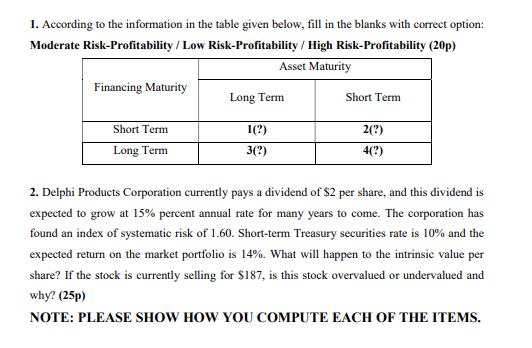

Question: 1. According to the information in the table given below, fill in the blanks with correct option: Moderate Risk-Profitability / Low Risk-Profitability / High Risk-Profitability

1. According to the information in the table given below, fill in the blanks with correct option: Moderate Risk-Profitability / Low Risk-Profitability / High Risk-Profitability (20p) Asset Maturity Financing Maturity Long Term Short Term Short Term 2(?) 1(?) 3(?) Long Term 4(?) 2. Delphi Products Corporation currently pays a dividend of $2 per share, and this dividend is expected to grow at 15% percent annual rate for many years to come. The corporation has found an index of systematic risk of 1.60. Short-term Treasury securities rate is 10% and the expected return on the market portfolio is 14%. What will happen to the intrinsic value per share? If the stock is currently selling for $187, is this stock overvalued or undervalued and why? (25p) NOTE: PLEASE SHOW HOW YOU COMPUTE EACH OF THE ITEMS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts