Question: 1. Activity-based costing a) (10 marks) Prepare an activity-based costing analysis of each product (The-Bar, Alamonde and Salt-Lick) using the information provided from Exhibit 6

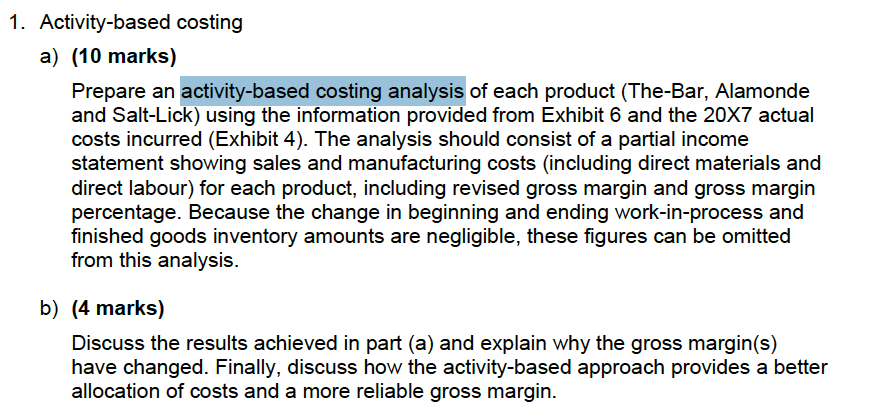

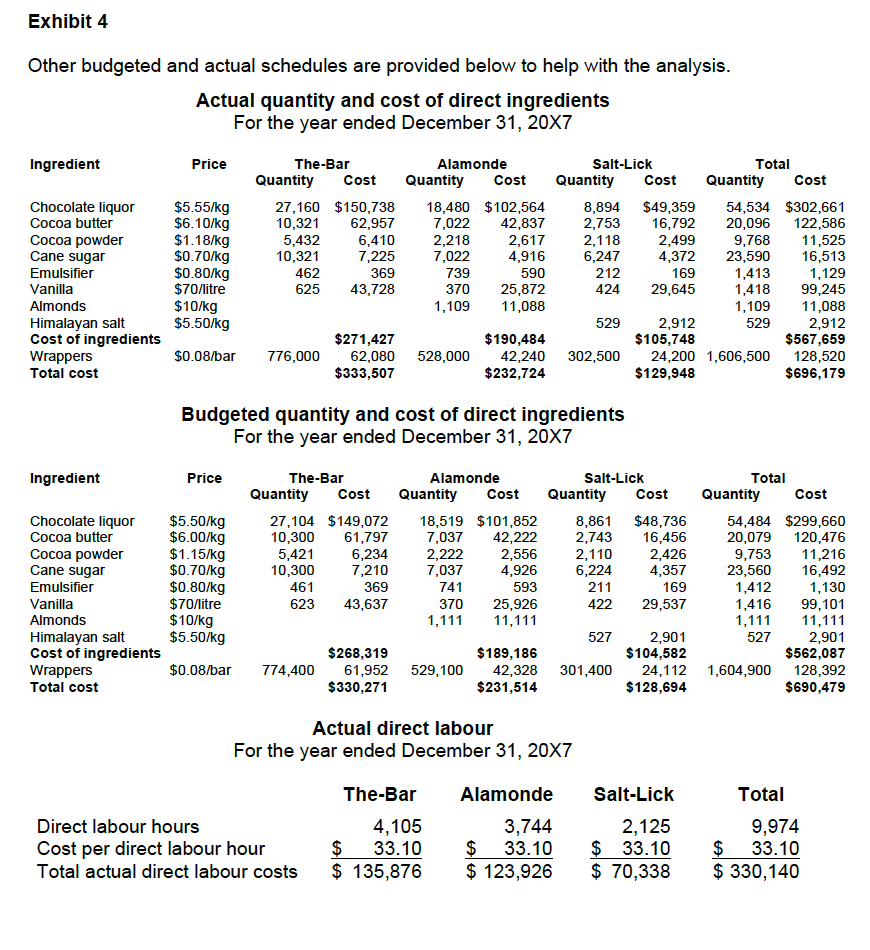

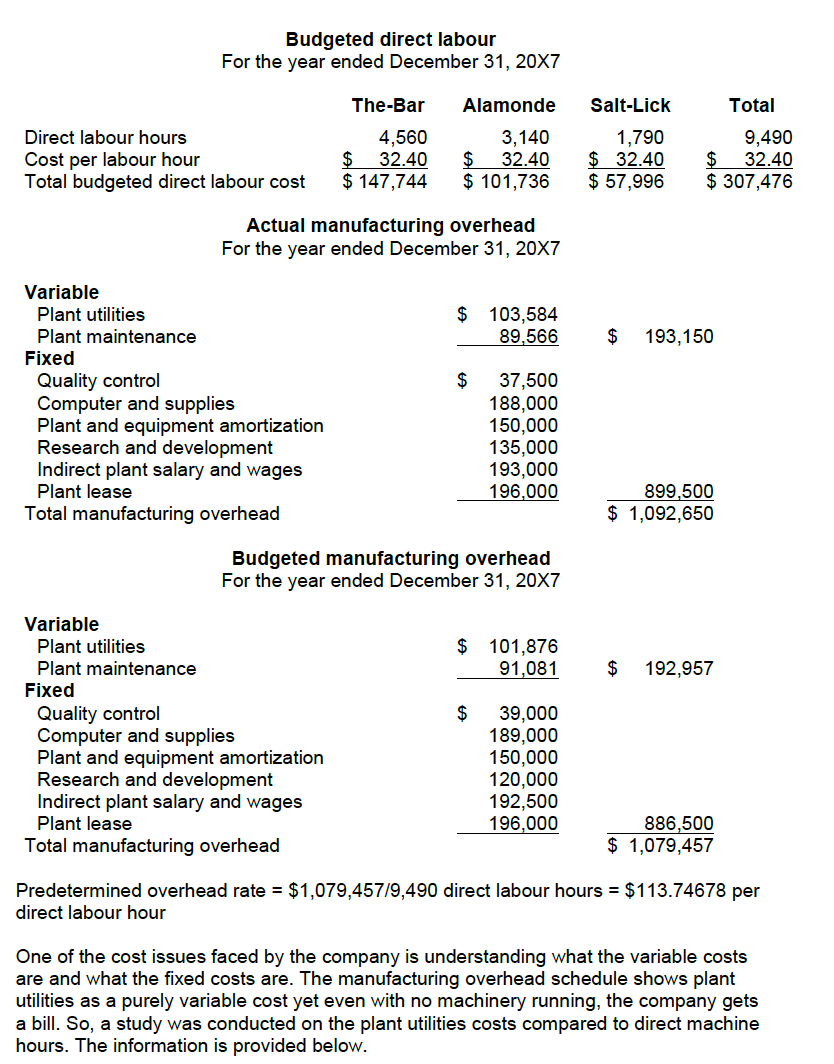

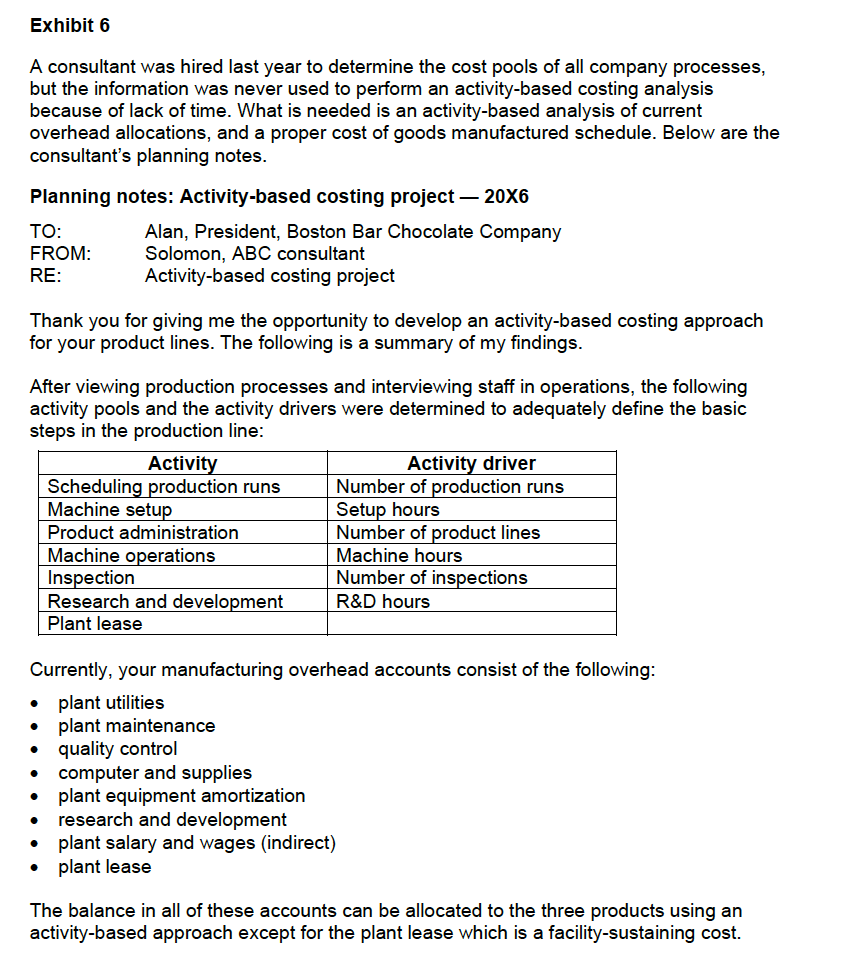

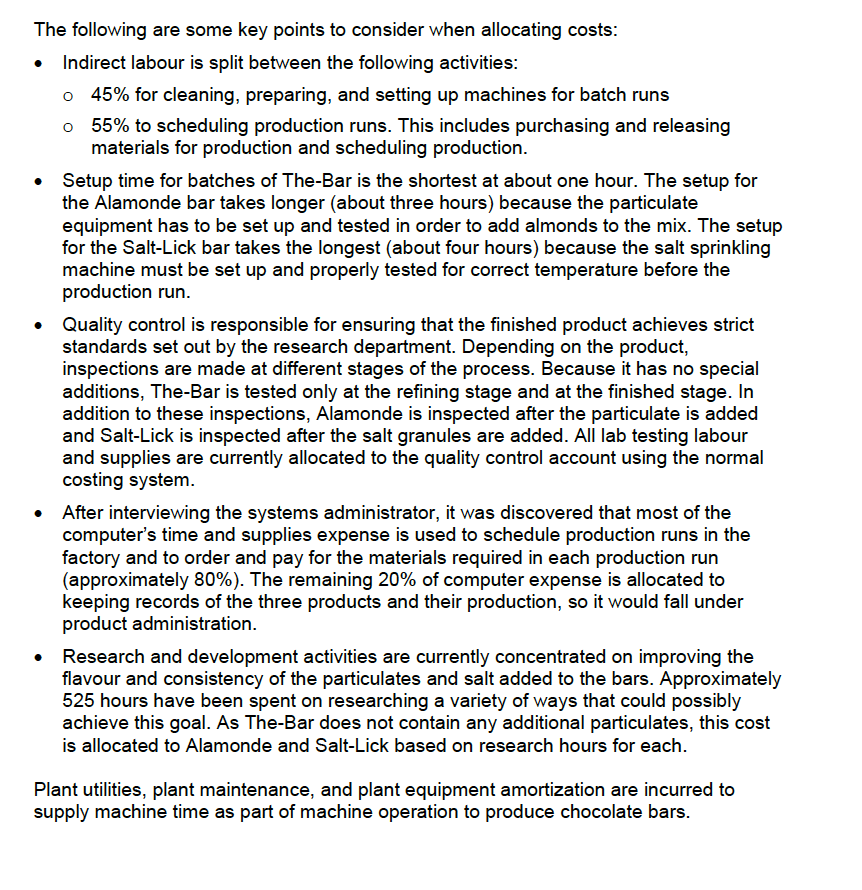

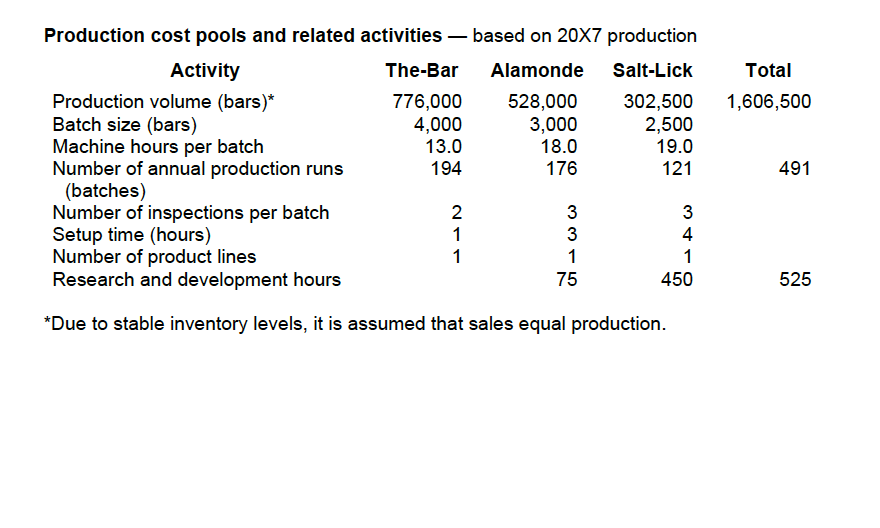

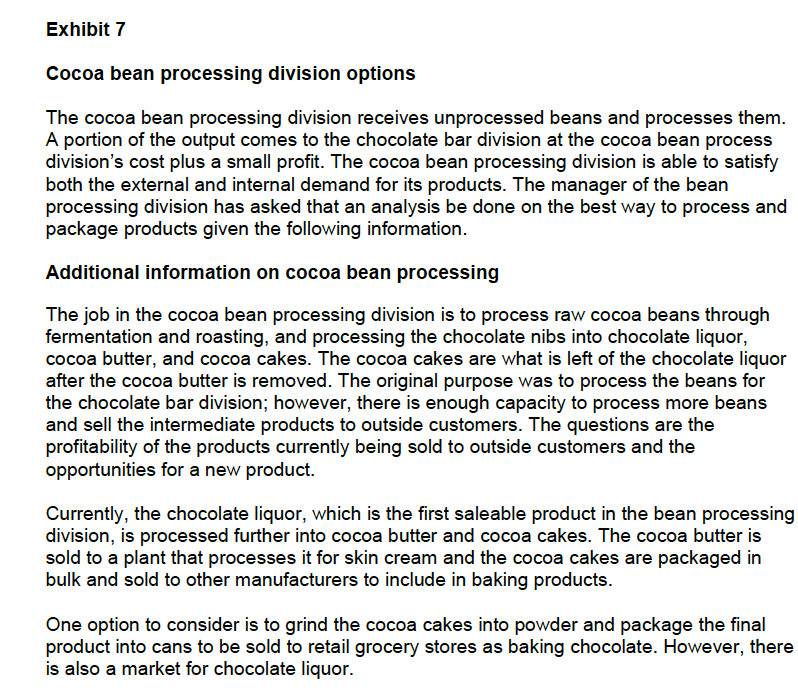

1. Activity-based costing a) (10 marks) Prepare an activity-based costing analysis of each product (The-Bar, Alamonde and Salt-Lick) using the information provided from Exhibit 6 and the 20x7 actual costs incurred (Exhibit 4). The analysis should consist of a partial income statement showing sales and manufacturing costs (including direct materials and direct labour) for each product, including revised gross margin and gross margin percentage. Because the change in beginning and ending work-in-process and finished goods inventory amounts are negligible, these figures can be omitted from this analysis. b) (4 marks) Discuss the results achieved in part (a) and explain why the gross margin(s) have changed. Finally, discuss how the activity-based approach provides a better allocation of costs and a more reliable gross margin. Exhibit 4 Other budgeted and actual schedules are provided below to help with the analysis. Actual quantity and cost of direct ingredients For the year ended December 31, 20X7 Ingredient Price Chocolate liquor Cocoa butter Cocoa powder Cane sugar Emulsifier Vanilla Almonds Himalayan salt Cost of ingredients Wrappers Total cost $5.55/kg $6.10/kg $1.18/kg $0.70/kg $0.80/kg $70/litre $10/kg $5.50/kg The-Bar Alamonde Salt-Lick Total Quantity Cost Quantity Cost Quantity Cost Quantity Cost 27,160 $150,738 18,480 $102,564 8,894 $49,359 54,534 $302,661 10,321 62,957 7,022 42,837 2,753 16,792 20,096 122,586 5,432 6,410 2,218 2,617 2,118 2,499 9,768 11,525 10,321 7,225 7,022 4,916 6,247 4,372 23,590 16,513 462 369 739 590 212 169 1,413 1,129 625 43,728 370 25,872 424 29,645 1,418 99,245 1,109 11,088 1,109 11,088 529 2,912 529 2,912 $271,427 $190,484 $105,748 $567,659 776,000 62,080 528,000 42,240 302,500 24,200 1,606,500 128,520 $333,507 $232,724 $129,948 $696,179 $0.08/bar Budgeted quantity and cost of direct ingredients For the year ended December 31, 20X7 Ingredient Price Chocolate liquor Cocoa butter Cocoa powder Cane sugar Emulsifier Vanilla Almonds Himalayan salt Cost of ingredients Wrappers Total cost $5.50/kg $6.00/kg $1.15/kg $0.70/kg $0.80/kg $70/litre $10/kg $5.50/kg The-Bar Quantity Cost 27,104 $149,072 10,300 61,797 5,421 6,234 10,300 7,210 461 369 623 43,637 Alamonde Quantity Cost 18,519 $101,852 7,037 42,222 2,222 2,556 7,037 4,926 741 593 370 25,926 1,111 11,111 Salt-Lick Total Quantity Cost Quantity Cost 8,861 $48,736 54,484 $299,660 2,743 16,456 20,079 120,476 2,110 2,426 9,753 11,216 6,224 4,357 23,560 16,492 211 169 1,412 1,130 422 29,537 1,416 99,101 1,111 11,111 527 2,901 527 2,901 $104,582 $562,087 301,400 24,112 1,604,900 128,392 $128,694 $690,479 $0.08/bar 774,400 $268,319 61,952 529,100 $330,271 $189,186 42,328 $231,514 Actual direct labour For the year ended December 31, 20X7 Direct labour hours Cost per direct labour hour Total actual direct labour costs The-Bar 4,105 $ 33.10 $ 135,876 Alamonde 3,744 $ 33.10 $ 123,926 Salt-Lick 2,125 $ 33.10 $ 70,338 Total 9,974 $ 33.10 $ 330,140 Budgeted direct labour For the year ended December 31, 20X7 Total Direct labour hours Cost per labour hour Total budgeted direct labour cost The-Bar 4,560 $ 32.40 $ 147,744 Alamonde 3,140 $ 32.40 $ 101,736 Salt-Lick 1,790 $ 32.40 $ 57,996 9,490 $ 32.40 $ 307,476 Actual manufacturing overhead For the year ended December 31, 20X7 $ 103,584 89,566 $ 193,150 Variable Plant utilities Plant maintenance Fixed Quality control Computer and supplies Plant and equipment amortization Research and development Indirect plant salary and wages Plant lease Total manufacturing overhead 37,500 188,000 150,000 135,000 193,000 196,000 899,500 $ 1,092,650 Budgeted manufacturing overhead For the year ended December 31, 20X7 $ 101,876 91,081 $ 192,957 $ Variable Plant utilities Plant maintenance Fixed Quality control Computer and supplies Plant and equipment amortization Research and development Indirect plant salary and wages Plant lease Total manufacturing overhead 39,000 189,000 150,000 120,000 192,500 196,000 886,500 $ 1,079,457 Predetermined overhead rate = $1,079,457/9,490 direct labour hours = $113.74678 per direct labour hour One of the cost issues faced by the company is understanding what the variable costs are and what the fixed costs are. The manufacturing overhead schedule shows plant utilities as a purely variable cost yet even with no machinery running, the company gets a bill. So, a study was conducted on the plant utilities costs compared to direct machine hours. The information is provided below. Exhibit 6 A consultant was hired last year to determine the cost pools of all company processes, but the information was never used to perform an activity-based costing analysis because of lack of time. What is needed is an activity-based analysis of current overhead allocations, and a proper cost of goods manufactured schedule. Below are the consultant's planning notes. Planning notes: Activity-based costing project 20X6 TO: Alan, President, Boston Bar Chocolate Company FROM: Solomon, ABC consultant RE: Activity-based costing project Thank you for giving me the opportunity to develop an activity-based costing approach for your product lines. The following is a summary of my findings. After viewing production processes and interviewing staff in operations, the following activity pools and the activity drivers were determined to adequately define the basic steps in the production line: Activity Activity driver Scheduling production runs Number of production runs Machine setup Setup hours Product administration Number of product lines Machine operations Machine hours Inspection Number of inspections Research and development R&D hours Plant lease Currently, your manufacturing overhead accounts consist of the following: plant utilities plant maintenance quality control computer and supplies plant equipment amortization research and development plant salary and wages (indirect) plant lease . The balance in all of these accounts can be allocated to the three products using an activity-based approach except for the plant lease which is a facility-sustaining cost. . The following are some key points to consider when allocating costs: Indirect labour is split between the following activities: 45% for cleaning, preparing, and setting up machines for batch runs o 55% to scheduling production runs. This includes purchasing and releasing materials for production and scheduling production. Setup time for batches of The-Bar is the shortest at about one hour. The setup for the Alamonde bar takes longer (about three hours) because the particulate equipment has to be set up and tested in order to add almonds to the mix. The setup for the Salt-Lick bar takes the longest (about four hours) because the salt sprinkling machine must be set up and properly tested for correct temperature before the production run. Quality control is responsible for ensuring that the finished product achieves strict standards set out by the research department. Depending on the product, inspections are made at different stages of the process. Because it has no special additions, The-Bar is tested only at the refining stage and at the finished stage. In addition to these inspections, Alamonde is inspected after the particulate is added and Salt-Lick is inspected after the salt granules are added. All lab testing labour and supplies are currently allocated to the quality control account using the normal costing system. After interviewing the systems administrator, it was discovered that most of the computer's time and supplies expense is used to schedule production runs in the factory and to order and pay for the materials required in each production run (approximately 80%). The remaining 20% of computer expense is allocated to keeping records of the three products and their production, so it would fall under product administration. Research and development activities are currently concentrated on improving the flavour and consistency of the particulates and salt added to the bars. Approximately 525 hours have been spent on researching a variety of ways that could possibly achieve this goal. As The-Bar does not contain any additional particulates, this cost is allocated to Alamonde and Salt-Lick based on research hours for each. Plant utilities, plant maintenance, and plant equipment amortization are incurred to supply machine time as part of machine operation to produce chocolate bars. Total 1,606,500 Production cost pools and related activities based on 20x7 production Activity The-Bar Alamonde Salt-Lick Production volume (bars)* 776,000 528,000 302,500 Batch size (bars) 4,000 3,000 2,500 Machine hours per batch 13.0 18.0 19.0 Number of annual production runs 194 176 121 (batches) Number of inspections per batch 2. 3 3 Setup time (hours) 1 3 4 Number of product lines 1 1 1 Research and development hours 450 491 75 525 *Due to stable inventory levels, it is assumed that sales equal production. Exhibit 7 Cocoa bean processing division options The cocoa bean processing division receives unprocessed beans and processes them. A portion of the output comes to the chocolate bar division at the cocoa bean process division's cost plus a small profit. The cocoa bean processing division is able to satisfy both the external and internal demand for its products. The manager of the bean processing division has asked that an analysis be done on the best way to process and package products given the following information. Additional information on cocoa bean processing The job in the cocoa bean processing division is to process raw cocoa beans through fermentation and roasting, and processing the chocolate nibs into chocolate liquor, cocoa butter, and cocoa cakes. The cocoa cakes are what is left of the chocolate liquor after the cocoa butter is removed. The original purpose was to process the beans for the chocolate bar division; however, there is enough capacity to process more beans and sell the intermediate products to outside customers. The questions are the profitability of the products currently being sold to outside customers and the opportunities for a new product. Currently, the chocolate liquor, which is the first saleable product in the bean processing division, is processed further into cocoa butter and cocoa cakes. The cocoa butter is sold to a plant that processes it for skin cream and the cocoa cakes are packaged in bulk and sold to other manufacturers to include in baking products. One option to consider is to grind the cocoa cakes into powder and package the final product into cans to be sold to retail grocery stores as baking chocolate. However, there is also a market for chocolate liquor. Illustration of cocoa bean processing and opportunities Procedure cocoa bean processing division Cocoa cakes Sales value: $17,550 Grinding and packaging (Cost: $6,500) Canned baking cocoa Sales value: $28,900 Raw cacao beans! $10,000 Roasting and refining process (Cost: $6,500) Chocolate liquor - sales value: $54.000 Pressing and drying (Cost: $3,800) Cocoa butter Sales value: $31,900 Processing and sales opportunity Sales opportunity The illustration is based on the following data: Unprocessed cocoa beans price per 5,000 kg Roasting and refining costs resulting in chocolate liquor Yield of chocolate liquor Selling price of chocolate liquor per kilogram Cost of processing liquor into cocoa butter and cakes Yield of cocoa butter Yield of cocoa cakes Sales value of cocoa butter per kilogram Sales value of cocoa cakes per kilogram Cost of grinding cocoa cakes into powder and packaging Yield of cans of powdered baking cocoa Selling price per can of powdered baking cocoa $10,000 $6,500 80% $13.50 $3,800 55% 45% $14.50 $9.75 $6,500 6,800 $4.25 The final issue is the increasing cost of cocoa for production. Because of rising temperatures in cocoa-producing countries, it is predicted that many of Africa's cocoa- production areas will be too hot to grow cocoa crops in the near future. Some farmers are already replacing their cocoa crops with palm oil or rubber. This will put upwards pressure on the price of cocoa if there are fewer suppliers. 1. Activity-based costing a) (10 marks) Prepare an activity-based costing analysis of each product (The-Bar, Alamonde and Salt-Lick) using the information provided from Exhibit 6 and the 20x7 actual costs incurred (Exhibit 4). The analysis should consist of a partial income statement showing sales and manufacturing costs (including direct materials and direct labour) for each product, including revised gross margin and gross margin percentage. Because the change in beginning and ending work-in-process and finished goods inventory amounts are negligible, these figures can be omitted from this analysis. b) (4 marks) Discuss the results achieved in part (a) and explain why the gross margin(s) have changed. Finally, discuss how the activity-based approach provides a better allocation of costs and a more reliable gross margin. Exhibit 4 Other budgeted and actual schedules are provided below to help with the analysis. Actual quantity and cost of direct ingredients For the year ended December 31, 20X7 Ingredient Price Chocolate liquor Cocoa butter Cocoa powder Cane sugar Emulsifier Vanilla Almonds Himalayan salt Cost of ingredients Wrappers Total cost $5.55/kg $6.10/kg $1.18/kg $0.70/kg $0.80/kg $70/litre $10/kg $5.50/kg The-Bar Alamonde Salt-Lick Total Quantity Cost Quantity Cost Quantity Cost Quantity Cost 27,160 $150,738 18,480 $102,564 8,894 $49,359 54,534 $302,661 10,321 62,957 7,022 42,837 2,753 16,792 20,096 122,586 5,432 6,410 2,218 2,617 2,118 2,499 9,768 11,525 10,321 7,225 7,022 4,916 6,247 4,372 23,590 16,513 462 369 739 590 212 169 1,413 1,129 625 43,728 370 25,872 424 29,645 1,418 99,245 1,109 11,088 1,109 11,088 529 2,912 529 2,912 $271,427 $190,484 $105,748 $567,659 776,000 62,080 528,000 42,240 302,500 24,200 1,606,500 128,520 $333,507 $232,724 $129,948 $696,179 $0.08/bar Budgeted quantity and cost of direct ingredients For the year ended December 31, 20X7 Ingredient Price Chocolate liquor Cocoa butter Cocoa powder Cane sugar Emulsifier Vanilla Almonds Himalayan salt Cost of ingredients Wrappers Total cost $5.50/kg $6.00/kg $1.15/kg $0.70/kg $0.80/kg $70/litre $10/kg $5.50/kg The-Bar Quantity Cost 27,104 $149,072 10,300 61,797 5,421 6,234 10,300 7,210 461 369 623 43,637 Alamonde Quantity Cost 18,519 $101,852 7,037 42,222 2,222 2,556 7,037 4,926 741 593 370 25,926 1,111 11,111 Salt-Lick Total Quantity Cost Quantity Cost 8,861 $48,736 54,484 $299,660 2,743 16,456 20,079 120,476 2,110 2,426 9,753 11,216 6,224 4,357 23,560 16,492 211 169 1,412 1,130 422 29,537 1,416 99,101 1,111 11,111 527 2,901 527 2,901 $104,582 $562,087 301,400 24,112 1,604,900 128,392 $128,694 $690,479 $0.08/bar 774,400 $268,319 61,952 529,100 $330,271 $189,186 42,328 $231,514 Actual direct labour For the year ended December 31, 20X7 Direct labour hours Cost per direct labour hour Total actual direct labour costs The-Bar 4,105 $ 33.10 $ 135,876 Alamonde 3,744 $ 33.10 $ 123,926 Salt-Lick 2,125 $ 33.10 $ 70,338 Total 9,974 $ 33.10 $ 330,140 Budgeted direct labour For the year ended December 31, 20X7 Total Direct labour hours Cost per labour hour Total budgeted direct labour cost The-Bar 4,560 $ 32.40 $ 147,744 Alamonde 3,140 $ 32.40 $ 101,736 Salt-Lick 1,790 $ 32.40 $ 57,996 9,490 $ 32.40 $ 307,476 Actual manufacturing overhead For the year ended December 31, 20X7 $ 103,584 89,566 $ 193,150 Variable Plant utilities Plant maintenance Fixed Quality control Computer and supplies Plant and equipment amortization Research and development Indirect plant salary and wages Plant lease Total manufacturing overhead 37,500 188,000 150,000 135,000 193,000 196,000 899,500 $ 1,092,650 Budgeted manufacturing overhead For the year ended December 31, 20X7 $ 101,876 91,081 $ 192,957 $ Variable Plant utilities Plant maintenance Fixed Quality control Computer and supplies Plant and equipment amortization Research and development Indirect plant salary and wages Plant lease Total manufacturing overhead 39,000 189,000 150,000 120,000 192,500 196,000 886,500 $ 1,079,457 Predetermined overhead rate = $1,079,457/9,490 direct labour hours = $113.74678 per direct labour hour One of the cost issues faced by the company is understanding what the variable costs are and what the fixed costs are. The manufacturing overhead schedule shows plant utilities as a purely variable cost yet even with no machinery running, the company gets a bill. So, a study was conducted on the plant utilities costs compared to direct machine hours. The information is provided below. Exhibit 6 A consultant was hired last year to determine the cost pools of all company processes, but the information was never used to perform an activity-based costing analysis because of lack of time. What is needed is an activity-based analysis of current overhead allocations, and a proper cost of goods manufactured schedule. Below are the consultant's planning notes. Planning notes: Activity-based costing project 20X6 TO: Alan, President, Boston Bar Chocolate Company FROM: Solomon, ABC consultant RE: Activity-based costing project Thank you for giving me the opportunity to develop an activity-based costing approach for your product lines. The following is a summary of my findings. After viewing production processes and interviewing staff in operations, the following activity pools and the activity drivers were determined to adequately define the basic steps in the production line: Activity Activity driver Scheduling production runs Number of production runs Machine setup Setup hours Product administration Number of product lines Machine operations Machine hours Inspection Number of inspections Research and development R&D hours Plant lease Currently, your manufacturing overhead accounts consist of the following: plant utilities plant maintenance quality control computer and supplies plant equipment amortization research and development plant salary and wages (indirect) plant lease . The balance in all of these accounts can be allocated to the three products using an activity-based approach except for the plant lease which is a facility-sustaining cost. . The following are some key points to consider when allocating costs: Indirect labour is split between the following activities: 45% for cleaning, preparing, and setting up machines for batch runs o 55% to scheduling production runs. This includes purchasing and releasing materials for production and scheduling production. Setup time for batches of The-Bar is the shortest at about one hour. The setup for the Alamonde bar takes longer (about three hours) because the particulate equipment has to be set up and tested in order to add almonds to the mix. The setup for the Salt-Lick bar takes the longest (about four hours) because the salt sprinkling machine must be set up and properly tested for correct temperature before the production run. Quality control is responsible for ensuring that the finished product achieves strict standards set out by the research department. Depending on the product, inspections are made at different stages of the process. Because it has no special additions, The-Bar is tested only at the refining stage and at the finished stage. In addition to these inspections, Alamonde is inspected after the particulate is added and Salt-Lick is inspected after the salt granules are added. All lab testing labour and supplies are currently allocated to the quality control account using the normal costing system. After interviewing the systems administrator, it was discovered that most of the computer's time and supplies expense is used to schedule production runs in the factory and to order and pay for the materials required in each production run (approximately 80%). The remaining 20% of computer expense is allocated to keeping records of the three products and their production, so it would fall under product administration. Research and development activities are currently concentrated on improving the flavour and consistency of the particulates and salt added to the bars. Approximately 525 hours have been spent on researching a variety of ways that could possibly achieve this goal. As The-Bar does not contain any additional particulates, this cost is allocated to Alamonde and Salt-Lick based on research hours for each. Plant utilities, plant maintenance, and plant equipment amortization are incurred to supply machine time as part of machine operation to produce chocolate bars. Total 1,606,500 Production cost pools and related activities based on 20x7 production Activity The-Bar Alamonde Salt-Lick Production volume (bars)* 776,000 528,000 302,500 Batch size (bars) 4,000 3,000 2,500 Machine hours per batch 13.0 18.0 19.0 Number of annual production runs 194 176 121 (batches) Number of inspections per batch 2. 3 3 Setup time (hours) 1 3 4 Number of product lines 1 1 1 Research and development hours 450 491 75 525 *Due to stable inventory levels, it is assumed that sales equal production. Exhibit 7 Cocoa bean processing division options The cocoa bean processing division receives unprocessed beans and processes them. A portion of the output comes to the chocolate bar division at the cocoa bean process division's cost plus a small profit. The cocoa bean processing division is able to satisfy both the external and internal demand for its products. The manager of the bean processing division has asked that an analysis be done on the best way to process and package products given the following information. Additional information on cocoa bean processing The job in the cocoa bean processing division is to process raw cocoa beans through fermentation and roasting, and processing the chocolate nibs into chocolate liquor, cocoa butter, and cocoa cakes. The cocoa cakes are what is left of the chocolate liquor after the cocoa butter is removed. The original purpose was to process the beans for the chocolate bar division; however, there is enough capacity to process more beans and sell the intermediate products to outside customers. The questions are the profitability of the products currently being sold to outside customers and the opportunities for a new product. Currently, the chocolate liquor, which is the first saleable product in the bean processing division, is processed further into cocoa butter and cocoa cakes. The cocoa butter is sold to a plant that processes it for skin cream and the cocoa cakes are packaged in bulk and sold to other manufacturers to include in baking products. One option to consider is to grind the cocoa cakes into powder and package the final product into cans to be sold to retail grocery stores as baking chocolate. However, there is also a market for chocolate liquor. Illustration of cocoa bean processing and opportunities Procedure cocoa bean processing division Cocoa cakes Sales value: $17,550 Grinding and packaging (Cost: $6,500) Canned baking cocoa Sales value: $28,900 Raw cacao beans! $10,000 Roasting and refining process (Cost: $6,500) Chocolate liquor - sales value: $54.000 Pressing and drying (Cost: $3,800) Cocoa butter Sales value: $31,900 Processing and sales opportunity Sales opportunity The illustration is based on the following data: Unprocessed cocoa beans price per 5,000 kg Roasting and refining costs resulting in chocolate liquor Yield of chocolate liquor Selling price of chocolate liquor per kilogram Cost of processing liquor into cocoa butter and cakes Yield of cocoa butter Yield of cocoa cakes Sales value of cocoa butter per kilogram Sales value of cocoa cakes per kilogram Cost of grinding cocoa cakes into powder and packaging Yield of cans of powdered baking cocoa Selling price per can of powdered baking cocoa $10,000 $6,500 80% $13.50 $3,800 55% 45% $14.50 $9.75 $6,500 6,800 $4.25 The final issue is the increasing cost of cocoa for production. Because of rising temperatures in cocoa-producing countries, it is predicted that many of Africa's cocoa- production areas will be too hot to grow cocoa crops in the near future. Some farmers are already replacing their cocoa crops with palm oil or rubber. This will put upwards pressure on the price of cocoa if there are fewer suppliers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts