Question: ) 1. According to pecking order theory, managers will often choose to finance with: A. New equity rather than debt, due to bankruptcy costs. B.

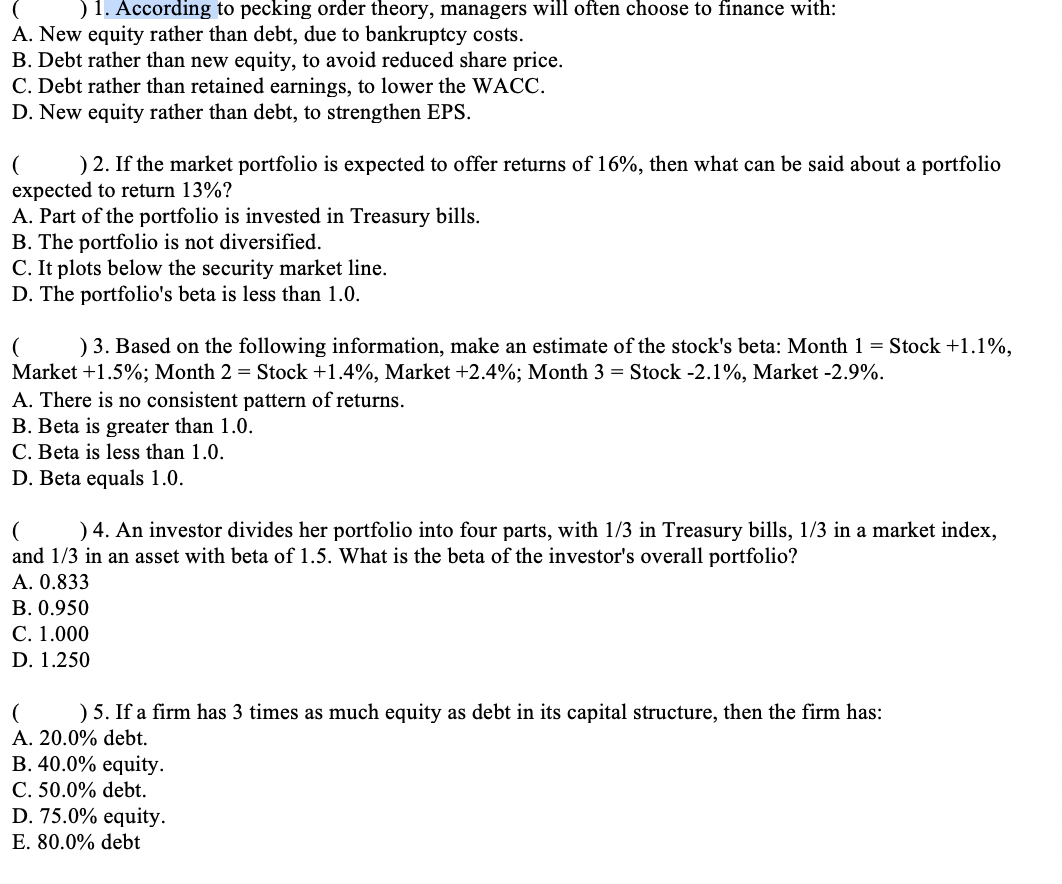

) 1. According to pecking order theory, managers will often choose to finance with: A. New equity rather than debt, due to bankruptcy costs. B. Debt rather than new equity, to avoid reduced share price. C. Debt rather than retained earnings, to lower the WACC. D. New equity rather than debt, to strengthen EPS. ( ) 2. If the market portfolio is expected to offer returns of 16%, then what can be said about a portfolio expected to return 13%? A. Part of the portfolio is invested in Treasury bills. B. The portfolio is not diversified. C. It plots below the security market line. D. The portfolio's beta is less than 1.0. ) 3. Based on the following information, make an estimate of the stock's beta: Month 1 = Stock +1.1%, Market +1.5%; Month 2 = Stock +1.4%, Market +2.4%; Month 3 = Stock -2.1%, Market -2.9%. A. There is no consistent pattern of returns. B. Beta is greater than 1.0. C. Beta is less than 1.0. D. Beta equals 1.0. ( ) 4. An investor divides her portfolio into four parts, with 1/3 in Treasury bills, 1/3 in a market index, and 1/3 in an asset with beta of 1.5. What is the beta of the investor's overall portfolio? A. 0.833 B. 0.950 C. 1.000 D. 1.250 ( ) 5. If a firm has 3 times as much equity as debt in its capital structure, then the firm has: A. 20.0% debt. B. 40.0% equity. C. 50.0% debt. D. 75.0% equity. E. 80.0% debt

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts