all calculations) to Blackboard using the link provided with the homework assign 5 6 Bill Smith acquired the rights to an oil reserve located on a property outside of Little Rock, Arkansas. Bill paid $ 550,000 for the 7 rights to the oil, and his engineers have determined that approximately 10,000 barrels of oil could be extracted from the oil 8 reserve through drilling activities. Bill expects the gross income from the property to be $250,000 in 2021, and taxable 9 income is expected to be $25,000. During 2021, Bill expects to extract 500 barrels of oil from the property. 10 11 Question 1: What is Bill's cost depletion for 2021? 12 Question 2: What is Bill's percentage depletion for 2021? 13 Question 3: Based on the answers to Questions 1 and 2, what is the total depletion deduction for 2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts