Question: 1. Acqusition Analysis $ 1) Acquisition analysis Based on the information in the Background information sheet, provide the required calculations at acquisition date. On 1/07/2018

| 1. Acqusition Analysis | |||

| $ | |||

1) Acquisition analysis Based on the information in the "Background information" sheet, provide the required calculations at acquisition date.

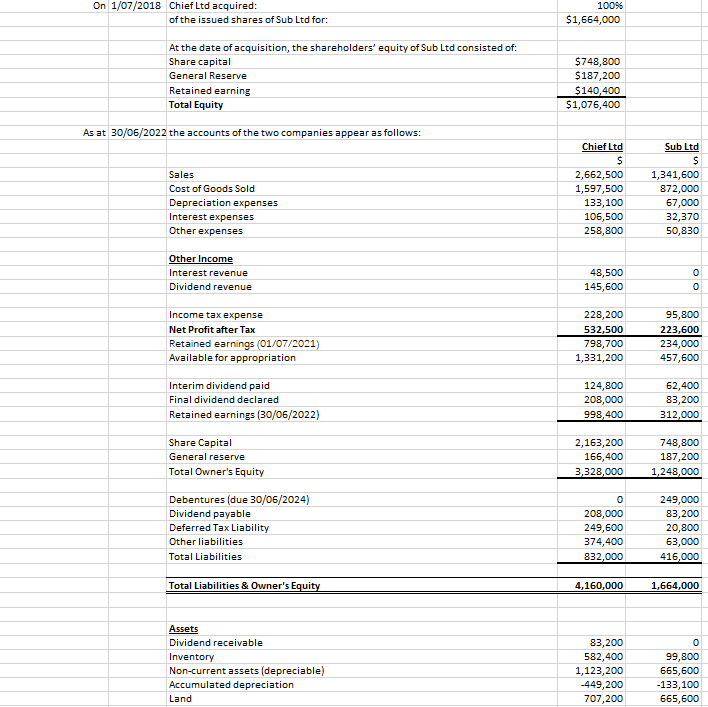

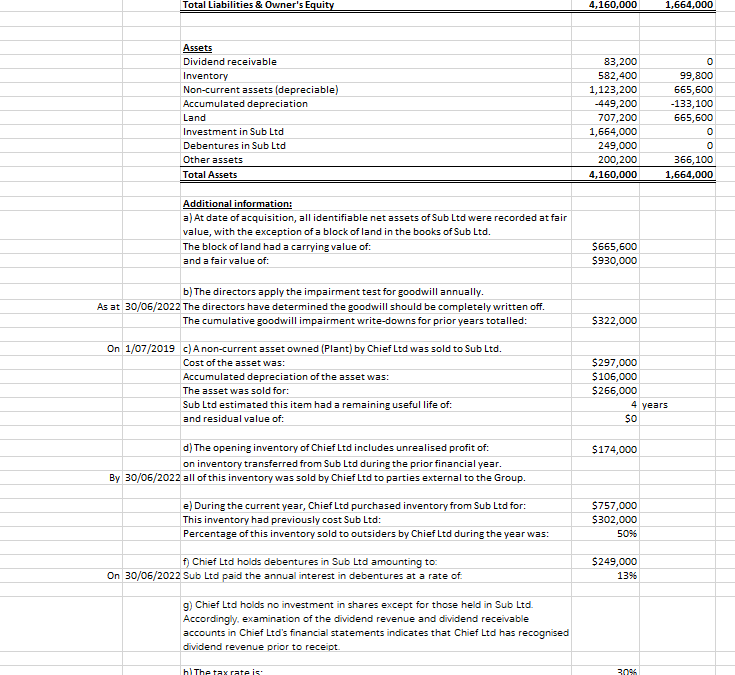

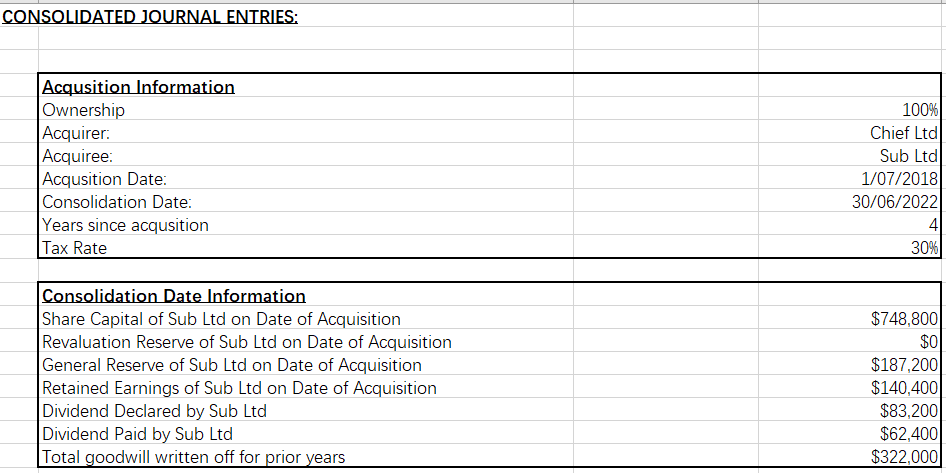

On 1/07/2018 Chief Ltd acquired: of the issued shares of Sub Ltd for: At the date of acquisition, the shareholders' equity of Sub Ltd consisted of: Share capital General Reserve Retained earning Total Equity As at 30/06/2022 the accounts of the two companies appear as follows: Sales Cost of Goods Sold Depreciation expenses Interest expenses Other expenses Other Income Interest revenue Dividend revenue Income tax expense Net Profit after Tax Retained earnings (01/07/2021) Available for appropriation Interim dividend paid Final dividend declared Retained earnings (30/06/2022) Share Capital General reserve Total Owner's Equity Debentures (due 30/06/2024) Dividend payable Deferred Tax Liability Other liabilities Total Liabilities Total Liabilities & Owner's Equity Assets Dividend receivable Inventory Non-current assets (depreciable) Accumulated depreciation Land 100% $1,664,000 $748,800 $187,200 $140,400 $1,076,400 Chief Ltd $ 2,662,500 1,597,500 133,100 106,500 258,800 48,500 145,600 228,200 532,500 798,700 1,331,200 124,800 208,000 998,400 2,163,200 166,400 3,328,000 0 208,000 249,600 374,400 832,000 4,160,000 83,200 582,400 1,123,200 -449,200 707,200 Sub Ltd $ 1,341,600 872,000 67,000 32,370 OO 0 0 95,800 223,600 234,000 457,600 62,400 83,200 312,000 748,800 187,200 1,248,000 249,000 83,200 20,800 63,000 416,000 1,664,000 0 99,800 665,600 -133,100 665,600 Total Liabilities & Owner's Equity Assets Dividend receivable Inventory Non-current assets (depreciable) Accumulated depreciation Land Investment in Sub Ltd Debentures in Sub Ltd Other assets Total Assets Additional information: a) At date of acquisition, all identifiable net assets of Sub Ltd were recorded at fair value, with the exception of a block of land in the books of Sub Ltd. The block of land had a carrying value of: and a fair value of: b) The directors apply the impairment test for goodwill annually. As at 30/06/2022 The directors have determined the goodwill should be completely written off. The cumulative goodwill impairment write-downs for prior years totalled: On 1/07/2019 c) A non-current asset owned (Plant) by Chief Ltd was sold to Sub Ltd. Cost of the asset was: Accumulated depreciation of the asset was: The asset was sold for: Sub Ltd estimated this item had a remaining useful life of: and residual value of: d) The opening inventory of Chief Ltd includes unrealised profit of: on inventory transferred from Sub Ltd during the prior financial year. By 30/06/2022 all of this inventory was sold by Chief Ltd to parties external to the Group. e) During the current year, Chief Ltd purchased inventory from Sub Ltd for: This inventory had previously cost Sub Ltd: Percentage of this inventory sold to outsiders by Chief Ltd during the year was: f) Chief Ltd holds debentures in Sub Ltd amounting to: On 30/06/2022 Sub Ltd paid the annual interest in debentures at a rate of g) Chief Ltd holds no investment in shares except for those held in Sub Ltd. Accordingly, examination of the dividend revenue and dividend receivable accounts in Chief Ltd's financial statements indicates that Chief Ltd has recognised dividend revenue prior to receipt. h) The tax rate is: 4,160,000 83,200 582,400 1,123,200 -449,200 707,200 1,664,000 249,000 200,200 4,160,000 $665,600 $930,000 $322,000 $297,000 $106,000 $266,000 $174,000 $757,000 $302,000 50% $249,000 13% 30% 1,664,000 0 99,800 665,600 -133,100 665,600 0 0 366,100 1,664,000 4 years $0 CONSOLIDATED JOURNAL ENTRIES: Acqusition Information Ownership Acquirer: Acquiree: Acqusition Date: Consolidation Date: Years since acqusition Tax Rate Consolidation Date Information Share Capital of Sub Ltd on Date of Acquisition Revaluation Reserve of Sub Ltd on Date of Acquisition General Reserve of Sub Ltd on Date of Acquisition Retained Earnings of Sub Ltd on Date of Acquisition Dividend Declared by Sub Ltd Dividend Paid by Sub Ltd Total goodwill written off for prior years 100% Chief Ltd Sub Ltd 1/07/2018 30/06/2022 4 30% $748,800 $0 $187,200 $140,400 $83,200 $62,400 $322,000 On 1/07/2018 Chief Ltd acquired: of the issued shares of Sub Ltd for: At the date of acquisition, the shareholders' equity of Sub Ltd consisted of: Share capital General Reserve Retained earning Total Equity As at 30/06/2022 the accounts of the two companies appear as follows: Sales Cost of Goods Sold Depreciation expenses Interest expenses Other expenses Other Income Interest revenue Dividend revenue Income tax expense Net Profit after Tax Retained earnings (01/07/2021) Available for appropriation Interim dividend paid Final dividend declared Retained earnings (30/06/2022) Share Capital General reserve Total Owner's Equity Debentures (due 30/06/2024) Dividend payable Deferred Tax Liability Other liabilities Total Liabilities Total Liabilities & Owner's Equity Assets Dividend receivable Inventory Non-current assets (depreciable) Accumulated depreciation Land 100% $1,664,000 $748,800 $187,200 $140,400 $1,076,400 Chief Ltd $ 2,662,500 1,597,500 133,100 106,500 258,800 48,500 145,600 228,200 532,500 798,700 1,331,200 124,800 208,000 998,400 2,163,200 166,400 3,328,000 0 208,000 249,600 374,400 832,000 4,160,000 83,200 582,400 1,123,200 -449,200 707,200 Sub Ltd $ 1,341,600 872,000 67,000 32,370 OO 0 0 95,800 223,600 234,000 457,600 62,400 83,200 312,000 748,800 187,200 1,248,000 249,000 83,200 20,800 63,000 416,000 1,664,000 0 99,800 665,600 -133,100 665,600 Total Liabilities & Owner's Equity Assets Dividend receivable Inventory Non-current assets (depreciable) Accumulated depreciation Land Investment in Sub Ltd Debentures in Sub Ltd Other assets Total Assets Additional information: a) At date of acquisition, all identifiable net assets of Sub Ltd were recorded at fair value, with the exception of a block of land in the books of Sub Ltd. The block of land had a carrying value of: and a fair value of: b) The directors apply the impairment test for goodwill annually. As at 30/06/2022 The directors have determined the goodwill should be completely written off. The cumulative goodwill impairment write-downs for prior years totalled: On 1/07/2019 c) A non-current asset owned (Plant) by Chief Ltd was sold to Sub Ltd. Cost of the asset was: Accumulated depreciation of the asset was: The asset was sold for: Sub Ltd estimated this item had a remaining useful life of: and residual value of: d) The opening inventory of Chief Ltd includes unrealised profit of: on inventory transferred from Sub Ltd during the prior financial year. By 30/06/2022 all of this inventory was sold by Chief Ltd to parties external to the Group. e) During the current year, Chief Ltd purchased inventory from Sub Ltd for: This inventory had previously cost Sub Ltd: Percentage of this inventory sold to outsiders by Chief Ltd during the year was: f) Chief Ltd holds debentures in Sub Ltd amounting to: On 30/06/2022 Sub Ltd paid the annual interest in debentures at a rate of g) Chief Ltd holds no investment in shares except for those held in Sub Ltd. Accordingly, examination of the dividend revenue and dividend receivable accounts in Chief Ltd's financial statements indicates that Chief Ltd has recognised dividend revenue prior to receipt. h) The tax rate is: 4,160,000 83,200 582,400 1,123,200 -449,200 707,200 1,664,000 249,000 200,200 4,160,000 $665,600 $930,000 $322,000 $297,000 $106,000 $266,000 $174,000 $757,000 $302,000 50% $249,000 13% 30% 1,664,000 0 99,800 665,600 -133,100 665,600 0 0 366,100 1,664,000 4 years $0 CONSOLIDATED JOURNAL ENTRIES: Acqusition Information Ownership Acquirer: Acquiree: Acqusition Date: Consolidation Date: Years since acqusition Tax Rate Consolidation Date Information Share Capital of Sub Ltd on Date of Acquisition Revaluation Reserve of Sub Ltd on Date of Acquisition General Reserve of Sub Ltd on Date of Acquisition Retained Earnings of Sub Ltd on Date of Acquisition Dividend Declared by Sub Ltd Dividend Paid by Sub Ltd Total goodwill written off for prior years 100% Chief Ltd Sub Ltd 1/07/2018 30/06/2022 4 30% $748,800 $0 $187,200 $140,400 $83,200 $62,400 $322,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts