Question: 1 Aequiled information Section Break ( ( 8 - 1 1 ) [ The following information apples to the questions displayed betow ] A penaion

Aequiled information

Section Break

The following information apples to the questions displayed betow

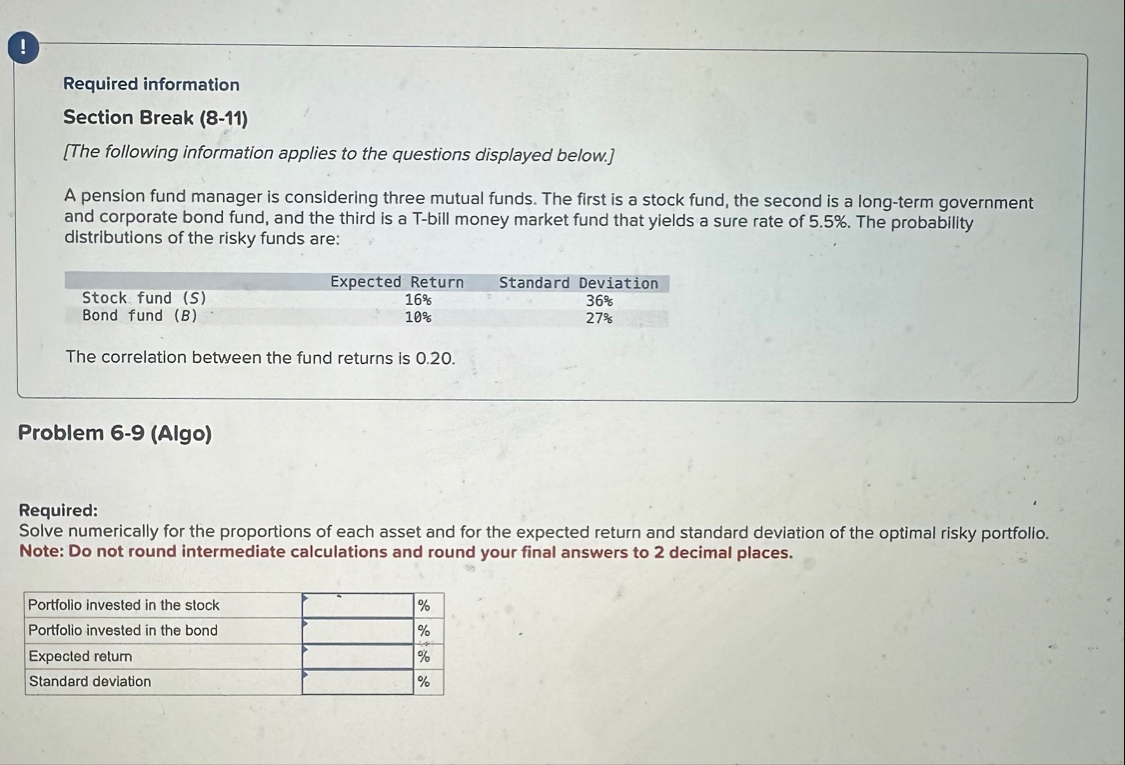

A penaion fund manager is considering three mutual funde. The frat is a stock fund, the second is a iongSer governemert and corporate bond fund, and the third is a Tbil money market fund that yields a sure rate of K The probabily sistrbutions of the risky funds are:

tableExpected Retien,Standafa DeviatiseStock fund StandardBond fund E

The cosselation befween the fund rephares is

Problem Algo

Aequired:

Solve numeskaly for the proportions of each asset and for the expected retarn and standerd deviston of the cobinal faly porthia Neter Doe net round imermediate calculations and round your final asowers te decinel pleces.

tablePurtite inveited in me slock,Purkie inveried in the liond,Expeited retum,Suaderd deviation,

Required information

Section Break

The following information applies to the questions displayed below.

A pension fund manager is considering three mutual funds. The first is a stock fund, the second is a longterm government and corporate bond fund, and the third is a Tbill money market fund that yields a sure rate of The probability distributions of the risky funds are:

tableExpected Return,Standard DeviationStock fund

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock