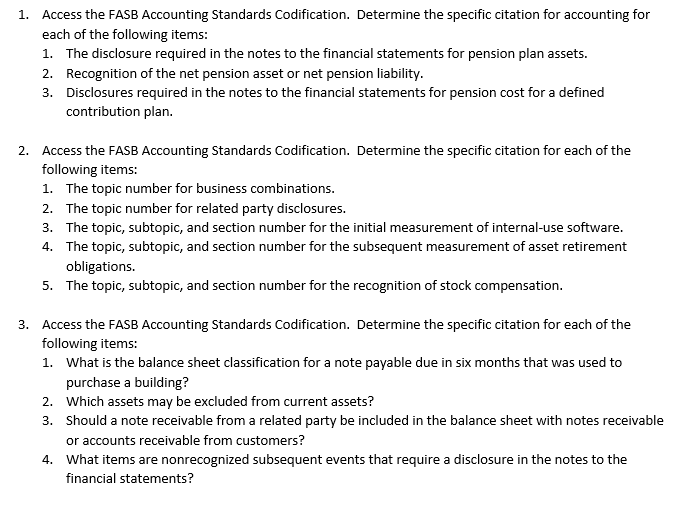

Question: 1. Access the FASB Accounting Standards Codification. Determine the specific citation for accounting for each of the following items 1. The disclosure required in the

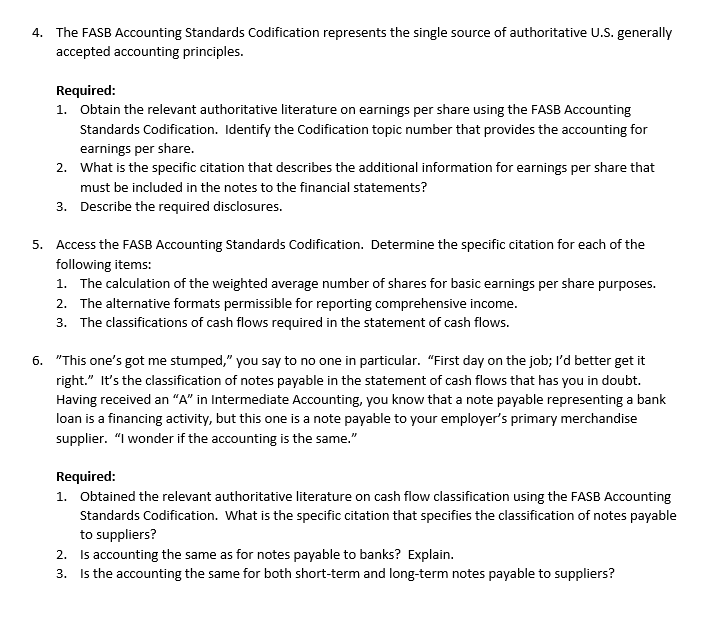

1. Access the FASB Accounting Standards Codification. Determine the specific citation for accounting for each of the following items 1. The disclosure required in the notes to the financial statements for pension plan assets. 2. Recognition of the net pension asset or net pension liability 3. Disclosures required in the notes to the financial statements for pension cost for a defined contribution plan. 2. Access the FASB Accounting Standards Codification. Determine the specific citation for each of the following items: 1. The topic number for business combinations. 2. The topic number for related party disclosures. 3. The topic, subtopic, and section number for the initial measurement of internal-use software 4. The topic, subtopic, and section number for the subsequent measurement of asset retirement obligations. 5. The topic, subtopic, and section number for the recognition of stock compensation 3. Access the FASB Accounting Standards Codification. Determine the specific citation for each of the following items: 1. What is the balance sheet classification for a note payable due in six months that was used to purchase a building? Which assets may be excluded from current assets? Should a note receivable from a related party be included in the balance sheet with notes receivable or accounts receivable from customers? What items are nonrecognized subsequent events that require a disclosure in the notes to the financial statements? 2. 3. 4. 4. The FASB Accounting Standards Codification represents the single source of authoritative U.S. generally accepted accounting principles. Required: 1. Obtain the relevant authoritative literature on earnings per share using the FASB Accounting Standards Codification. Identify the Codification topic number that provides the accounting for earnings per share. 2. What is the specific citation that describes the additional information for earnings per share that must be included in the notes to the financial statements? 3. Describe the required disclosures. Access the FASB Accounting Standards Codification. Determine the specific citation for each of the following items: 1. The calculation of the weighted average number of shares for basic earnings per share purposes. 2. The alternative formats permissible for reporting comprehensive income. 3. The classifications of cash flows required in the statement of cash flows. 5. 6. "This one's got me stumped," you say to no one in particular. "First day on the job; I'd better get it right." It's the classification of notes payable in the statement of cash flows that has you in doubt. Having received an "A" in Intermediate Accounting, you know that a note payable representing a bank loan is a financing activity, but this one is a note payable to your employer's primary merchandise supplier. "I wonder if the accounting is the same." Required: 1. Obtained the relevant authoritative literature on cash flow classification using the FASB Accounting Standards Codification. What is the specific citation that specifies the classification of notes payable to suppliers? Is accounting the same as for notes payable to banks? Explain. Is the accounting the same for both short-term and long-term notes payable to suppliers? 2. 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts